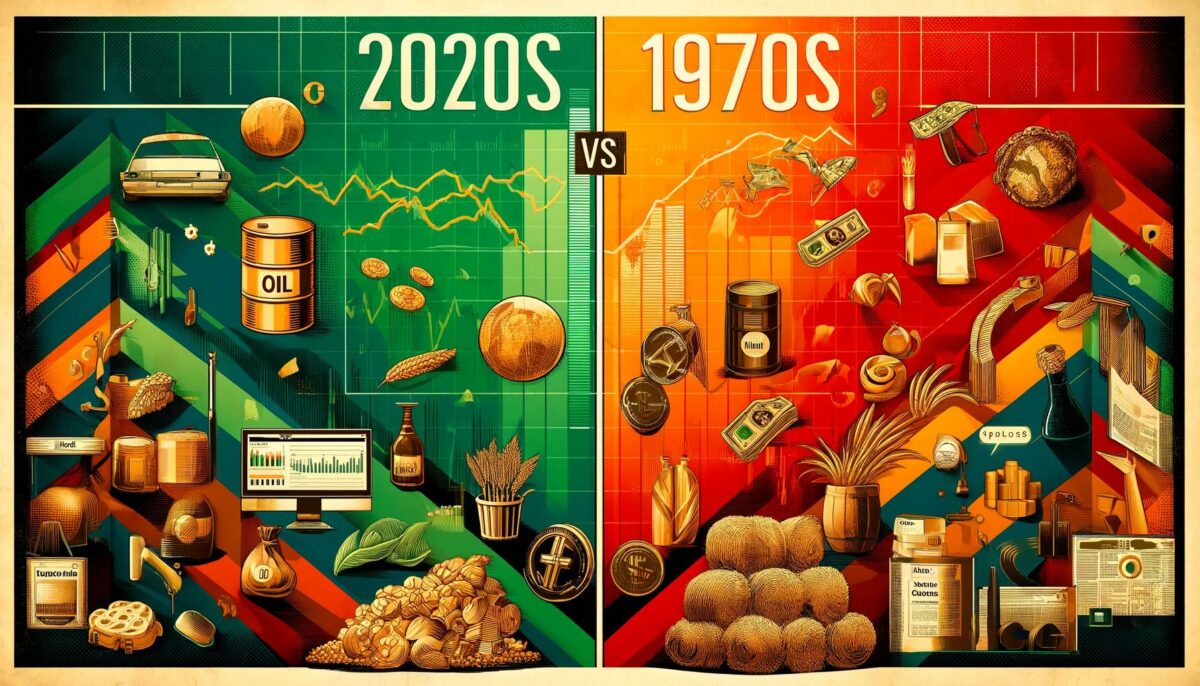

2020s vs. 1970s: Will Commodity Trends Predict Inflation?

In today’s economic environment, investors face a panorama reminiscent of the inflation-ridden 1970s.

With such historical inflation haunting the current decade, the financial focus has sharply pivoted back to commodities. Let’s discuss why commodities have reclaimed their spotlight in the market and examine their historical role during the turbulent 1970s.

Why Commodities Have Reclaimed the Spotlight

Commodities are raw materials that are essential for the production of goods and services. In times of economic uncertainty, investors turn to commodities as a safe-haven asset to protect their portfolios from inflation and market volatility. The recent increase in commodity prices can be attributed to various factors such as supply chain disruptions, geopolitical tensions, and changing consumer demand.

During the 1970s, the global economy experienced a period of high inflation due to rising energy prices, labor costs, and government spending. This led to a surge in commodity prices, particularly oil and precious metals. Investors who had allocated a portion of their portfolios to commodities were able to hedge against inflation and preserve their wealth.

The Historical Role of Commodities in the 1970s

During the 1970s, commodity prices experienced a massive bull market as a result of inflationary pressures and supply constraints. The oil crisis of 1973 caused a sharp spike in oil prices, leading to widespread economic turmoil and recession. In response, investors flocked to commodities such as gold, silver, and agricultural products as a store of value.

As we enter the 2020s, the current economic landscape bears striking similarities to the 1970s. The COVID-19 pandemic has disrupted global supply chains, resulting in rising commodity prices and inflationary pressures. As central banks continue to implement loose monetary policies and governments increase fiscal spending, investors are once again turning to commodities as a hedge against inflation.

How Will This Affect Me?

For individual investors, the resurgence of commodities as a key asset class presents both opportunities and risks. Investing in commodities can provide diversification benefits and protection against inflation, but it also carries inherent volatility and market unpredictability. It is important for investors to carefully assess their risk tolerance and investment goals before allocating capital to commodities.

How Will This Affect the World?

The reemergence of commodities as a focal point in the financial markets has broader implications for the global economy. Rising commodity prices can lead to higher production costs for businesses, potentially resulting in increased consumer prices and reduced consumer spending. Governments may also be forced to implement tighter monetary policies in order to curb inflation, which could slow economic growth and job creation.

Conclusion

As we navigate through the uncertainties of the 2020s, the lessons learned from the inflationary 1970s serve as a valuable guide for investors and policymakers alike. Commodities have once again taken center stage in the financial markets, offering a potential hedge against inflation and market volatility. By closely monitoring commodity trends and understanding their historical significance, investors can position themselves to weather the economic challenges ahead.