Daily Pivots Analysis in EUR/USD

Introduction

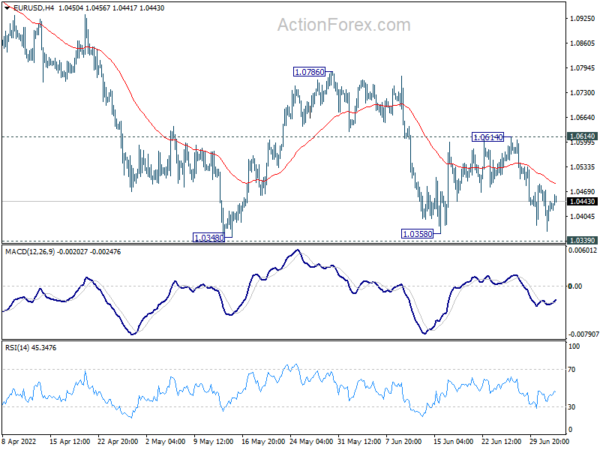

When it comes to trading foreign exchange, understanding daily pivots can be a crucial tool for traders to make informed decisions. In the case of EUR/USD, the daily pivots are currently set at (S1) 1.0366, (P) 1.0428, and (R1) 1.0489. These levels are used by traders to identify potential support and resistance areas in the market.

Current Market Situation

At the moment, the intraday bias in EUR/USD remains neutral. This means that there is no clear direction in the market, and further decline is expected as long as certain conditions are met. Traders should closely monitor the market to see if any trends start to emerge.

Factors Affecting EUR/USD

There are several factors that can influence the movement of EUR/USD, including economic indicators, political events, and market sentiment. Traders should stay informed about these factors to make better trading decisions.

How This Will Affect You

For individual traders, the daily pivots analysis in EUR/USD can provide valuable insight into potential entry and exit points. By understanding these levels, traders can better manage risk and optimize their trading strategies.

How This Will Affect the World

On a larger scale, the movement of EUR/USD can have implications for the global economy. Changes in exchange rates can impact international trade, investment flows, and economic growth. It is important for policymakers and businesses to monitor these changes and adapt accordingly.

Conclusion

In conclusion, daily pivots analysis in EUR/USD can be a useful tool for traders looking to navigate the foreign exchange market. By closely monitoring these levels and staying informed about market factors, traders can make more informed decisions and potentially improve their trading performance.