The Impact of Economic Data on Currency Markets

Introduction

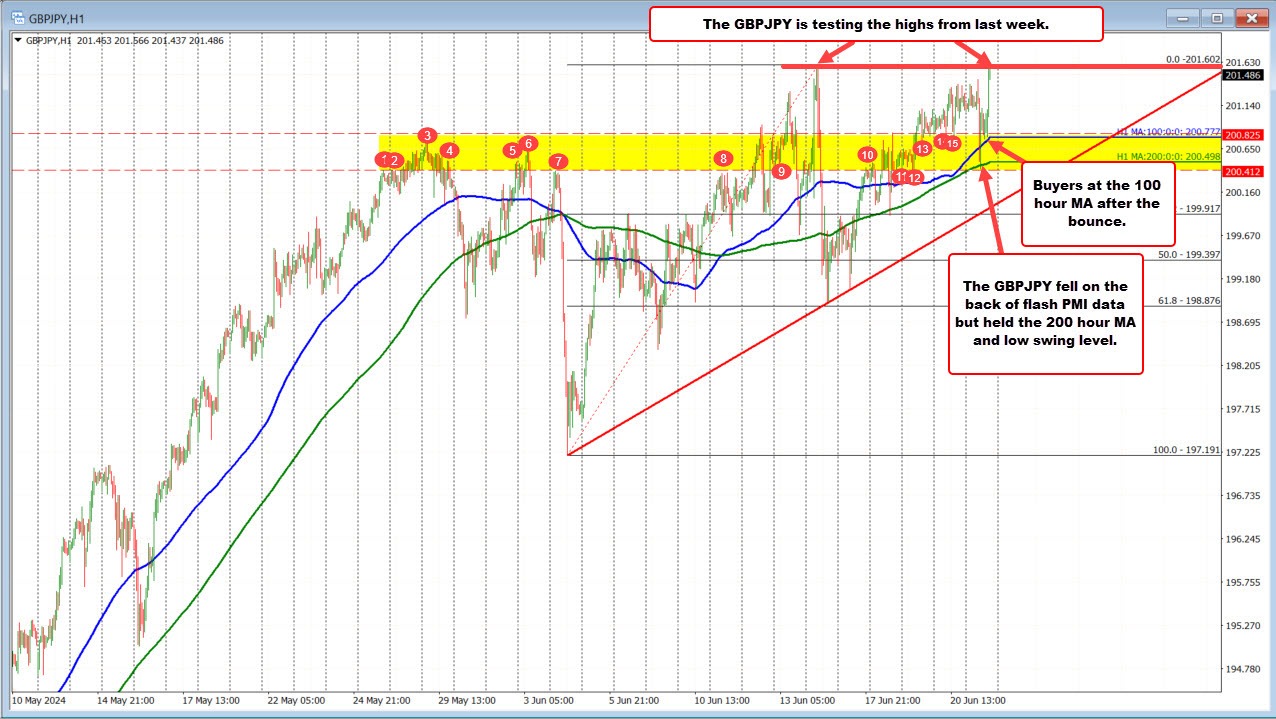

The GBPJPY has been on an upward trend this week, but it turned lower during the European session following weaker-than-expected flash PMI data. The price dropped below its 100-hour moving average (blue line on the chart above at 200.77) but found support near the 200-hour moving average and the lower boundary of a swing area between 200.41 and 200.825. After finding support, the pair rallied to last week’s high of 201.60. A break above this level could trigger further upside momentum, pushing the pair higher.

Impact on Individuals

For individual traders and investors, changes in economic data such as PMI reports can have a significant impact on their forex trading strategies. Weaker-than-expected data can lead to a depreciation in the currency, while stronger-than-expected data can result in an appreciation. It is important for individuals to stay informed about economic indicators and their potential impact on currency markets in order to make informed trading decisions.

Impact on the World

The movement of currency pairs like GBPJPY can have broader implications for the global economy. A weaker Japanese yen relative to the British pound can benefit Japanese exporters by making their goods more competitive in international markets. On the other hand, a stronger yen can make Japanese exports more expensive for foreign buyers. This can impact trade balances and overall economic growth in both countries.

Conclusion

In conclusion, economic data releases play a crucial role in driving movements in currency markets. Traders and investors need to pay close attention to these indicators in order to anticipate market trends and adjust their trading strategies accordingly.