Running Away with the Idea: Australian and New Zealand Dollars Surge Ahead

Fed Pause and Currency Surge

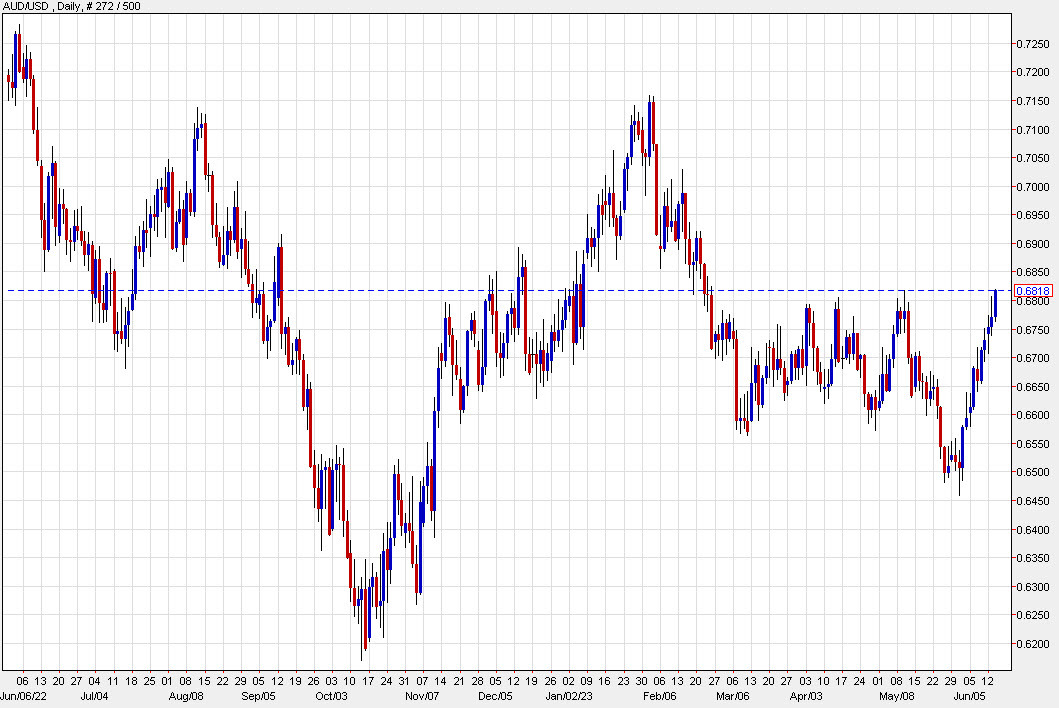

The Australian and New Zealand dollars are making waves in the currency market with the possibility of a longer potential Fed pause. Just hours before the latest decision, NZD/USD is up 1.0% and AUD/USD is up 0.75%. The pairs are rallying following softer US producer prices, indicating a shift in market sentiment towards these currencies.

Pivot towards Asian Assets

There seems to be a pivot towards Asian-leveraged assets, with China recently lowering rates and poised to make further moves in the coming days. This shift may also explain why the Canadian Dollar is lagging behind its commodity counterparts despite an increase in oil prices today.

Impact on Markets and Investors

The surge in the Australian and New Zealand dollars could have significant implications for investors and markets. With the Fed potentially pausing its rate hikes, investors may be looking for alternative currencies to invest in, leading to a rise in demand for the Australian and New Zealand dollars.

Furthermore, the pivot towards Asian assets suggests a diversification of investment portfolios, as investors seek opportunities in emerging markets with strong growth potential.

Impact on the Global Economy

On a global scale, the strengthening of the Australian and New Zealand dollars could have wide-ranging effects. A stronger Australian dollar may boost exports and tourism in Australia, while a stronger New Zealand dollar could benefit the country’s export-driven economy.

Moreover, the pivot towards Asian assets, particularly with China taking proactive measures, could signal increased confidence in the region’s economic stability and growth prospects. This could have a positive spillover effect on global markets and economies.

Conclusion

In conclusion, the surge in the Australian and New Zealand dollars, along with the pivot towards Asian assets, reflects shifting dynamics in the global economy. Investors and markets are adjusting their strategies in response to these developments, creating opportunities for growth and diversification. It will be interesting to see how these trends continue to evolve and impact the world economy in the coming days and weeks.