Onchain Highlights DEFINITION:

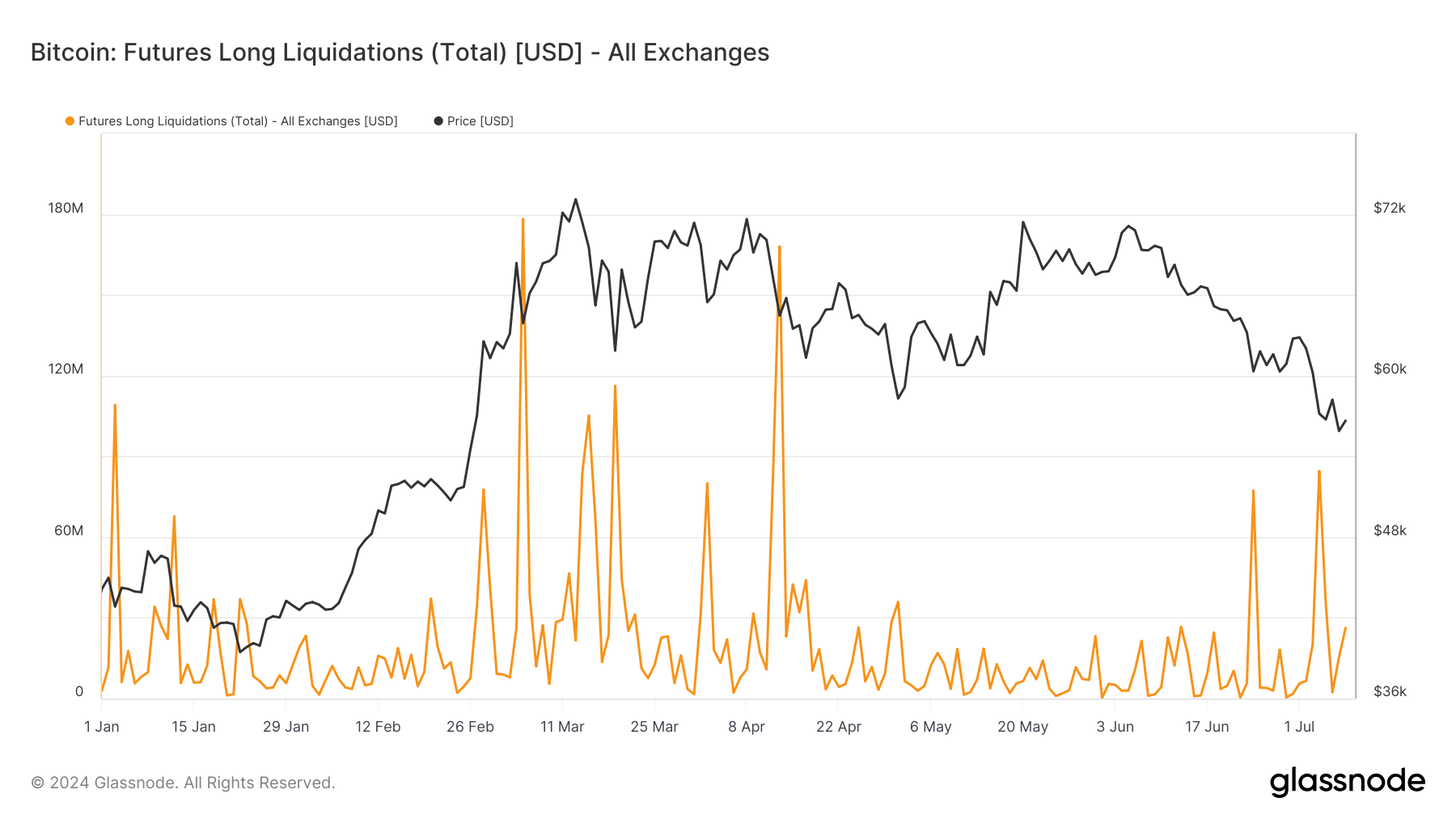

The sum liquidated volume (USD Value) from long positions in futures contracts.

Over the past month, Bitcoin has experienced notable price fluctuations, with the price dropping from around $60,000 in mid-May to below $55,000 by early July. This period saw spikes in futures long liquidations, suggesting significant volatility in the market.

Post-halving volatility triggers significant Bitcoin futures liquidations

With the recent post-halving volatility in the cryptocurrency market, there have been significant Bitcoin futures liquidations. This has been a result of the sharp price fluctuations that Bitcoin has experienced in recent months. Traders who were holding long positions in futures contracts were forced to liquidate their positions due to the rapid price drops, leading to a surge in liquidated volume.

These liquidations have highlighted the inherent risks in trading futures contracts, especially in a highly volatile market like Bitcoin. It serves as a reminder to traders to always use proper risk management techniques and to be mindful of the potential for large losses in such fast-moving markets.

How this will affect me:

As a cryptocurrency trader, the increased volatility and subsequent liquidations in Bitcoin futures contracts should serve as a cautionary tale. It is important to be aware of the risks involved in trading futures and to always have a solid risk management strategy in place to protect against significant losses.

How this will affect the world:

The significant Bitcoin futures liquidations resulting from post-halving volatility have wider implications for the cryptocurrency market and the financial world as a whole. It highlights the need for better regulation and oversight in the futures market to protect investors and prevent market manipulation. It also serves as a reminder of the unpredictable nature of cryptocurrencies and the importance of staying informed and adaptable in such a rapidly evolving market.

Conclusion:

In conclusion, the recent spike in Bitcoin futures liquidations following post-halving volatility underscores the importance of risk management and market awareness in the cryptocurrency trading world. Traders should approach futures trading with caution and be prepared for sudden price fluctuations that could lead to significant losses. As the market continues to evolve, it will be essential for traders to stay informed and adapt to changing market conditions to navigate the uncertainties of the cryptocurrency landscape.