USDSEK Showing Reaction From Intraday Buying Zone

Introduction

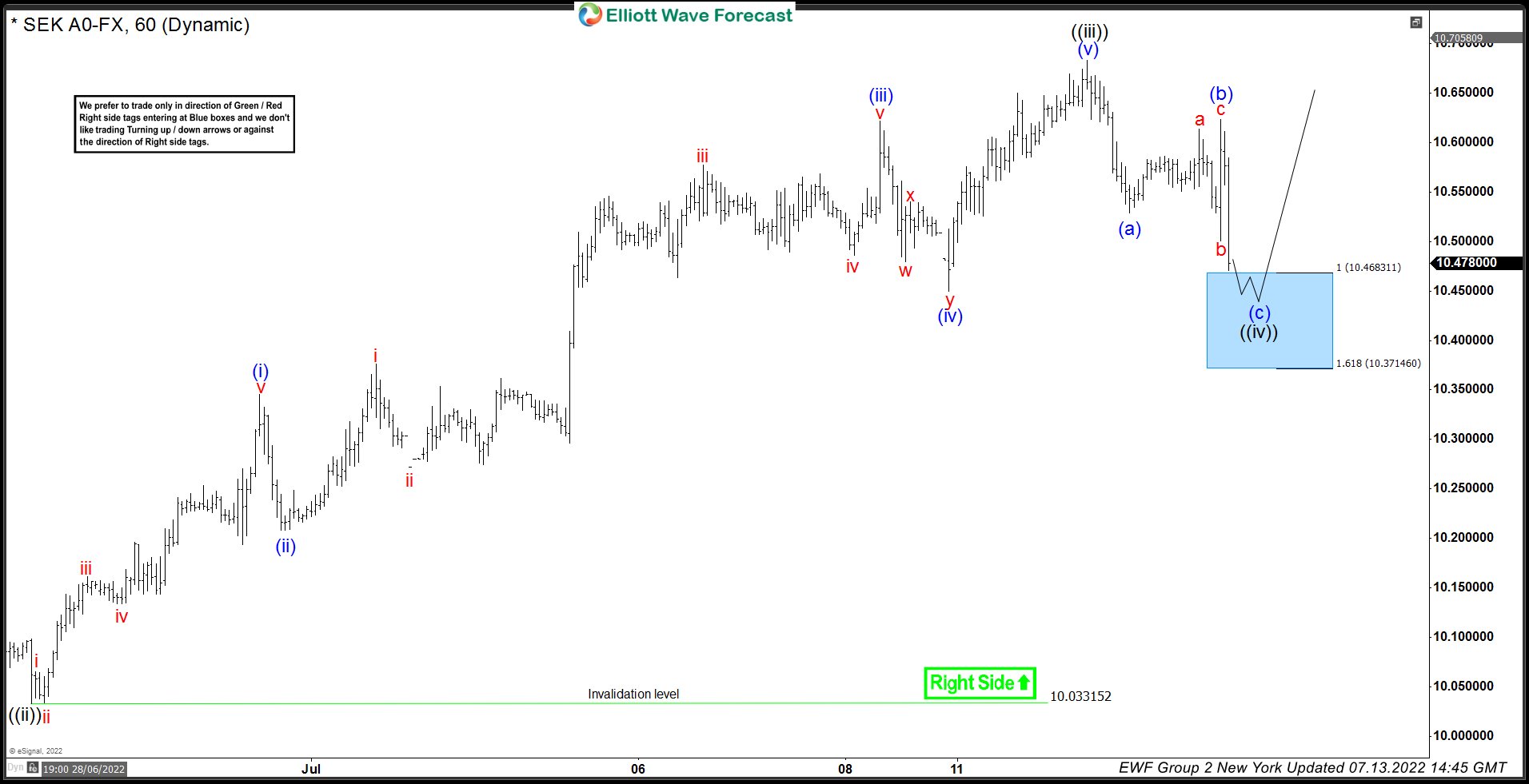

In this technical article, we’re going to take a quick look at the Elliott Wave charts of USDSEK, another forex pair we have traded in EWF. As our members know, we have been calling for the rally in the pair due to impulsive bullish sequences. Consequently, we recommended members to avoid selling the pair, while looking for buying opportunities.

USDSEK Elliott Wave Analysis

Upon analyzing the Elliott Wave charts of USDSEK, it is evident that the pair is showing a reaction from the intraday buying zone. The impulsive bullish sequences have played out as expected, leading to a strong rally in the pair. This reaction from the buying zone indicates that the bullish momentum is likely to continue in the near future.

As traders, it is important to stay updated on these technical analyses in order to make informed decisions in the forex market. By understanding the Elliott Wave patterns and reacting accordingly, traders can capitalize on profitable trading opportunities.

Impact on Individuals

For individual traders, the analysis of USDSEK’s Elliott Wave charts provides valuable insights into potential trading opportunities. By following the recommended buying zones and avoiding selling the pair, traders can maximize their profits and minimize their risks in the market.

Global Impact

On a global scale, the rally in USDSEK can have a ripple effect on other currency pairs and financial markets. The bullish momentum in USDSEK indicates a positive sentiment towards the US dollar, which could potentially lead to increased investor confidence and overall market growth.

Conclusion

In conclusion, the Elliott Wave analysis of USDSEK highlights the importance of staying informed and adapting to market trends. By following the recommended strategies and buying zones, traders can navigate the forex market with confidence and capitalize on profitable opportunities. Remember, knowledge is power in the world of trading.