Euro’s Brief Respite Ends, Renewed Selloff Driven by French Political Woes

What Happened?

President Emmanuel Macron’s decision to call for a snap election in France has sent shockwaves through the Eurozone, with the Euro coming under significant pressure. The move has heightened fiscal consolidation risks, leading credit rating agency Moody’s to describe the situation as “credit negative.” The uncertainty surrounding the upcoming election has eroded investor confidence, particularly following a poll suggesting that the National Rally could make significant gains.

The Impact on the Euro

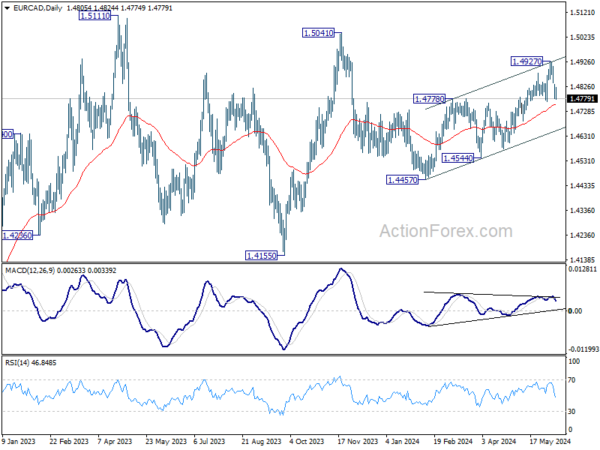

The Euro had seen a brief respite in recent weeks, but the renewed selloff driven by French political woes has put the currency back on shaky ground. The increasing uncertainty in France has raised concerns about the stability of the Eurozone as a whole, leading to a decline in the value of the Euro against other major currencies.

How Will This Affect Me?

As a consumer or investor in the Eurozone, the renewed selloff driven by French political woes could have a direct impact on your finances. The depreciation of the Euro may lead to higher prices for imported goods and increased costs for foreign travel. Additionally, the instability in the Eurozone could impact investment decisions and economic growth in the region, potentially affecting job opportunities and overall prosperity.

How Will This Affect the World?

The escalating political uncertainty in France and its impact on the Euro could have wider implications for the global economy. As one of the largest economies in the Eurozone, any instability in France could reverberate across the region and beyond, affecting international trade, financial markets, and investor sentiment. The implications of a weakened Euro could also impact countries outside of the Eurozone, leading to increased volatility in currency markets and potentially influencing global economic growth.

Conclusion

The Euro’s brief respite has come to an end, with renewed selloff driven by French political woes sending the currency into a tailspin. The upcoming snap election in France has heightened fiscal consolidation risks and eroded investor confidence, leading to increased uncertainty in the Eurozone. The implications of this development may have far-reaching effects on individuals, businesses, and economies both within the Eurozone and around the world.