Welcome to the CryptoSlate Blog!

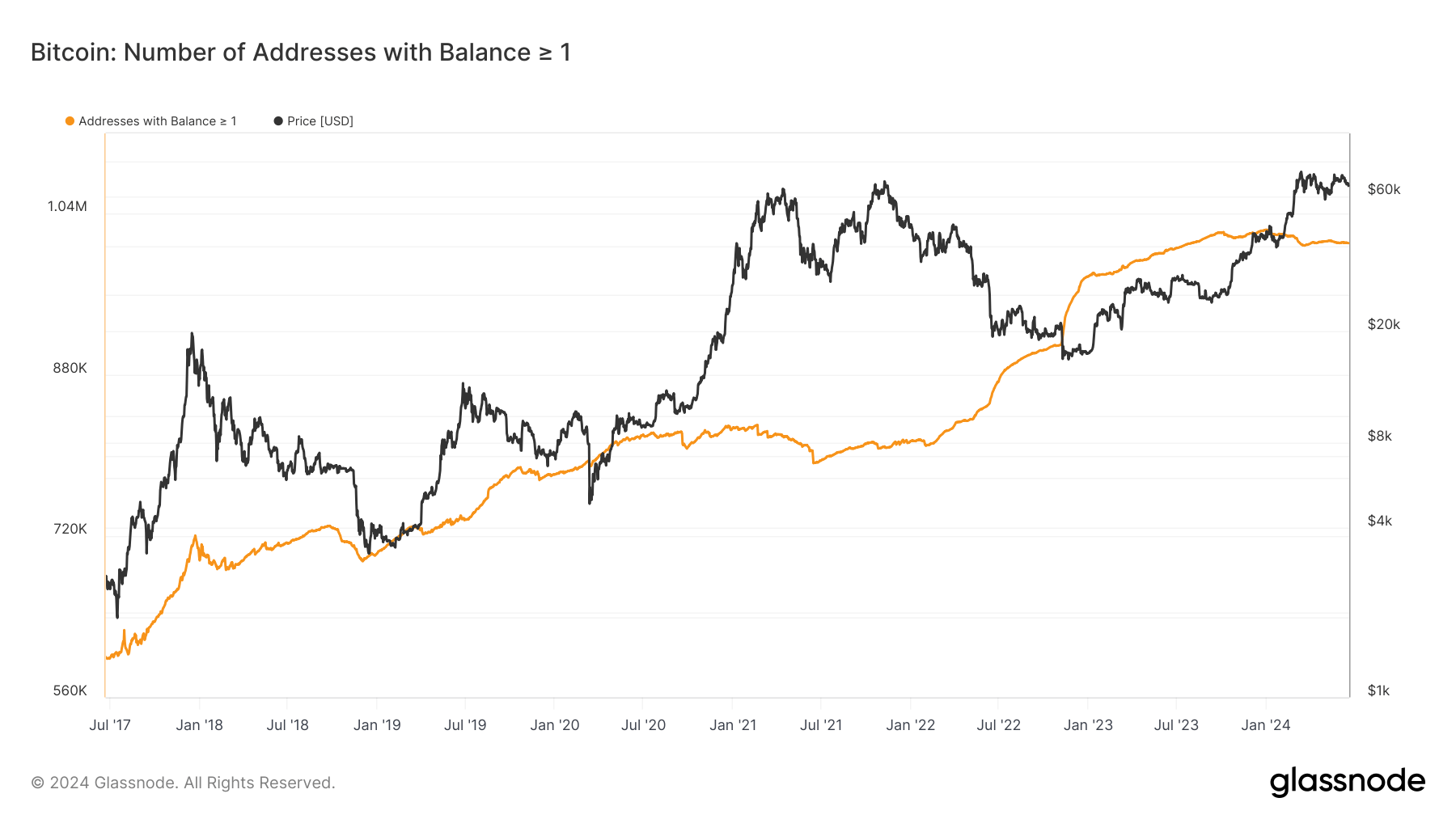

Bitcoin addresses holding over 1 BTC drop to just above 1 million

Onchain Highlights DEFINITION: The number of unique addresses holding at least 1 coin.

Bitcoin addresses holding at least one coin have exhibited a dynamic trend against its price in 2024. As the year began, the number of such addresses hovered around 1.023 million. However, a decline followed, hitting approximately 1.011 million by mid-June. This reduction in the number of Bitcoin addresses holding over 1 BTC has raised eyebrows in the crypto community.

Many speculations surround the reason behind this drop in the number of addresses holding significant amounts of Bitcoin. Some experts believe it could be attributed to large holders selling off some of their BTC, while others think it may be a sign of consolidation among Bitcoin investors. Whatever the reason may be, it is clear that the dynamics of the crypto market are constantly shifting.

Despite the decrease in the number of addresses holding over 1 BTC, Bitcoin continues to be a popular choice for investors looking to diversify their portfolios. The cryptocurrency’s price volatility has been a topic of discussion for years, with many investors seeing it as both a risk and an opportunity. As the market evolves, it will be interesting to see how Bitcoin addresses holding significant amounts of BTC continue to fluctuate.

Impact on Individuals:

For individual Bitcoin investors holding over 1 BTC, this drop in the number of addresses may have implications on their portfolios. It could signify a changing trend in the market and prompt investors to reassess their investment strategies. It is important for individuals to stay informed about market trends and make educated decisions when it comes to their crypto holdings.

Impact on the World:

The decrease in Bitcoin addresses holding over 1 BTC could have larger implications on the global economy. Bitcoin’s popularity as a store of value and investment asset has grown significantly in recent years, making it a key player in the financial market. Any shifts in the number of addresses holding significant amounts of Bitcoin could impact the overall stability of the crypto market and influence investor sentiment worldwide.

Conclusion:

In conclusion, the drop in the number of Bitcoin addresses holding over 1 BTC is a noteworthy development that highlights the ever-changing nature of the cryptocurrency market. Whether it signals a shift in investor behavior or simply a temporary adjustment remains to be seen. As the crypto industry continues to evolve, it is essential for both individuals and the world at large to stay informed and adapt to these changes in order to navigate the market successfully.