The Bank of Canada Decision: What to Expect

June 5, 2024

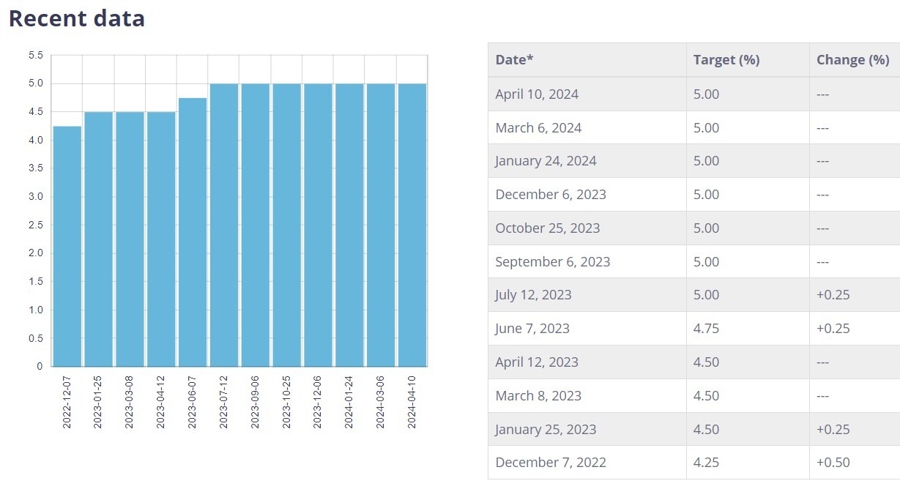

The Bank of Canada decision is due at 1345 GMT on Wednesday, 5 June 2024, which is 0945 Eastern time. The consensus is for the Bank to cut from 5 to 4.75%. Commonwealth Bank of Australia say a cut is expected, no cut is a risk: The risk is the BoC stands pat. The market is only pricing about 57bp of cuts this year, including 20bp for this week’s meeting. While we expect a total of three cuts this year, a dovish repricing may be limited this week if the BoC sends a cautious message on future rate cuts.

With inflation on the rise and economic growth starting to slow, many are anticipating a rate cut from the Bank of Canada. This decision can have significant implications for the Canadian economy and beyond. A rate cut could stimulate borrowing and spending, but it could also weaken the Canadian dollar and increase inflationary pressures.

How This Decision Will Affect Me

As a consumer, a rate cut could mean lower interest rates on loans and mortgages, making it more affordable to borrow money. However, it could also lead to higher prices on goods and services as inflation rises. Overall, the impact on individual Canadians will depend on their financial situation and spending habits.

How This Decision Will Affect the World

The Bank of Canada’s decision can have ripple effects on the global economy. A rate cut could weaken the Canadian dollar, making Canadian exports more competitive on the international market. It could also influence the policies of other central banks around the world, as they monitor and react to changes in interest rates.

Conclusion

The Bank of Canada’s decision on interest rates is eagerly awaited by economists, investors, and everyday Canadians alike. Whether the Bank chooses to cut rates or maintain the status quo, the implications of this decision will be felt far and wide. Stay tuned for the announcement on June 5th to see how it will shape the economic landscape in the months to come.