Emotional Impact of Massive Bitcoin Withdrawal from Coinbase

The Importance of Trust in Cryptocurrency Exchanges

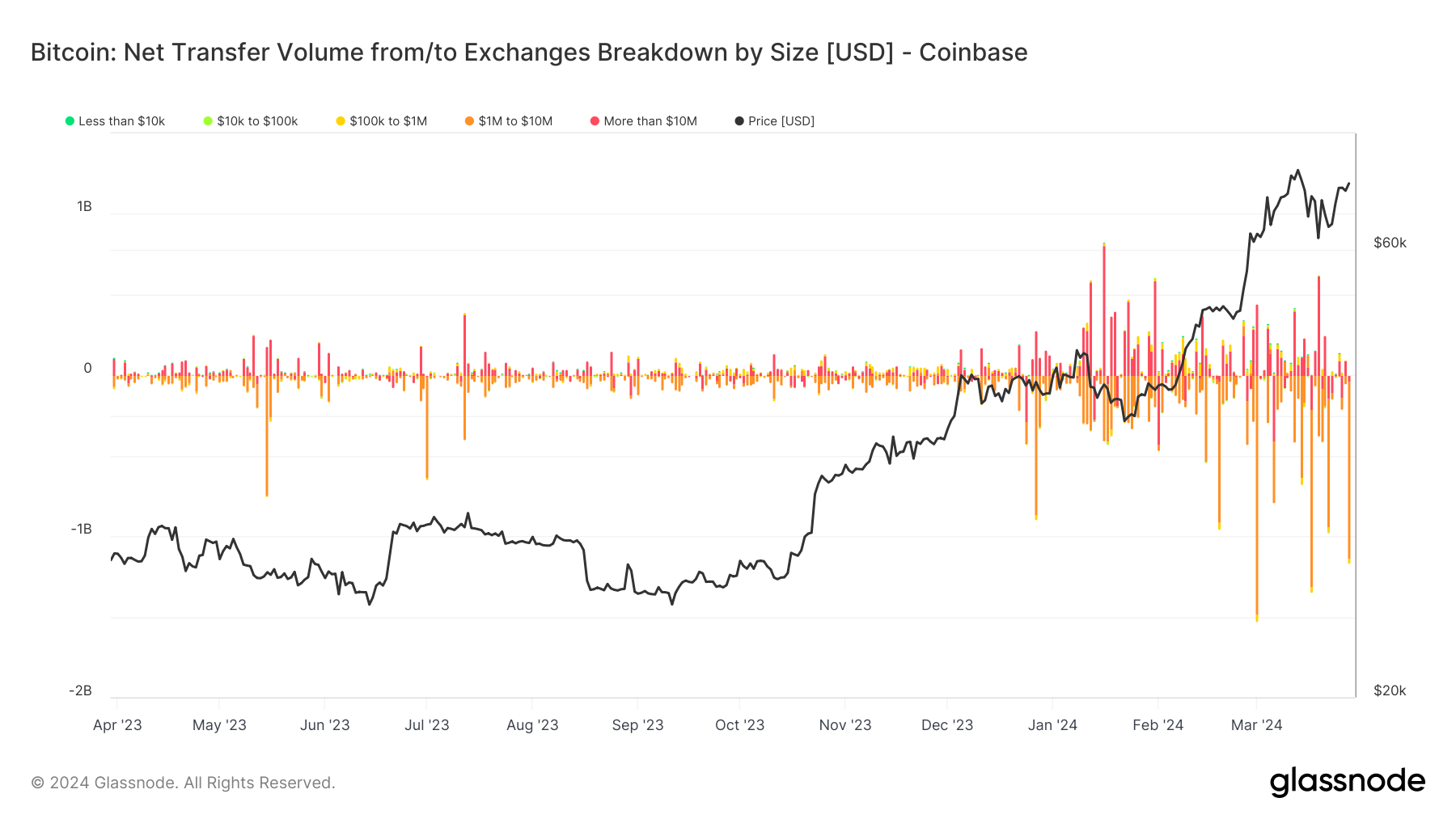

On March 28th, Coinbase exchange experienced a significant event that raised eyebrows in the cryptocurrency community – a withdrawal of approximately 16,100 BTC, valued at a staggering $1.1 billion. This massive outflow of Bitcoin is the third-largest withdrawal in a year, according to data from Arkham Intelligence.

Trust is a crucial element in the world of cryptocurrency, as investors and traders rely on exchanges to securely hold their digital assets. When a major exchange like Coinbase sees such a substantial withdrawal in a single day, it can shake the confidence of its users. Questions arise about the security and stability of the platform, leading to concerns about the safety of funds stored on the exchange.

The Rollercoaster of Bitcoin Prices

Bitcoin’s value is highly volatile, with prices fluctuating wildly based on market demand and investor sentiment. The withdrawal of $1.1 billion worth of Bitcoin from Coinbase had an immediate impact on the price of the cryptocurrency, causing it to dip and creating uncertainty among traders.

For those who hold Bitcoin or are considering investing in it, events like this highlight the risks involved in the cryptocurrency market. The ability to move such large amounts of digital currency in a short period of time can lead to sudden price shifts and market instability.

The Future of Cryptocurrency Exchanges

As the popularity of cryptocurrencies continues to grow, the role of exchanges like Coinbase becomes increasingly crucial. These platforms serve as the gateway for individuals to buy, sell, and store digital assets, making them a vital component of the crypto ecosystem.

Events like the massive Bitcoin withdrawal from Coinbase serve as a reminder of the importance of transparency, security, and reliability in cryptocurrency exchanges. Users must be able to trust that their funds are safe and that the platform they are using operates with integrity.

While this withdrawal may have caused a stir in the cryptocurrency community, it also presents an opportunity for exchanges to reassess their security measures and communication strategies. By prioritizing transparency and addressing the concerns of their users, exchanges can build trust and foster a more stable and resilient crypto market.

How will this impact me?

As an individual investor or trader in the cryptocurrency market, events like the massive Bitcoin withdrawal from Coinbase can have a direct impact on your holdings and investment strategy. Sudden price shifts and market volatility following such events can lead to gains or losses in your portfolio, highlighting the importance of staying informed and making well-informed decisions.

How will this impact the world?

The cryptocurrency market is a global phenomenon that has the potential to reshape the world of finance and commerce. Events like the massive Bitcoin withdrawal from Coinbase serve as a reminder of the rapid pace of innovation and disruption in the digital asset space, sparking conversations about regulation, security, and the future of money.

Conclusion

While the massive Bitcoin withdrawal from Coinbase may have caused shockwaves in the cryptocurrency community, it also serves as a valuable lesson in the importance of trust, transparency, and security in the digital asset space. As the world of finance continues to evolve, exchanges must adapt to meet the needs of their users and ensure the long-term viability of the crypto market.