Bitcoin ETFs Suffer Large Outflow as Investors Exit, While Ether ETFs See Small Inflows

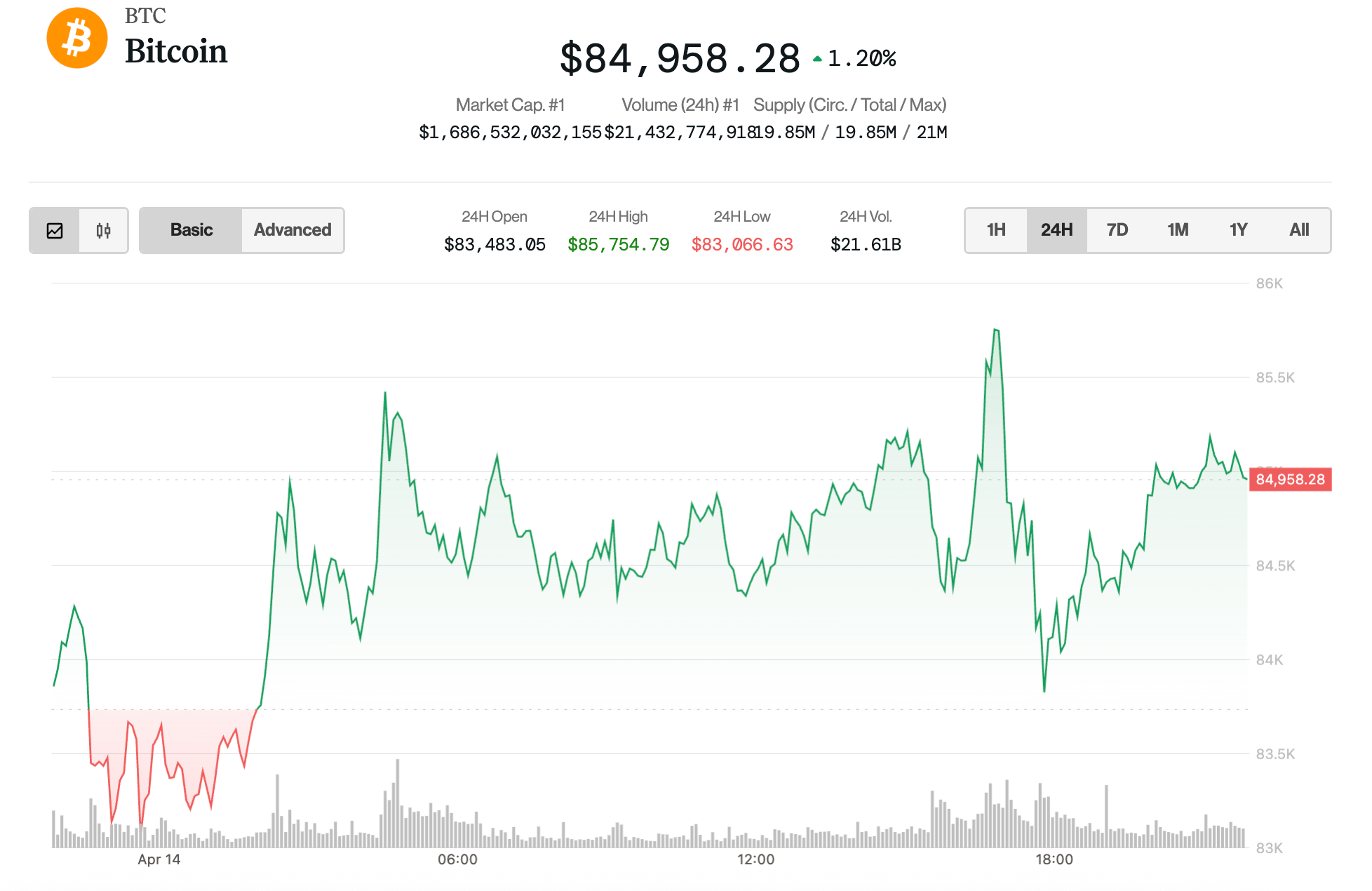

Last Friday, the cryptocurrency market experienced some significant movements as investors showed their hands. According to data from various sources, Bitcoin Exchange-Traded Funds (ETFs) recorded a massive outflow of $65 million with no offsetting inflows.

Leading the Exodus: GBTC, ARKB, and BITB

The three largest Bitcoin ETFs, Grayscale Bitcoin Trust (GBTC), Ark 21Shares Bitcoin ETF (ARKB), and Bitwise Bitcoin ETF Trust (BITB), led the charge with outflows of $32.4 million, $21.4 million, and $11.2 million, respectively.

Ether ETFs Buck the Trend with Small Inflows

In contrast, Ether ETFs saw a small inflow of $2 million, marking a break from their multi-day outflow trend. ProShares Short Bitcoin Strategy ETF (BITI), which is an inverse Bitcoin ETF, also saw an inflow of $1.1 million.

What Does This Mean for Me?

As an individual investor, these movements may not directly impact you, but they can provide valuable insights into the market’s sentiment. Large outflows from Bitcoin ETFs can indicate that institutional investors are selling off their holdings, potentially due to bearish sentiment or other reasons.

Global Implications: A Ripple Effect

On a larger scale, these outflows could have ripple effects on the broader market. Institutional selling can put downward pressure on Bitcoin’s price, potentially leading to a bear market. However, it’s important to note that the cryptocurrency market is highly volatile and subject to rapid price swings.

Looking Ahead

As we move forward, it will be essential to keep an eye on these trends and any potential catalysts that could influence investor sentiment. Whether you’re an individual investor or an institutional player, staying informed can help you make more informed decisions and navigate the ever-changing cryptocurrency landscape.

- Keep track of ETF flows for insights into market sentiment

- Stay informed about potential catalysts that could impact investor sentiment

- Remember the cryptocurrency market is volatile and subject to rapid price swings

In conclusion, last Friday’s outflows from Bitcoin ETFs and inflows to Ether ETFs offer valuable insights into the market’s sentiment. As individual investors, we can use this information to make more informed decisions. On a larger scale, these trends could have ripple effects on the broader market. Staying informed and keeping an eye on these trends will be essential as we navigate the ever-changing cryptocurrency landscape.