The Great OKX Controversy: A $41M Transfer that Shook the Crypto World

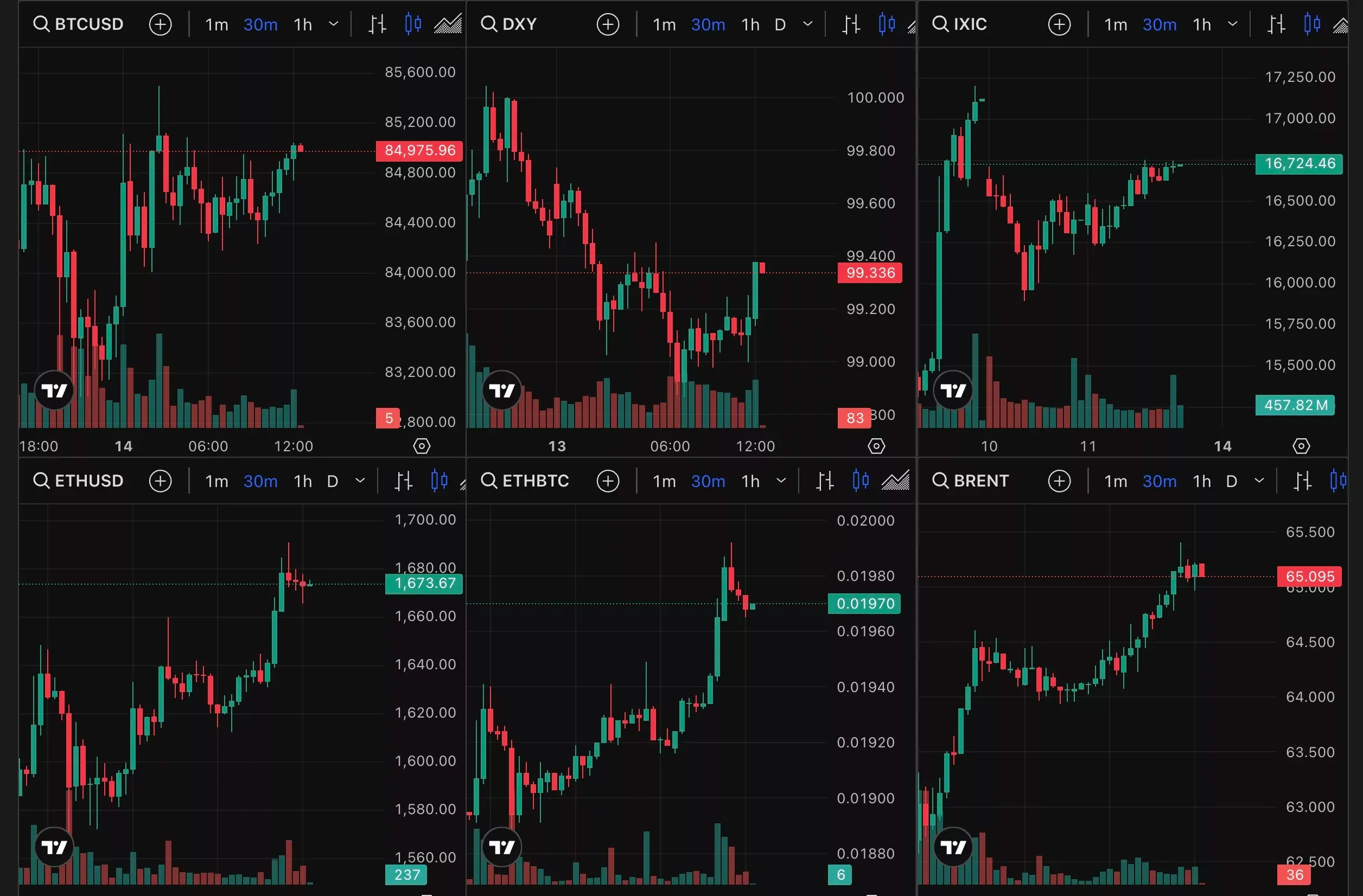

In the ever-volatile world of cryptocurrencies, where prices can fluctuate wildly in a matter of seconds, it takes a significant event to truly cause a stir. One such incident occurred just a few weeks ago, when an insider-linked wallet moved an astounding $41 million worth of Omnichain (OM) tokens from one exchange to another, sparking panic and triggering a 90% price collapse.

The Suspicious Transfer

The transfer in question took place on the OKX exchange, formerly known as OKEx. The sudden movement of such a large amount of tokens, just before the price of OM plummeted, raised suspicions among the crypto community. Some accused insiders of manipulating the market, while others pointed fingers at the exchange itself.

The OKX CEO’s Response

In response to the growing outrage, OKX CEO Jay Hao took to social media to address the situation. He slammed the incident as a “scandal” and pledged complete transparency on liquidation and collateral data. Hao also assured users that the exchange had not been involved in any wrongdoing and that all KYC (Know Your Customer) procedures had been followed.

The Aftermath

Despite Hao’s reassurances, the damage had already been done. The price of OM continued to plummet, reaching new lows as investors scrambled to sell their tokens. The incident served as a stark reminder of the risks involved in the crypto market and the potential for manipulation.

Impact on Individual Investors

- Those who held large positions in OM suffered significant losses.

- The incident highlights the importance of doing thorough research before investing in any crypto asset.

- It also underscores the need for transparency and accountability in the crypto industry.

Impact on the Crypto World

- The OKX controversy added fuel to the ongoing debate about the need for regulation in the crypto industry.

- It also served as a reminder of the risks involved in investing in cryptocurrencies and the potential for market manipulation.

- The incident may lead to increased scrutiny of exchanges and their practices.

Conclusion

The OKX controversy serves as a cautionary tale in the crypto world. While the industry offers the potential for high returns, it also comes with significant risks. As investors, it’s important to stay informed and do thorough research before making any investment decisions. It’s also crucial for exchanges to prioritize transparency and accountability to build trust with their users. Only then can we navigate the volatile crypto market with confidence.

So, the next time you hear about a large transfer or price collapse in the crypto world, take a step back and consider the bigger picture. And remember, as with any investment, there’s always a risk involved. But with the right information and a level head, you can make informed decisions and weather the storms of the crypto market.