Trading with a Twist: Why Being a Contrarian Isn’t Always Enough – A Guide to Navigating the Forex Market

BEING A CONTRARIAN IS NOT ENOUGH

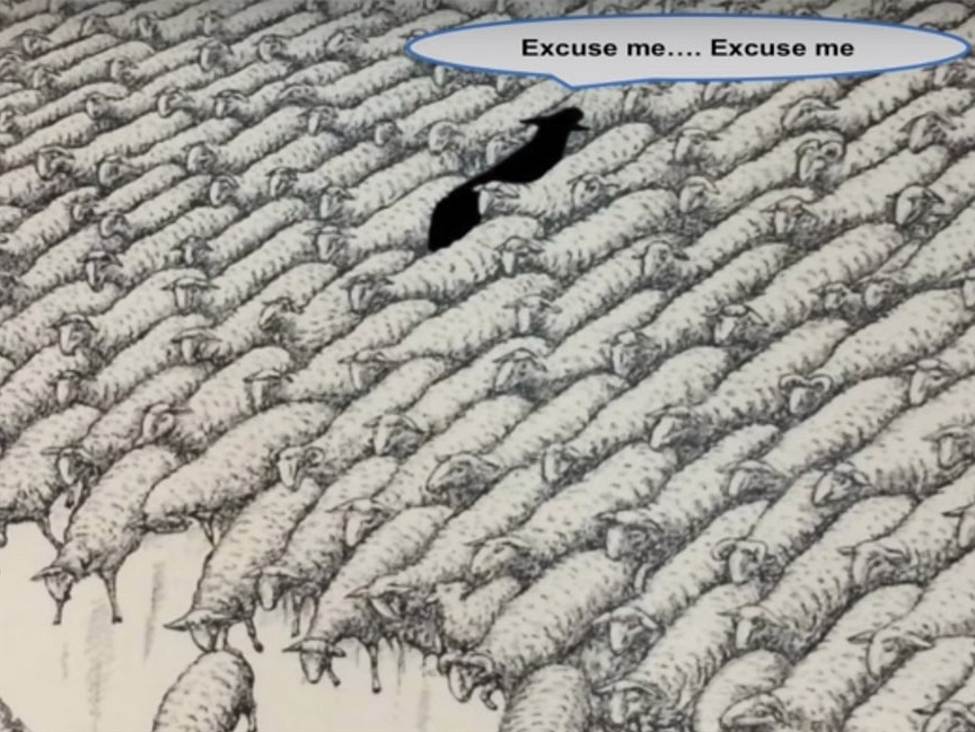

In trading, you generally hear that to make money you have to be a contrarian. This is a half-truth. You need to be an independent thinker. You shouldn’t be a contrarian just for the sake of it.

There’s a famous saying “60 million Frenchmen can’t be wrong”. This is based on the idea that the crowd is collectively smarter than any one individual. Therefore, you can follow the herd (the trend) as long as there are reasons to do so, but you need to look out for signals…

When it comes to navigating the Forex market, simply going against the crowd or following every trend blindly may not always lead to success. It’s important to understand the fundamentals of trading and have a well-thought-out strategy in place. Being a contrarian can be beneficial in certain situations, but it’s not a one-size-fits-all approach.

Why Being an Independent Thinker Matters

Being an independent thinker in the world of trading means not being swayed by popular opinion or market trends. It means doing your own research, analyzing the data, and making decisions based on your own conclusions. While it’s important to consider the opinions of others, ultimately, you are responsible for your own trading decisions.

However, being an independent thinker doesn’t mean being a contrarian for the sake of it. It’s about creating a balance between following the crowd when it makes sense and going against the crowd when there are valid reasons to do so.

So, how do you navigate the complexities of the Forex market as an independent thinker? Here are a few tips to help you on your trading journey:

- Do Your Own Research: Take the time to analyze market trends, economic indicators, and news events that may impact currency prices.

- Develop a Trading Strategy: Create a plan that outlines your trading goals, risk tolerance, and entry/exit points. Stick to your strategy, but be open to adjusting it as needed.

- Stay Informed: Stay up-to-date on market developments and be aware of potential risks that may affect your trades.

- Practice Patience: Trading requires discipline and patience. Don’t rush into trades or let emotions cloud your judgment.

How Being a Contrarian Can Impact You

As an individual trader, being a contrarian can have both positive and negative effects on your trading success. While going against the crowd can sometimes result in profitable trades, it can also lead to significant losses if not done carefully. It’s essential to strike a balance between contrarian and consensus trading to achieve long-term success in the Forex market.

How Being a Contrarian Can Impact the World

In the world of Forex trading, the collective actions of individual traders can impact the overall market trends and volatility. If a large number of traders decide to go against the crowd, it can create shifts in currency prices and market sentiment. This dynamic interplay between contrarians and consensus traders shapes the Forex market on a larger scale.

Conclusion

While being a contrarian can be a valuable trading strategy, it’s essential to approach it with caution and an independent mindset. By carefully analyzing market trends, developing a solid trading strategy, and staying informed, you can navigate the Forex market with confidence and success. Remember, being an independent thinker is key to thriving in the world of trading.