The beginning of the week is marked by heightened risk aversion and increasing geopolitical uncertainties

Escalating conflicts in the Middle East

As the new week kicks off, the global financial markets are grappling with heightened risk aversion and escalating geopolitical uncertainties, with the primary focus on the situation in the Middle East. The region has been marred by conflicts and tensions for decades, but the recent developments have raised concerns among investors and policymakers alike.

Safe-haven assets on the rise

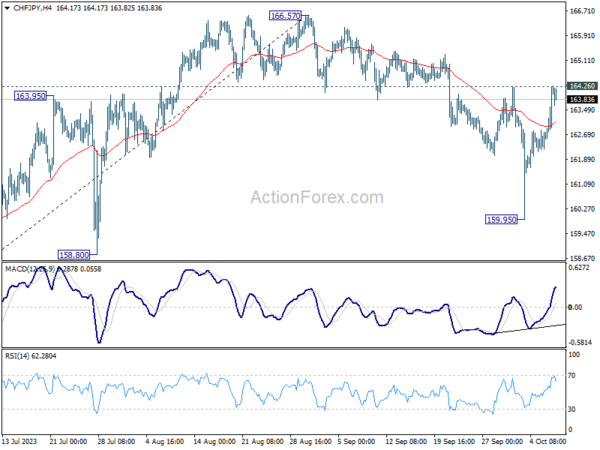

The upsurge in geopolitical tensions has prompted a noticeable shift towards safe-haven assets, with investors seeking refuge in assets like gold, oil, and safe-haven currencies. Among these safe havens, the Japanese Yen has emerged as the strongest contender in the Asian session, reflecting the nervous sentiment prevalent in the markets.

Pivots to US Inflation and UK GDP Insights

Amidst the geopolitical uncertainties, the focus later in the week is expected to pivot towards key economic data releases, including US inflation figures and UK GDP insights. These data points will provide crucial insights into the state of the world’s largest economy and one of the leading financial hubs, shaping market expectations and influencing investment decisions.

The Impact on Individuals

For individual investors, the heightened risk aversion and geopolitical uncertainties can translate into increased volatility in financial markets, impacting the value of investments and portfolios. It is essential for individuals to stay informed, diversify their investments, and consider risk management strategies to navigate the uncertain market conditions effectively.

The Global Ramifications

On a global scale, the escalation of conflicts in the Middle East and the ensuing geopolitical tensions can have far-reaching implications, affecting international relations, trade flows, and energy markets. The shift towards safe-haven assets reflects a broader sense of unease and uncertainty in the global economy, highlighting the interconnected nature of financial markets and geopolitical developments.

Conclusion

As the week unfolds, the interplay between geopolitical tensions, economic data releases, and market dynamics will continue to shape investor sentiment and market trends. It is crucial for individuals and policymakers alike to closely monitor these developments, adapt to changing conditions, and make informed decisions to navigate the uncertain landscape effectively.