WTI Oil Futures Soar to Three-Month Highs

The Market Update

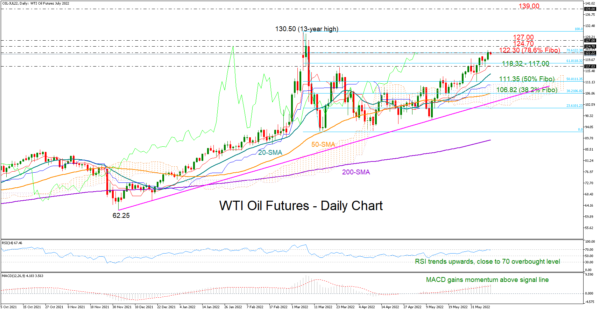

WTI oil futures (July delivery) extended their series of higher highs up to $123.15 on Wednesday before easing a bit – the highest in three months. This surge in prices comes amidst ongoing supply concerns and geopolitical tensions in key oil-producing regions.

Reasons Behind the Surge

The recent increase in oil prices can be attributed to a variety of factors, including the ongoing conflict in Ukraine and the potential for supply disruptions in major oil-producing countries like Russia and Iran. In addition, the global economic recovery has led to increased demand for oil, further driving up prices.

Implications for Investors

For investors, the rise in oil prices presents both opportunities and challenges. On one hand, those who have invested in oil futures stand to gain from the price increase. However, higher oil prices can also lead to increased costs for businesses and consumers, potentially impacting economic growth.

How This Will Affect Me

As a consumer, expect to see higher prices at the gas pump and potentially on other goods and services that rely on oil. This could lead to increased inflation and a higher cost of living in the short term.

Global Impact

Internationally, higher oil prices could have far-reaching effects on the global economy. Countries that rely heavily on oil imports may face economic challenges, while oil-exporting nations could see a boost in revenue. Geopolitical tensions in key oil-producing regions may also escalate, leading to further uncertainty in the market.

In Conclusion

The surge in WTI oil futures to three-month highs reflects the complex interplay of supply and demand dynamics, geopolitical tensions, and global economic factors. While investors may benefit from the price increase, consumers and businesses alike will feel the impact of higher oil prices in the coming months.