Net Consumer Credit and Mortgage Lending in the United Kingdom

Increasing Consumer Credit and Decreasing Mortgage Lending

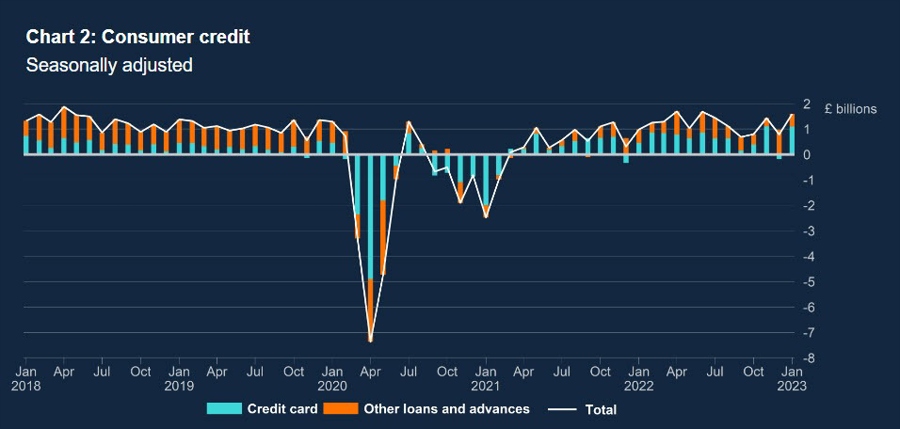

Net mortgage lending to individuals decreased from £3.1 billion to £2.5 billion in January with mortgage approvals declining for a fifth month running. On net, consumers borrowed an additional £1.6 billion in consumer credit with the annual growth rate for all consumer credit increasing to 7.5%. The prior consumer credit amount of £35.61 billion has been revised to £40.54 billion. Net consumer credit of £1.6 billion exceeded the expected £0.8 billion, while the prior amount of £0.5 billion has been revised to £0.8 billion.

Analysis and Implications

This latest data on net consumer credit and mortgage lending in the UK indicates a significant increase in consumer borrowing behavior, particularly in the realm of consumer credit. The rise in consumer credit suggests that individuals are increasingly relying on borrowed funds to support their spending habits and maintain their standard of living. This trend raises concerns about the overall financial health of households, as excessive levels of debt can lead to financial instability and economic downturns.

On the other hand, the decrease in net mortgage lending and the consecutive decline in mortgage approvals highlight a cooling housing market in the UK. This trend could be indicative of potential issues in the property market, such as affordability constraints and weakening demand. The decrease in mortgage lending may also signal a slowdown in the overall economy, as the housing market often acts as a key indicator of economic health.

Impact on Individuals

The increasing consumer credit and decreasing mortgage lending in the UK could have several implications for individuals. For borrowers, the rise in consumer credit may make it easier to access funds for spending, but it also increases the risk of accumulating unsustainable levels of debt. On the other hand, the cooling housing market could mean lower property prices and reduced opportunities for homeowners looking to sell or refinance their homes.

Global Implications

From a global perspective, the trends in net consumer credit and mortgage lending in the UK could signal broader economic shifts and challenges. A rise in consumer borrowing could contribute to increased household debt levels, impacting consumer confidence and spending patterns. The cooling housing market in the UK could also have ripple effects on the global real estate market, as changes in property prices and mortgage lending trends in one country often influence similar trends in others.

Conclusion

In conclusion, the recent data on net consumer credit and mortgage lending in the UK paints a complex picture of the country’s economic landscape. While the increase in consumer credit may provide a short-term boost to spending and economic activity, it also raises concerns about the sustainability of household debt levels. The decrease in mortgage lending signals potential challenges in the housing market and could have wider implications for the overall economy. It will be important to monitor these trends closely and consider their impact on individuals and the global economy moving forward.