Analysts clash over future of Bitcoin ETFs as institutional interest lags

Introduction

Jim Bianco, head of Bianco Research, has been at the forefront of the debate surrounding Bitcoin ETFs. He has raised concerns about the centralization of these ETFs and their impact on the decentralized nature of Bitcoin. Bianco recently made a statement asserting that a spot ETF is not decentralized and criticized the main investors in these ETFs as “Orange FOMO poker chips for paper-handed small-time traders (degens).” The clash between analysts over the future of Bitcoin ETFs is indicative of the ongoing debate within the cryptocurrency community.

The Argument Against Bitcoin ETFs

Bianco’s criticism of Bitcoin ETFs stems from his belief that they undermine the core principles of decentralization that Bitcoin was founded upon. He argues that the centralization of these ETFs goes against the ethos of a peer-to-peer electronic cash system and raises concerns about the control exerted by institutional investors.

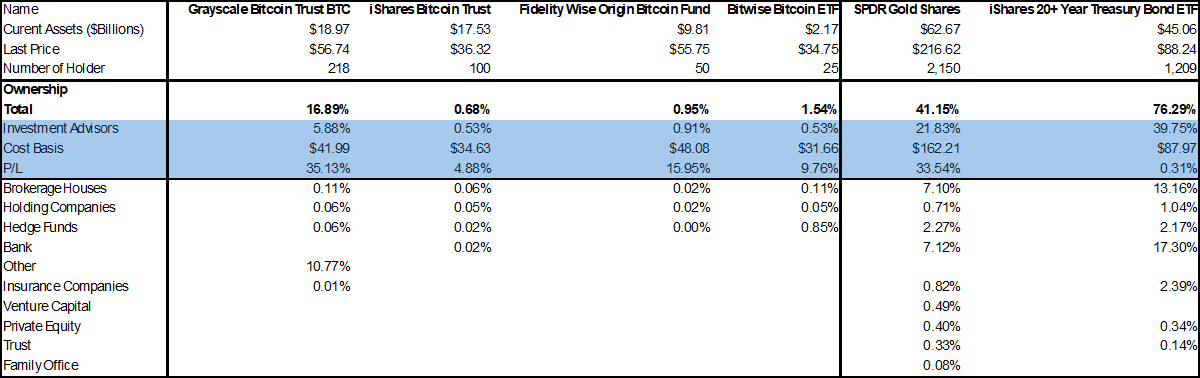

Impact on Institutional Interest

Despite the growing popularity of cryptocurrencies, institutional interest in Bitcoin ETFs has been lagging. The skepticism surrounding the centralized nature of these ETFs may be one of the factors contributing to this lack of institutional uptake. Bianco’s vocal criticism of Bitcoin ETFs may further deter institutional investors from entering the market.

The Future of Bitcoin ETFs

The clash between analysts like Jim Bianco and proponents of Bitcoin ETFs highlights the ongoing debate within the cryptocurrency community. As the space continues to evolve, the future of Bitcoin ETFs remains uncertain. It is clear that the issue of centralization will continue to be a point of contention among industry experts and enthusiasts alike.

How it will affect me

As a retail investor, the debate over the future of Bitcoin ETFs may impact your investment decisions. The concerns raised by analysts like Jim Bianco about centralization and institutional interest could influence the overall market sentiment and performance of Bitcoin ETFs. It is important to stay informed about these developments and consider the implications for your investment strategy.

How it will affect the world

The ongoing clash over the future of Bitcoin ETFs could have broader implications for the cryptocurrency market and the financial industry as a whole. If institutional interest in Bitcoin ETFs continues to lag due to concerns about centralization, it may hinder the mainstream adoption of cryptocurrencies. This could impact the global perception of cryptocurrencies as a legitimate asset class and reshape the regulatory landscape surrounding digital assets.

Conclusion

The debate over the future of Bitcoin ETFs underscores the complexities and challenges associated with integrating cryptocurrencies into traditional financial systems. Analysts like Jim Bianco bring important perspectives to the table, raising critical questions about the impact of centralization on the decentralized ethos of Bitcoin. As the cryptocurrency market continues to evolve, it is essential to consider the implications of these debates for both individual investors and the broader financial ecosystem.