Discover the Hilarious Truth: How Skipping These 10 Days a Year Could Wipe Out Your Crypto Gains According to Fundstrat

Introduction

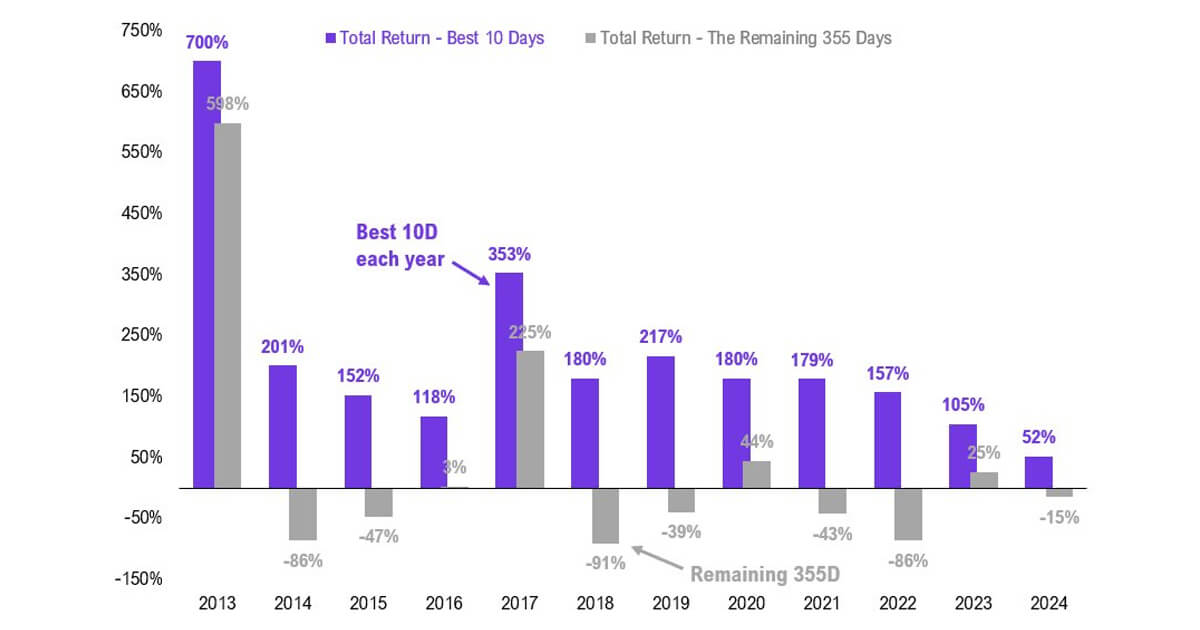

Bitcoin, the ever-popular cryptocurrency, is known for its unpredictable nature. Investors often find it challenging to time the market and make profitable decisions. With various investment strategies available, such as dollar-cost averaging and lump-sum buying, individuals aim to maximize their gains in this volatile market. However, recent research from Fundstrat, as highlighted by Hunter Horsley, the CEO of Bitwise, reveals a fascinating pattern that sheds light on the potential risks associated with missing out on the top 10 days of Bitcoin’s returns each year.

Uncovering the Truth

According to the research conducted by Fundstrat, neglecting to capitalize on the top 10 days of Bitcoin’s returns in a given year could have a detrimental impact on your overall gains. In fact, missing out on these key days could potentially erase all the gains accumulated throughout the year, leaving investors at a significant loss. This revelation emphasizes the importance of staying actively engaged and informed in the crypto market to avoid missing out on lucrative opportunities.

As amusing as it may seem, the idea that simply skipping out on a few days could lead to substantial financial repercussions highlights the unpredictable and volatile nature of Bitcoin and other cryptocurrencies. It serves as a reminder to investors to remain vigilant and strategic in their approach to navigating this ever-evolving market.

How This Information May Affect You

For individual investors in the cryptocurrency space, the findings from Fundstrat’s research serve as a wake-up call to stay actively involved in monitoring market trends and seizing profitable opportunities. By understanding the potential consequences of missing out on the top 10 days of Bitcoin’s returns, investors can implement more strategic investment strategies and minimize their risk exposure.

How This Information May Affect the World

On a larger scale, the implications of Fundstrat’s research extend beyond individual investors to impact the cryptocurrency market as a whole. The revelation that missing out on key days could wipe out annual gains highlights the fragility and susceptibility of this market to external factors and investor behavior. As more individuals become aware of this phenomenon, it could lead to increased market volatility and a heightened sense of urgency among investors to capitalize on lucrative opportunities.

Conclusion

In conclusion, the hilarious truth uncovered by Fundstrat’s research serves as a valuable lesson for investors in the cryptocurrency space. By recognizing the potential risks associated with missing out on the top 10 days of Bitcoin’s returns, individuals can proactively adjust their investment strategies and mitigate their exposure to market volatility. Ultimately, staying informed and engaged in the crypto market is essential for maximizing gains and navigating this unpredictable landscape successfully.