Bitcoin’s Recent Struggles: A Closer Look at the Fifth Largest Realized Loss Since FTX Collapse and the Impact of Mt. Gox Panic

Description:

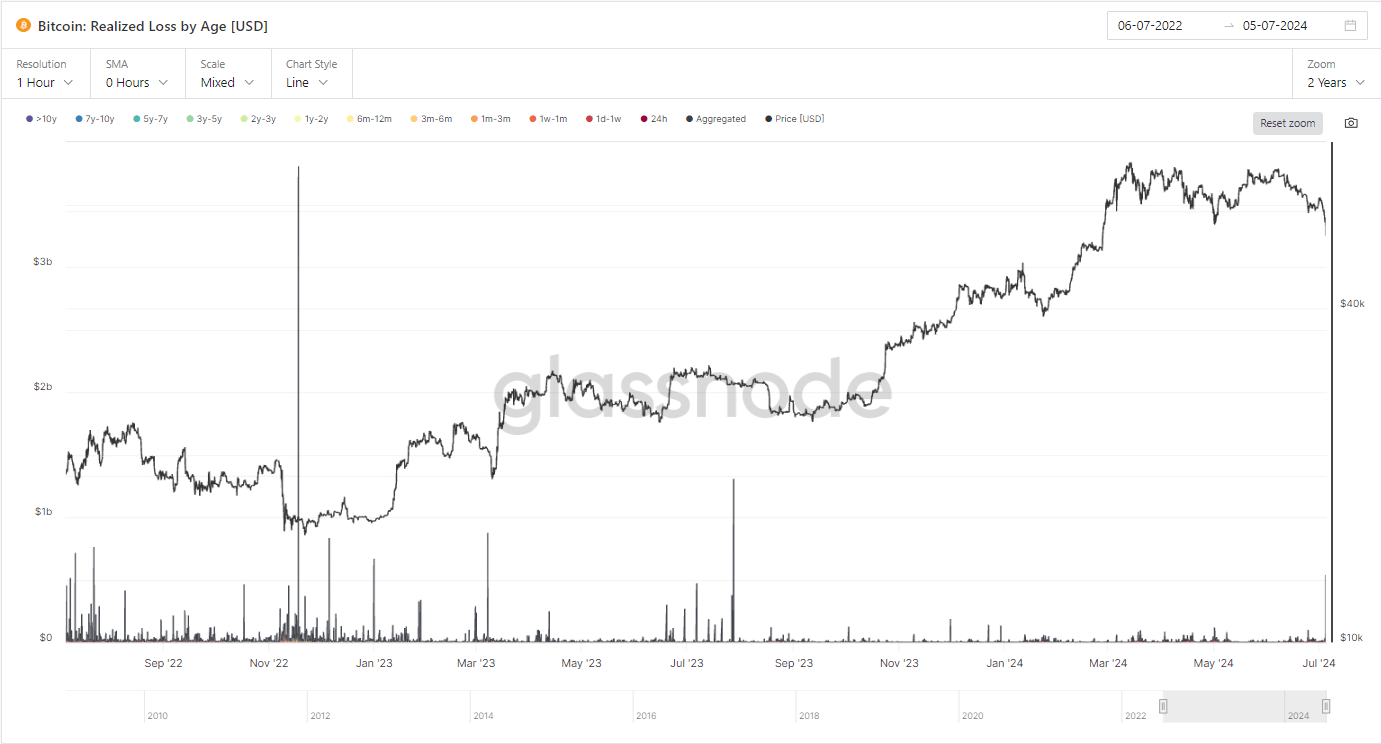

Quick Take: Bitcoin’s recent price dip to around $54,000 has triggered one of the largest realized losses since the FTX collapse, specifically the fifth biggest realized loss since. This significant sell-off is primarily attributed to panic selling spurred by news related to Mt. Gox. On July 5, within a one-hour resolution, Bitcoin’s aggregated realized loss…

Bitcoin’s Recent Struggles Unveiled

Bitcoin, the leading cryptocurrency, has recently faced a turbulent period marked by a significant price dip to around $54,000. This abrupt drop has triggered one of the largest realized losses in Bitcoin’s history since the collapse of FTX. Specifically, it stands as the fifth biggest realized loss since that unfortunate incident.

The primary reason behind this massive sell-off can be attributed to panic selling among investors, which was spurred by alarming news related to Mt. Gox. This event, unfolding on July 5, witnessed a rapid and intense selling frenzy, resulting in Bitcoin’s aggregated realized loss reaching staggering levels.

As the cryptocurrency market continues to navigate through these challenging times, it is crucial to delve deeper into the implications of Bitcoin’s recent struggles and the broader impact of events such as the Mt. Gox panic.

Impact on Individuals:

For individual investors in Bitcoin, the recent struggles faced by the cryptocurrency can have significant implications on their portfolios. The sudden price dip and subsequent realized losses may lead to heightened levels of anxiety and uncertainty among investors, prompting them to reassess their investment strategies and risk tolerance.

Furthermore, the increasing volatility in the cryptocurrency market can make it challenging for individuals to make informed decisions regarding their Bitcoin holdings. It is essential for investors to stay informed, exercise caution, and seek guidance from financial experts to navigate through these tumultuous times effectively.

Impact on the World:

Bitcoin’s recent struggles, coupled with events like the Mt. Gox panic, can have wider implications for the global economy and financial markets. The cryptocurrency market plays a significant role in shaping investor sentiment and market dynamics, making it crucial to monitor and analyze these developments closely.

The ripple effects of Bitcoin’s price movements and realized losses can extend beyond individual investors to impact the overall stability and confidence in the cryptocurrency market. This underscores the need for regulators, policymakers, and industry stakeholders to collaborate and implement measures to mitigate risks and safeguard the integrity of the market.

Conclusion:

In conclusion, Bitcoin’s recent struggles, marked by the fifth largest realized loss since the FTX collapse amid the Mt. Gox panic, highlight the inherent volatility and challenges present in the cryptocurrency market. As individuals and the world at large grapple with the implications of these developments, it is essential to exercise caution, stay informed, and adopt a prudent approach to navigating through these uncertain times.