Blog Post Article:

Fundamental Overview

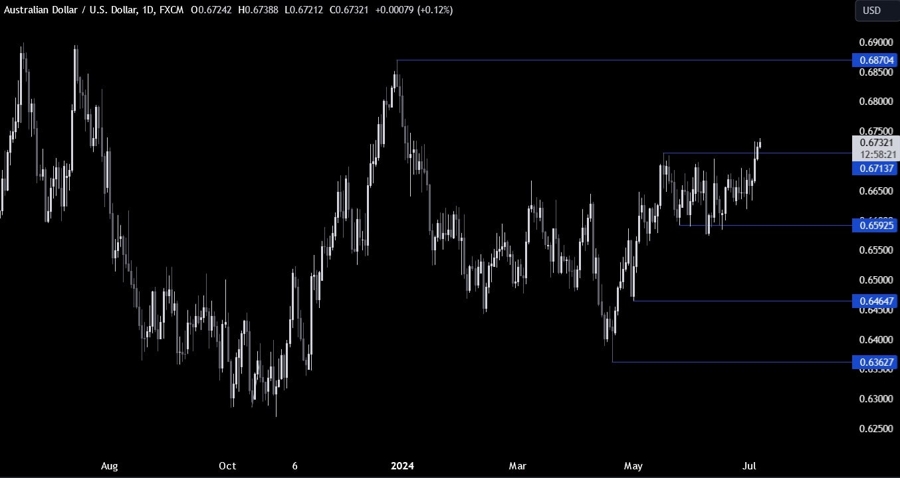

Hey there finance fanatics! Let’s dive into the wild world of currency markets. So, last week the USD took a hit across the board thanks to some not-so-great US Jobless Claims and ISM Services PMI reports. Doesn’t sound too thrilling, I know, but bear with me. While these numbers didn’t shake up interest rates too much, the general consensus is that the Fed is likely to slash rates not once, but twice by the end of the year. Buckle up, folks, it’s gonna be a bumpy ride.

On the flip side, the AUD has been feeling the heat lately. Blame it on the US Dollar’s recent surge, which seems to be more about quarter-end jitters than any real economic factors. Stay strong, Aussie, you’ll bounce back!

What’s coming up this week?

Alright, what can we expect in the days ahead? Well, keep an eye on those trade tensions between the US and China, as they continue to rattle markets. Oh, and don’t forget about those pesky Brexit negotiations throwing a wrench into things. Should be an interesting week indeed!

How this will affect YOU:

So, how will all this currency chaos affect you? Well, if you’re planning any overseas trips or shopping sprees, keep an eye on exchange rates. A weaker USD could mean your money goes a bit further abroad. On the flip side, if you’re an importer or exporter, be prepared for some volatility in the markets. It’s always good to stay on your toes!

How this will affect the WORLD:

As for the global impact, a shift in interest rates could have ripple effects across the globe. Emerging markets may see some relief with a weaker USD, while major economies like the EU and China will be closely watching any rate cuts from the Fed. Keep an eye on those headlines, world travelers!

Conclusion

And there you have it, folks! Currency markets are never dull, that’s for sure. Whether you’re a savvy investor or just casually following the news, it’s always good to stay in the loop. Until next time, happy trading!