Rebounding and Rising: A Recap of Today’s Forex Market News in the Americas – July 26th

Description:

US stocks close the week with gains on the day. S&P and Nasdaq lower for the week. Next week will be the Grand Daddy of the earning calendar this quarter. Baker Hughes oil rig count +5 to 482. ECBs Schnabel: Services inflation showing last mile in inflation fight especially difficult. European shares bounce back. Mixed performance for the week. Initial Atlanta Fed GDPNow growth tracker comes in at 2.8%. University of Michigan consumer sentiment for July 66.4 versus 66.0 estimate (and prelim). Kickstart the…

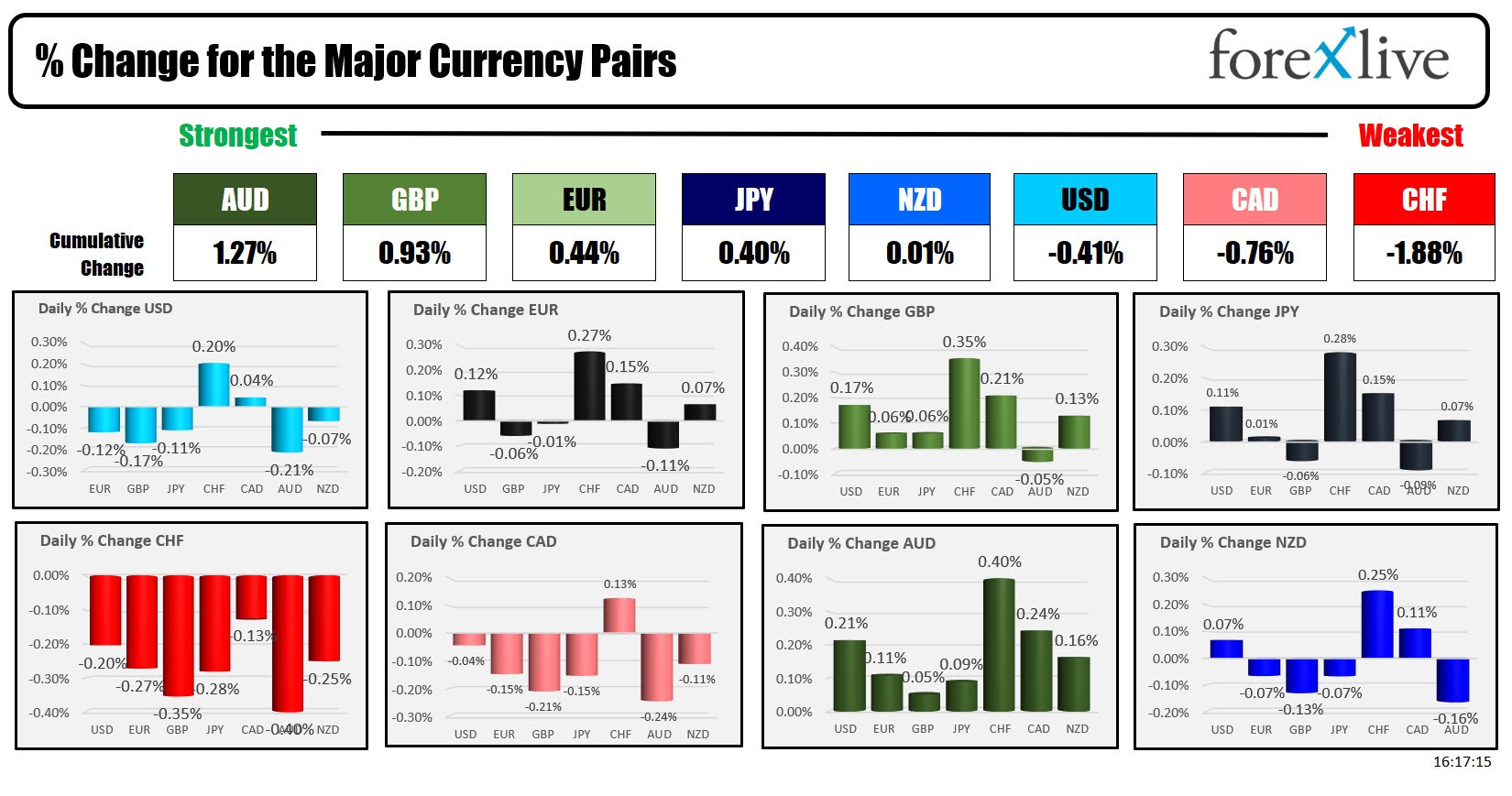

Today’s Forex Market Update:

Today, the Forex market in the Americas witnessed a mix of positive and negative movements across different sectors. With US stocks closing the week with gains, there was a sense of relief among investors. However, the S&P and Nasdaq experienced a downward trend throughout the week, indicating a slightly bearish sentiment.

Looking ahead, the upcoming week is expected to be crucial for the earning calendar, with significant announcements on the horizon. The Baker Hughes oil rig count also saw a slight increase, pointing towards potential growth in the oil sector.

On the global front, the European Central Bank’s Schnabel highlighted the challenges of tackling services inflation, emphasizing the complexity of the inflation fight. Despite this, European shares rebounded, showcasing resilience in the market.

Meanwhile, the Initial Atlanta Fed GDPNow growth tracker reported a growth rate of 2.8%, indicating a steady pace of economic expansion. Additionally, the University of Michigan consumer sentiment for July exceeded expectations, reflecting positive consumer outlook.

How This Will Affect Me:

As an individual investor or trader, the latest updates from the Forex market provide valuable insights into potential investment opportunities. The positive performance of US stocks and steady economic growth indicators can influence your investment decisions.

With upcoming earning announcements and fluctuations in the oil sector, it is essential to stay informed and adapt your investment strategy accordingly to navigate the market effectively.

How This Will Affect the World:

The fluctuations in the Forex market impact the global economy and financial stability. The mixed performance of European shares and challenges in tackling services inflation can have ripple effects on international markets.

As economies continue to recover from the pandemic-induced slowdown, monitoring key indicators such as GDP growth and consumer sentiment will be crucial in understanding the broader economic landscape.

Conclusion:

In conclusion, today’s Forex market news in the Americas reflects a dynamic and evolving financial landscape. While there are signs of resilience and growth, challenges persist, underscoring the need for vigilance and strategic decision-making in navigating the market.