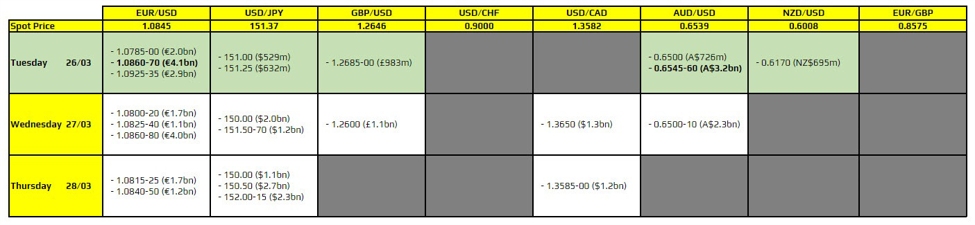

Get Ready for the FX Option Expiries on March 26th at 10am in New York City!

Description:

There are a couple of large ones to be wary of for the day, as highlighted in bold. The first ones are for EUR/USD, layered at the 1.0860-70 level. That coincides with some technical layers that could keep a lid on price action in the session ahead. Of note, the 100 and 200-hour moving averages at 1.0853-70 now and the 200-day moving average at 1.0872 are the key technical levels to watch. As such, the expiries just add another layer on top of that now.

Then, there are the ones for AUD/USD at 0.6…

Effect on Me:

As an individual investor or trader, the FX option expiries on March 26th at 10 am in New York City may impact the currency pairs you are trading. It is important to be aware of these large expiries, especially for EUR/USD and AUD/USD, as they can influence price action and create additional technical levels to watch for potential trading opportunities or risks.

Effect on the World:

On a larger scale, the FX option expiries scheduled for March 26th at 10 am in New York City can have ripple effects in the global foreign exchange market. Large expiries like the ones for EUR/USD and AUD/USD can affect currency valuations, market sentiment, and overall trading dynamics, potentially impacting international trade and economic stability.

Conclusion:

Being mindful of the FX option expiries on March 26th at 10 am in New York City is crucial for both individual traders and the global financial market. These expiries, particularly those for EUR/USD and AUD/USD, can play a significant role in shaping market movements and creating trading opportunities. Stay informed and prepared to navigate the potential impact of these expiries on your trading strategy and the broader economic landscape.