Humorous take on BlackRock’s iShares Bitcoin Trust (IBIT)

Hey there fellow crypto enthusiasts! Have you heard the buzz about BlackRock’s iShares Bitcoin Trust (IBIT)? This ETF has been making waves in the market ever since its launch in January. And let me tell you, it’s been a wild ride!

The IBIT Phenomenon

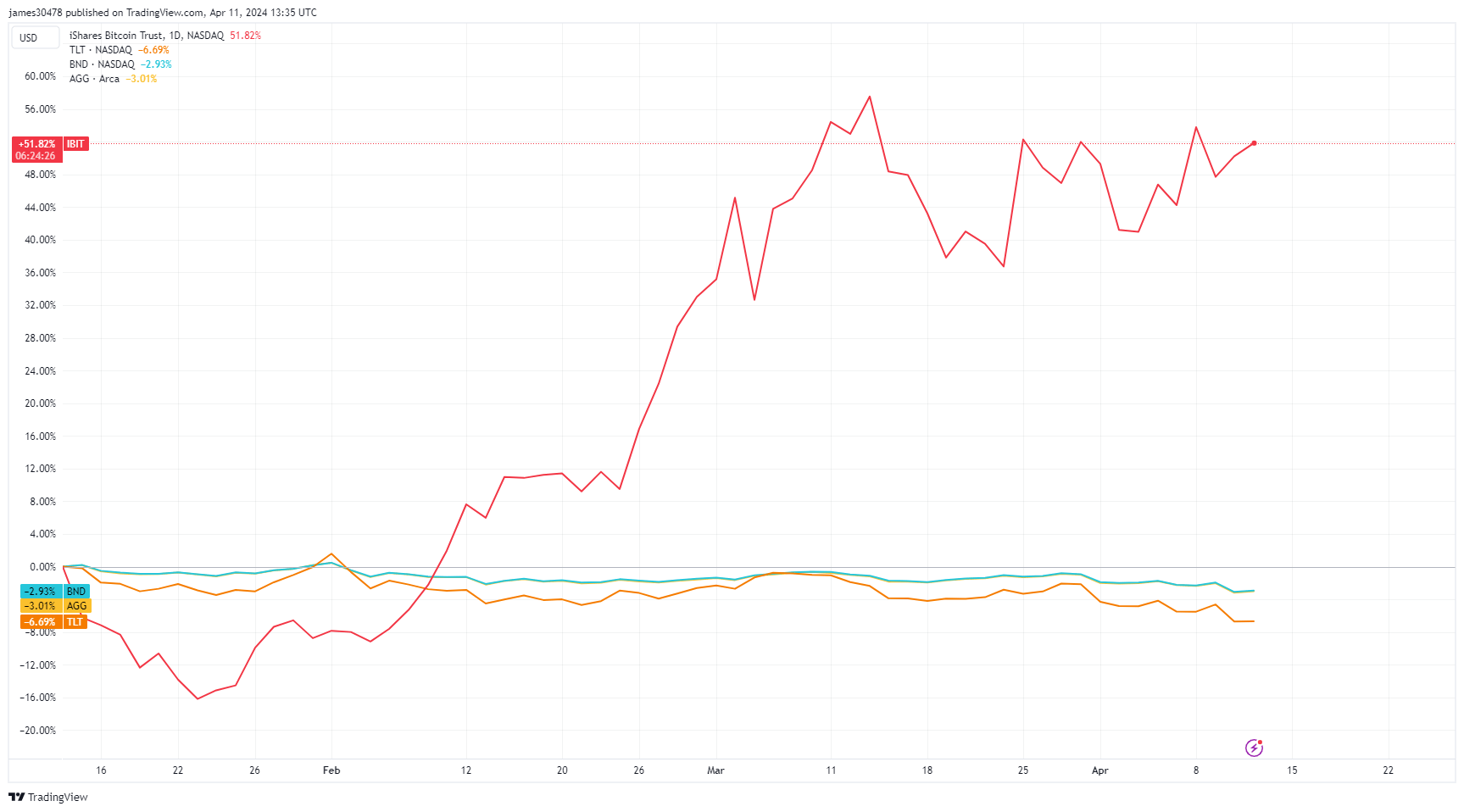

With a jaw-dropping 266,587 Bitcoin in its portfolio and a market cap of approximately $19 billion, IBIT is definitely not messing around. And the cherry on top? A whopping 52% year-to-date increase in share price, leaving bond ETFs in the dust. Talk about impressive!

Trading Volume Skyrockets

But wait, there’s more! IBIT recently hit over $300 million in trading volume within the first 30 minutes of trading, catapulting it into the top 10 ETFs. It’s safe to say that this little ETF is causing quite a stir in the crypto world.

How Will This Affect Me?

So, what does all this mean for us regular folks? Well, if you’re invested in IBIT, you’re probably doing a happy dance right about now. With such impressive performance, your portfolio is likely looking pretty healthy. But hey, if you’re not in on the action yet, now might be the time to consider jumping on the IBIT bandwagon!

How Will This Affect the World?

On a larger scale, the rise of IBIT signals the growing mainstream acceptance of cryptocurrencies. As more institutional investors flock to Bitcoin and other digital assets, we can expect to see even greater fluctuations in the market. The world of finance is changing, folks, and IBIT is leading the charge.

Conclusion

So, there you have it – the IBIT phenomenon in a nutshell. Whether you’re a seasoned crypto investor or just dipping your toes into the world of digital assets, BlackRock’s iShares Bitcoin Trust is definitely one to watch. Who knows what the future holds for IBIT, but one thing’s for sure – it’s definitely making its mark on the ETF market!