Professional and Educated: A Profit-Focused and Intense Look at the EUR/CHF Weekly Outlook

Description:

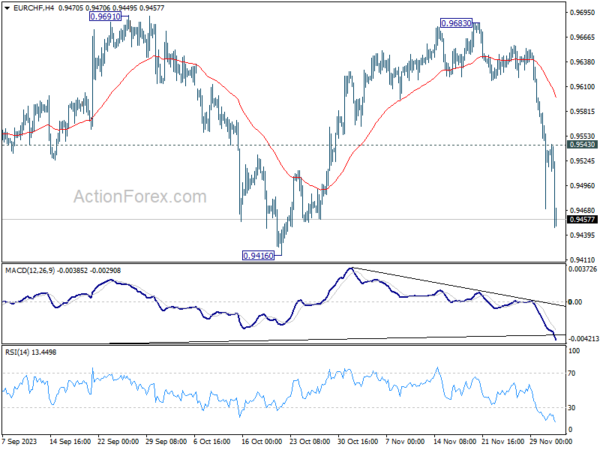

EUR/CHF’s steep decline last week indicates that rebound from 0.9416 has completed at 0.9683 already, after rejection by 0.9691 cluster resistance. Initial bias stays on the downside this week for retesting 0.9407/16 support zone. Decisive break there will resume larger down trend. On the upside, touching 0.9543 minor resistance will delay the bearish case…

Professional Insights:

As a professional trader in the forex market, it is essential to stay informed about the latest trends and developments. The recent decline in EUR/CHF signals a potential shift in market sentiment. It is crucial to analyze the market indicators and make informed decisions to maximize profits.

Educated traders understand the significance of technical analysis and fundamental factors when forecasting market movements. By incorporating this knowledge into their strategies, they can stay ahead of the curve and achieve their financial goals.

Profit-Focused Approach:

A profit-focused mindset is essential when trading in the forex market. Traders must set realistic goals and apply sound risk management practices to protect their capital. By staying disciplined and executing well-planned trades, traders can maximize their profitability in the long run.

Intense focus and dedication are required to succeed in the competitive forex market. Traders must continuously monitor market conditions and adjust their strategies accordingly to stay profitable in the fast-paced environment.

Impact on Individuals:

For individual traders, the bearish outlook on EUR/CHF could present both risks and opportunities. It is important to closely monitor the market and adjust trading strategies accordingly to navigate potential price fluctuations.

Traders may need to reassess their positions and consider implementing risk management strategies to protect their investments in light of the current market conditions.

Global Implications:

The larger down trend in EUR/CHF could have broader implications for the global forex market. Traders worldwide may adjust their trading strategies in response to the shifting market dynamics, impacting overall market liquidity and volatility.

Central banks and financial institutions may also monitor the EUR/CHF developments closely to assess their impact on currency exchange rates and international trade agreements.

Conclusion:

In conclusion, the EUR/CHF weekly outlook provides valuable insights for professional and educated traders seeking to stay profit-focused and intense in their trading activities. By staying informed and adapting to market conditions, traders can navigate the challenges and opportunities presented by the current market trends.

It is essential for individuals and the global market to remain vigilant and proactive in response to the evolving EUR/CHF dynamics to make informed decisions and mitigate risks effectively.