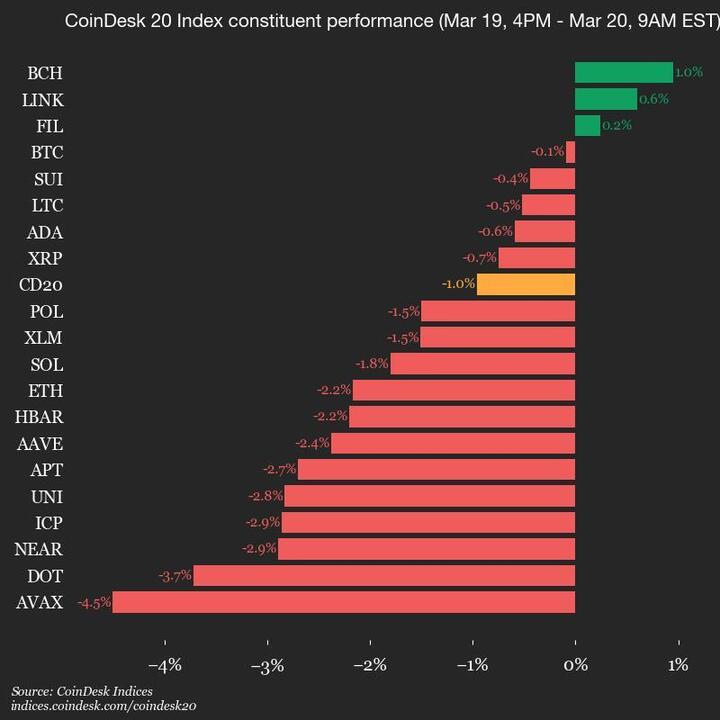

Recent Crypto Market Slump: Polkadot (DOT) Declines by 3.7%

The cryptocurrency market has experienced significant volatility in recent days, with many major coins seeing double-digit percentage losses. One such coin that underperformed was Polkadot (DOT), which declined by 3.7% over the past week. In this article, we’ll delve deeper into what this means for investors and the broader implications for the world of cryptocurrency.

Understanding Polkadot (DOT)

Polkadot is a decentralized, open-source blockchain platform that allows for the interoperability of multiple blockchains. It was created to address the issue of scalability and interoperability within the blockchain ecosystem. The platform’s native cryptocurrency, DOT, is used to secure the network, pay transaction fees, and participate in governance.

Impact on Investors

The recent decline in the price of DOT can be a worrying sign for investors who have holdings in the coin. For those who have a long-term investment strategy, this dip may present an opportunity to buy at a lower price and potentially profit from future price increases. However, for those who are new to investing in cryptocurrencies or have a short-term outlook, the volatility can be a cause for concern.

Implications for the Cryptocurrency World

The decline in the price of DOT is just one example of the broader volatility in the cryptocurrency market. This volatility can have far-reaching implications for the world of cryptocurrency, including:

- Reduced confidence: The volatility in the market can lead to reduced confidence in cryptocurrencies as a viable investment option, leading to a decrease in demand and further price declines.

- Regulatory scrutiny: The volatility can also lead to increased regulatory scrutiny, as governments and regulatory bodies seek to protect investors and maintain financial stability.

- Innovation and adoption: Despite the volatility, the cryptocurrency market continues to be a hotbed of innovation and adoption. Companies and individuals are increasingly turning to blockchain technology and cryptocurrencies to solve real-world problems and create new business models.

Conclusion

The recent decline in the price of Polkadot (DOT) is just one example of the broader volatility in the cryptocurrency market. While this volatility can be concerning for investors, it is important to remember that the long-term potential of cryptocurrencies remains significant. As the market continues to evolve, it is crucial for investors to stay informed and adopt a long-term investment strategy.

For the world at large, the volatility in the cryptocurrency market can lead to reduced confidence, increased regulatory scrutiny, and increased innovation and adoption. As the market matures and becomes more stable, it is likely that we will see greater acceptance and integration of cryptocurrencies into our daily lives.