Key Technical Breakouts in Equities and Crypto: Renewed Bullish Momentum Ahead

The financial markets have been witnessing significant shifts in the past few weeks, with both equities and cryptocurrencies displaying bullish technical signs. Let’s delve deeper into these breakouts and explore their potential implications.

Equities: The Bull Market Roars Back

The S&P 500 index has recently surged past the 4,600 level, marking a crucial resistance level that was last tested in May 2018. This breakout is considered a bullish sign, indicating a renewed momentum for the stock market. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators further support this bullish outlook. Many market analysts believe that this breakout could pave the way for a potential move towards the 5,000 mark.

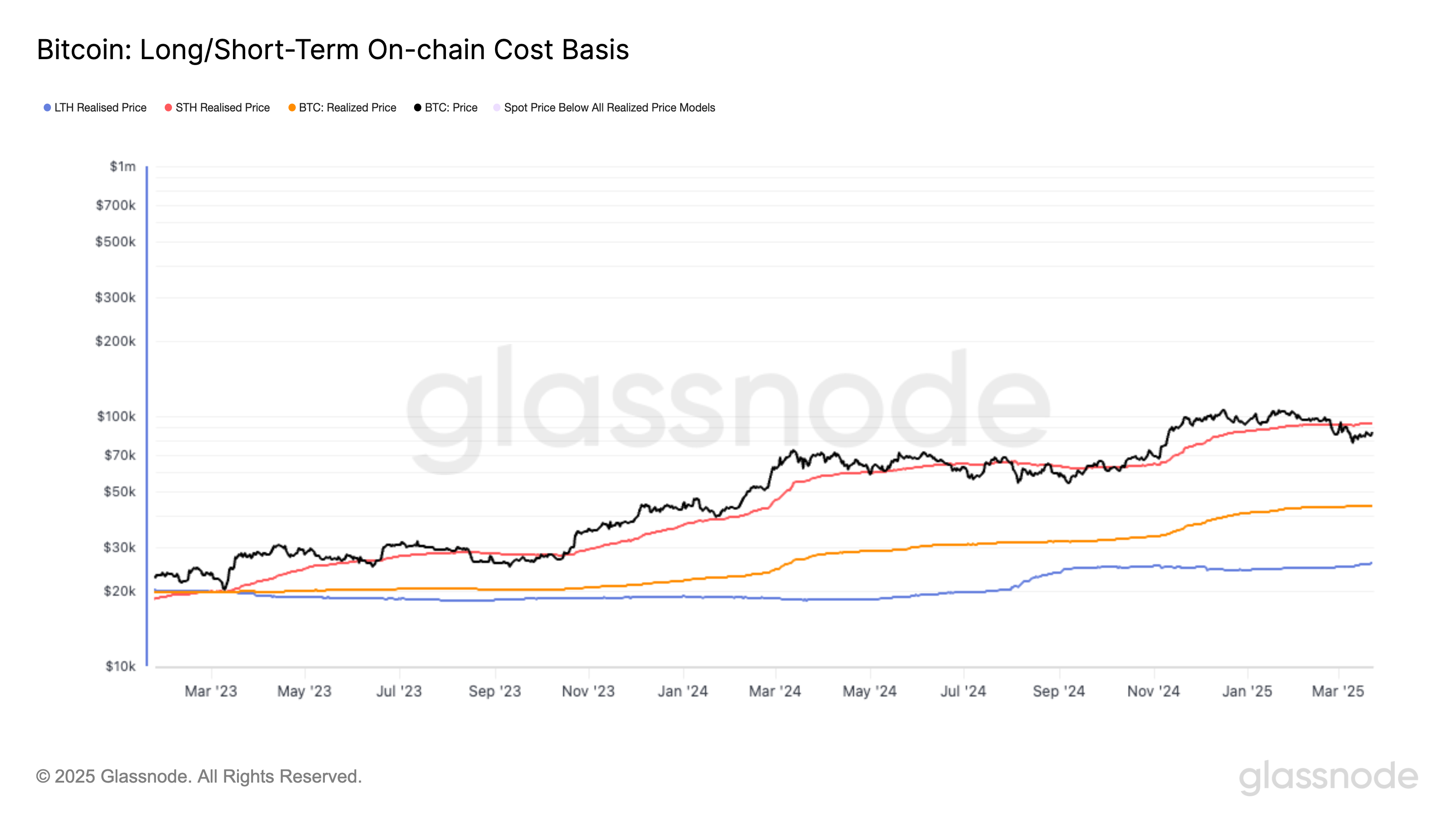

Cryptocurrencies: The Bear Market Hibernates

The crypto market has also shown signs of life, with Bitcoin surging past the $50,000 mark once again. This level is considered a significant psychological barrier for the world’s largest cryptocurrency. The bullish momentum in Bitcoin is also echoed in other major altcoins, such as Ethereum, Binance Coin, and Cardano. The RSI and MACD indicators suggest that the crypto market may be entering a new uptrend.

What Does This Mean for You?

For individual investors, these technical breakouts could mean potential opportunities for profit. A renewed bullish momentum in the stock market and crypto market could lead to significant gains for those who are well-positioned. It is, however, important to remember that investing always comes with risks, and it is crucial to conduct thorough research before making any investment decisions.

What Does This Mean for the World?

From a macroeconomic perspective, a renewed bullish momentum in equities and crypto could have several implications. For instance, it could lead to increased consumer confidence, which could, in turn, boost economic growth. Additionally, a strong stock market could attract more institutional investors, further fueling the bull market. In the case of cryptocurrencies, a sustained uptrend could lead to increased mainstream adoption, which could have far-reaching implications for the global financial system.

Conclusion

In conclusion, the recent technical breakouts in both equities and cryptocurrencies suggest that a renewed bullish momentum is on the horizon. While this could present opportunities for individual investors, it is essential to approach any investment decision with caution and thorough research. From a macroeconomic perspective, these breakouts could have significant implications for consumer confidence, economic growth, and the global financial system as a whole.

- Equities: The S&P 500 index has surged past the 4,600 level, indicating a renewed bullish momentum for the stock market.

- Cryptocurrencies: Bitcoin has surged past the $50,000 mark, with other major altcoins following suit.

- Individual investors: These technical breakouts could present opportunities for profit, but it is crucial to conduct thorough research before making any investment decisions.

- Macroeconomic implications: A renewed bullish momentum in equities and crypto could lead to increased consumer confidence, economic growth, and increased mainstream adoption of cryptocurrencies.