Slow Start to the Trading Week

It’s a rather slow start to the week, with major pairs and crosses stuck inside Friday’s range. Trading could remain subdued for the day with the US dollar struggling to find direction against most of its major peers.

Market Analysis

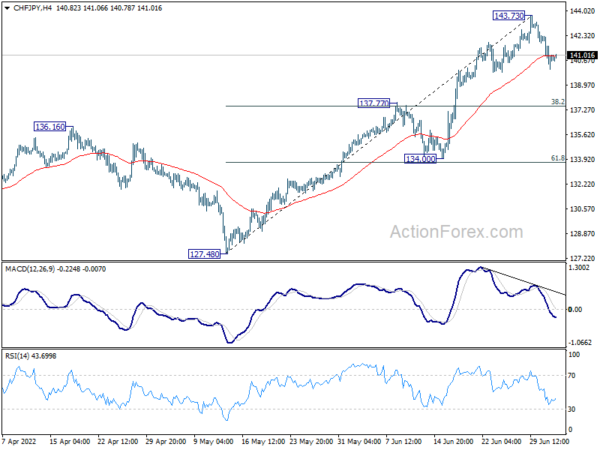

As we kick off the trading week, investors are keeping a close eye on the major currency pairs waiting for a break out of Friday’s range. The lack of significant economic data releases is contributing to the subdued trading activity, with most traders hesitant to make big moves until there is more clarity in the market.

Impact on Traders

For traders, this slow start to the week means that they may have to exercise patience and wait for clearer signals before making any major trading decisions. It is important to closely monitor key levels and be prepared to act quickly once the market breaks out of its current range.

How This Will Affect Me

As an individual trader, this slow start to the week may mean that I need to be more cautious with my trades and be prepared for potential market volatility once trading activity picks up. It is crucial to have a solid risk management plan in place to protect my investments.

Impact on the World

On a larger scale, the slow start to the trading week could have a ripple effect on global markets as trading activity remains subdued. This could impact investor sentiment and potentially lead to greater market uncertainty in the short term.

Conclusion

In conclusion, the slow start to the trading week is a reminder of the importance of patience and diligence in the forex market. As traders navigate the current market conditions, it is essential to stay informed, adapt to changing market dynamics, and be prepared for any potential opportunities that may arise.