GCC (Wisdom Tree Commodity Strategy Fund) Calling For Higher Commodities

Introduction

When it comes to tracking commodity trends, investors often look for reliable indicators to help guide their decisions. One such indicator that has been gaining attention is the GCC (Wisdom Tree Commodity Strategy Fund). This fund has shown a strong positive correlation with oil prices, making it a key player in the commodities market.

Analysis

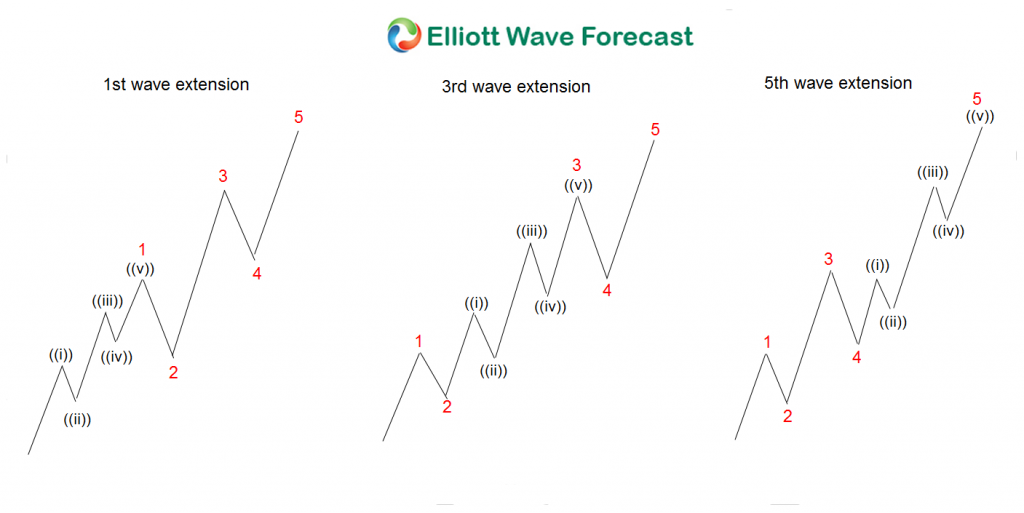

Back in March 2020, the GCC reached a critical point in its trajectory, hitting the blue box area. Since then, it has embarked on a rally that resembles a nest formation. A nest formation is a series of upward movements that indicate a potential uptrend in commodities prices.

Impact on Investors

For investors, the rally in the GCC fund could mean higher returns on commodity investments. By closely monitoring the movements of the GCC fund, investors can gain valuable insights into the direction of various commodities, helping them make informed decisions about their portfolios.

Impact on the World

On a larger scale, the rise in commodities prices signaled by the GCC fund could have broader implications for the global economy. Higher commodity prices could impact industries that rely heavily on raw materials, potentially leading to changes in production costs and consumer prices.

Conclusion

In conclusion, the GCC (Wisdom Tree Commodity Strategy Fund) appears to be signaling a bullish trend in commodities prices. By tracking the movements of this fund, investors can stay ahead of market trends and make strategic investment decisions. As commodities prices continue to rise, both investors and the global economy will need to adapt to these changes.