Robinhood’s New Wealth Management and Private Banking Services: A Game-Changer for Modest Portfolios

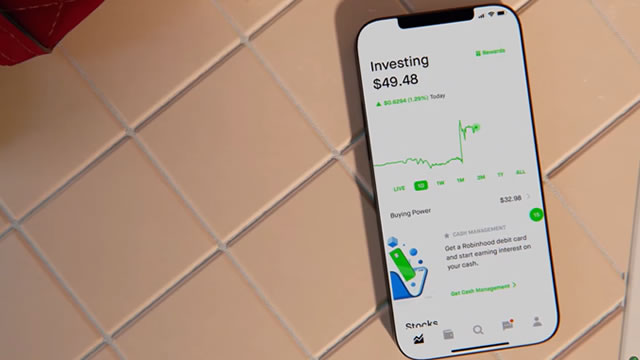

Robinhood, the popular trading platform known for its commission-free stock trading, has recently announced its plans to expand its offerings with wealth management and private banking services. This move comes as the company aims to have a more significant impact on its users’ financial habits, particularly those with modest portfolios.

Robinhood’s New Offerings: An Overview

Robinhood’s new services will include automated investment portfolios, personalized investment recommendations, and access to financial planning tools. These offerings will be available for users with as little as $1, making them more accessible to a broader audience than traditional wealth management and private banking services.

Impact on Individual Investors

For individual investors with modest portfolios, Robinhood’s new offerings could mean more accessible and affordable investment opportunities. With no minimum balance requirement and low fees, these services may be particularly attractive to younger investors or those who have previously been unable to access wealth management services.

- Automated investment portfolios: Robinhood’s automated investment portfolios will use algorithms to create diversified investment portfolios based on a user’s risk tolerance and investment goals.

- Personalized investment recommendations: Users will receive personalized investment recommendations based on their portfolio and investment goals.

- Financial planning tools: Robinhood’s financial planning tools will help users create budgets, set savings goals, and track their spending.

Impact on the World

Robinhood’s entry into the wealth management and private banking space could disrupt the traditional financial industry. By offering these services at a lower cost and with fewer barriers to entry, Robinhood may attract a significant number of new investors. This could lead to increased competition for traditional financial institutions and potentially drive down fees and improve access to investment services for a broader audience.

Conclusion

Robinhood’s new wealth management and private banking services represent an exciting development for individual investors with modest portfolios. By offering accessible and affordable investment opportunities, Robinhood is poised to attract a significant number of new investors and potentially disrupt the traditional financial industry. As these services become more widely available, it will be interesting to see how they impact the financial habits and investment behaviors of millions of users.

Stay tuned for more updates on Robinhood’s new offerings and how they may impact your personal finances and the financial world at large.