A Perfect Friday Read from Reuters!

Investing in Japan: A Risky Proposition

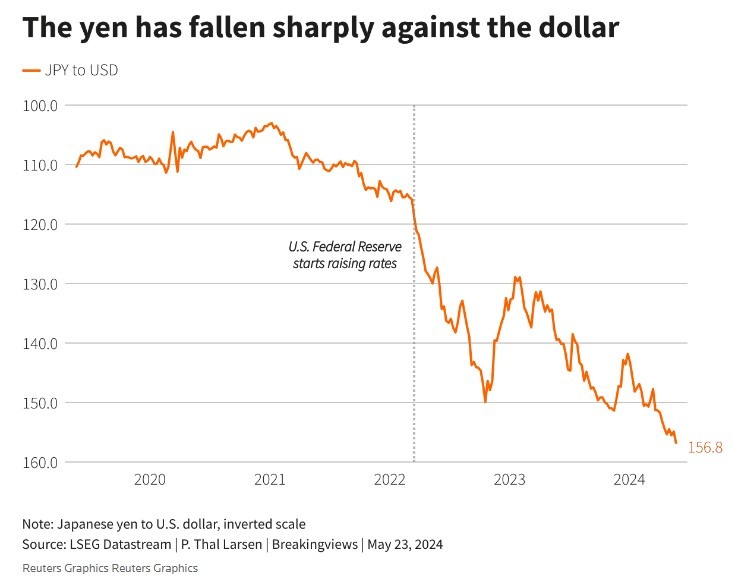

For more than two decades, investors lost their shirts in Japan. In a trade that became known as a “widowmaker”, they sold short Japanese government bonds with their tiny yields, yet suffered as long-term rates crept ever lower and bond prices rose. Today, taking a long position in Japan’s currency is similarly threatening to shorten the lifespans of investors in the Land of the Rising Sun. Over the past three years, the yen has fallen by around 50% against the…

Japan, a country known for its technological innovation, rich culture, and stunning landscapes, has also been a challenging market for investors. For years, investors have struggled to make profitable trades in Japan, with many facing significant losses. The trade of selling short Japanese government bonds, known as the “widowmaker trade”, has led to financial ruin for many over the years.

In recent years, investing in Japan’s currency, the yen, has also proven to be a risky proposition. The yen has experienced a dramatic decrease in value, falling by around 50% over the past three years. This has caused concern among investors, who fear the potential consequences of holding long positions in the Japanese currency.

As Japan continues to grapple with economic challenges, including deflation and an aging population, the future of investing in the country remains uncertain. While there may be opportunities for profit, the risks associated with investing in Japan are significant, and investors must proceed with caution.

How This Will Affect Me

As an individual investor, the volatility in the Japanese market may have a direct impact on your investment portfolio. If you hold positions in Japanese assets or are considering investing in Japan, it is important to carefully assess the risks involved and consider diversifying your portfolio to mitigate potential losses.

How This Will Affect the World

The uncertainty in the Japanese market could have far-reaching implications for the global economy. Japan is the third-largest economy in the world, and its economic performance has a significant impact on global financial markets. Instability in Japan could lead to fluctuations in currency exchange rates, stock markets, and commodity prices around the world.

Conclusion

Investing in Japan is not for the faint of heart. The challenges and risks associated with the Japanese market require careful consideration and prudent decision-making. While there may be opportunities for profit, investors must be aware of the potential pitfalls and proceed with caution. As the future of Japan’s economy remains uncertain, staying informed and staying vigilant will be key to navigating the challenging landscape of investing in the Land of the Rising Sun.