ANZ on China outlook:

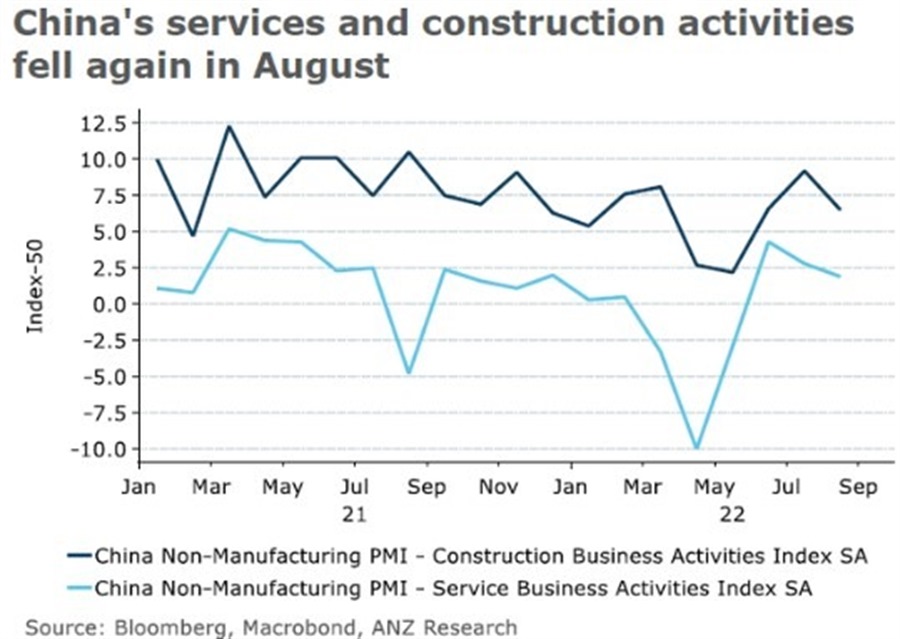

ANZ graph on the PMIs published earlier today:

ANZ has recently released data that paints a pessimistic picture of China’s economic outlook. According to their monthly tracker, if the economy does not bounce back strongly in September, GDP growth is expected to fall below 3.0% in Q3. Additionally, ANZ now forecasts China’s full-year GDP growth to be just 3.0% in 2022.

Data released by ANZ earlier today shows a concerning trend in China’s Purchasing Managers’ Index (PMI). PMI is an indicator of the economic health of the manufacturing sector, and a drop in this index could signal a slowdown in economic activity.

The latest PMI figures for China’s manufacturing sector in August were below expectations, with a reading of 49.4 compared to an expected 49.2. The non-manufacturing PMI also fell short of forecasts, coming in at 52.6 versus an expected 52.2.

How will this affect me?

As a consumer, a slowdown in China’s economy could lead to lower demand for goods and services, potentially impacting prices and availability of products. This could also have a ripple effect on global supply chains, leading to disruptions in the availability of certain items.

How will this affect the world?

China is the world’s second-largest economy, and any slowdown in its growth could have far-reaching implications for the global economy. A weaker Chinese economy could lead to decreased demand for exports from other countries, affecting industries worldwide. Additionally, China’s economic policies and decisions have a significant impact on global financial markets, so any instability in the Chinese economy could cause volatility in markets worldwide.

Conclusion

In conclusion, the latest data from ANZ paints a concerning picture of China’s economic outlook. With GDP growth expected to slow and PMI figures below expectations, it is clear that the Chinese economy is facing challenges. The effects of this slowdown will be felt not only by individuals and businesses in China but also by the global economy as a whole. It is important for policymakers and businesses to closely monitor the situation and prepare for potential repercussions.