Yen Hits Multi-Decade Lows, Euro Bounces Back, Dollar Remains Indecisive

Yen Continues Downtrend

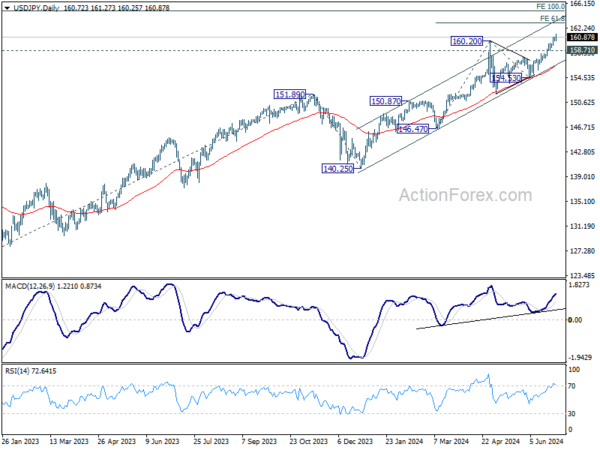

Yen remained in the spotlight last week, dominating headlines even as some significant global inflation data also moved markets. The Japanese currency continued its downtrend, reaching multi-decade lows. Despite the prolonged decline, Japanese authorities refrained from intervening directly in the markets. However, the looming threat of intervention kept traders cautious, resulting in a more controlled…

Euro Shows Resilience

On the other hand, the Euro bounced back from recent losses, showing resilience in the face of market volatility. The European currency benefited from positive economic indicators and increased investor confidence, leading to a stronger performance against its major counterparts. This positive momentum was a welcome development for Eurozone officials, who have been working to stabilize the currency amid ongoing challenges.

Dollar’s Uncertainty

Meanwhile, the US Dollar remained indecisive as mixed economic data and geopolitical tensions clouded the currency’s outlook. Market participants are closely monitoring the Federal Reserve’s next moves regarding interest rates and monetary policy, which could impact the Dollar’s performance in the coming weeks. The uncertainty surrounding the Dollar has caused fluctuations in currency markets, with traders adopting a cautious approach in their trading strategies.

How Will This Affect Me?

As a consumer or investor, the fluctuations in currency markets can have a direct impact on your purchasing power and investment portfolio. A weaker Yen could make Japanese exports more competitive on the global stage, potentially benefiting consumers who purchase goods from Japan. On the other hand, a stronger Euro may increase the cost of imported goods for consumers in Eurozone countries. The uncertain outlook for the US Dollar may affect the value of your investments in international markets, leading to potential gains or losses depending on currency movements.

How Will This Affect the World?

The performance of major currencies such as the Yen, Euro, and Dollar can have far-reaching implications for the global economy. A weaker Yen may boost Japan’s export-driven economy, supporting economic growth and trade activity. The strength of the Euro can impact the stability of the Eurozone and influence international trade dynamics. The uncertainty surrounding the US Dollar’s outlook may create volatility in financial markets and impact the decisions of central banks and policymakers around the world.

Conclusion

In conclusion, the recent developments in currency markets highlight the interconnected nature of the global economy and the importance of monitoring currency trends for individuals and businesses alike. While the Yen hits multi-decade lows, the Euro bounces back, and the Dollar remains indecisive, it is crucial to stay informed and adapt to changing market conditions to navigate the complex landscape of international finance.