Cardano’s Surprising 6% Surge: Bulls Regain Control

The cryptocurrency market has witnessed yet another intriguing price swing, with Cardano (ADA) leading the charge. In the past 24 hours, ADA has experienced a noteworthy increase of approximately 6%. This uptick occurred during the Asian trading session, with bulls firmly in control of the price action.

Bullish Trend: What Led to the Price Surge?

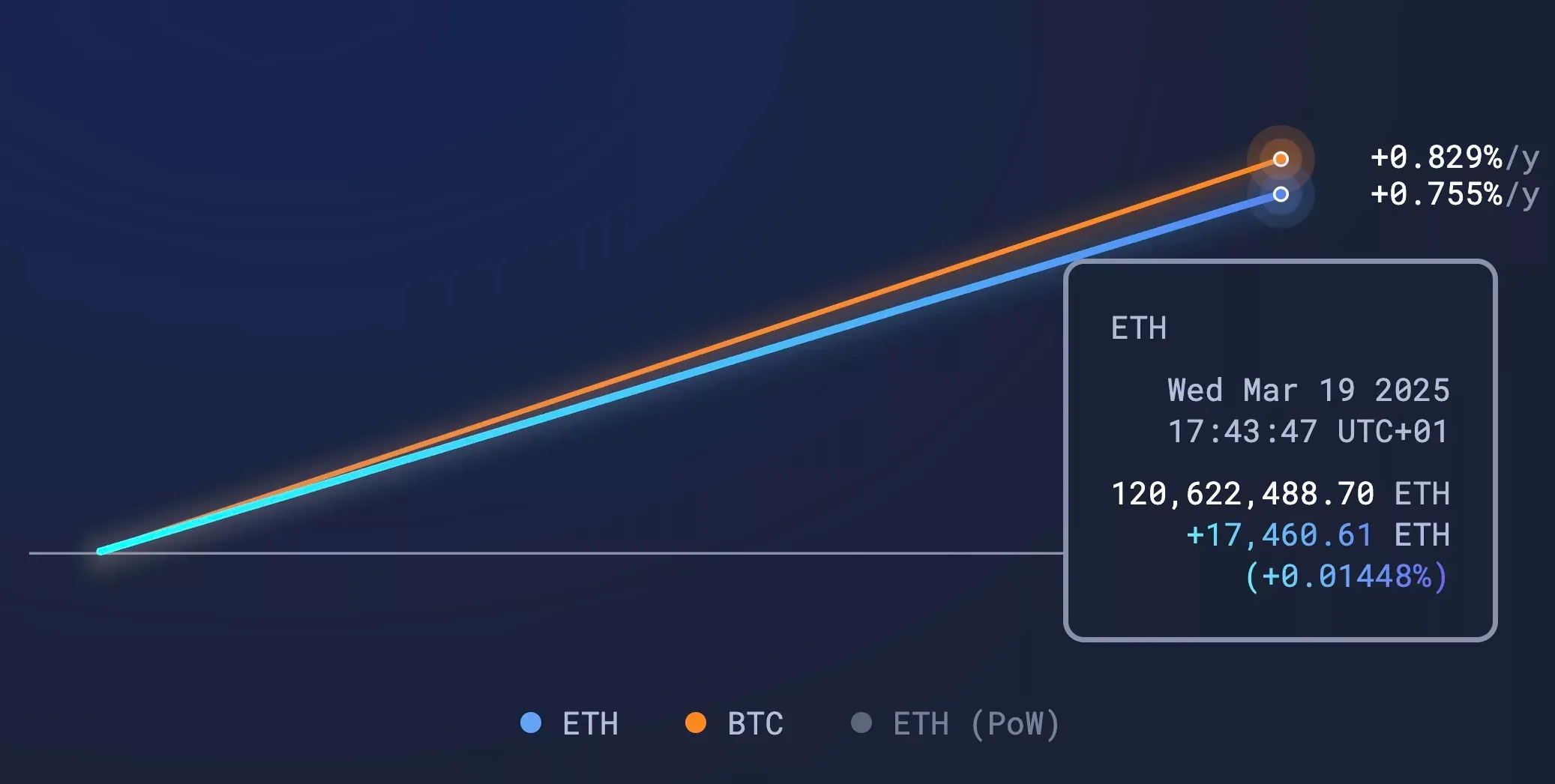

Several factors could have contributed to the sudden bullish trend for Cardano. First, the overall sentiment in the crypto market has been improving, with Bitcoin (BTC) and Ethereum (ETH) also experiencing modest gains. This positive momentum may have spilled over to ADA, boosting its value.

Second, there might be some anticipation in the market regarding upcoming developments for Cardano. For instance, the Shelley hard fork is expected to take place in the coming weeks, which aims to bring a proof-of-stake consensus mechanism to the Cardano network. This transition could lead to increased demand for ADA, as staking becomes a more attractive proposition.

Impact on Retail Investors: Opportunities and Risks

For retail investors, the sudden 6% surge in Cardano’s price presents both opportunities and risks. Those who have been holding ADA for a while might consider selling some of their holdings to lock in profits. Conversely, new investors could be enticed to enter the market, hoping to capitalize on the upward trend. However, it is essential to remember that the crypto market is highly volatile, and prices can change rapidly.

Global Implications: Economic and Geopolitical Consequences

The impact of Cardano’s price surge on the global economy and geopolitical landscape is a complex issue. On the one hand, the rise of Cardano and other cryptocurrencies could disrupt traditional financial systems, potentially leading to increased financial inclusion and reduced reliance on centralized institutions. On the other hand, the volatility of the crypto market could create instability, especially in countries with weak regulatory frameworks and fragile economies.

Looking Ahead: The Federal Reserve’s Interest Rate Decision

As we look ahead, the Federal Reserve’s interest rate decision will be a significant event that could influence the price action in the crypto market. If the Fed announces a more hawkish stance, it could lead to increased volatility and potentially dampen investor sentiment. Conversely, a more dovish stance could provide a boost to risky assets, including cryptocurrencies.

Regardless of the outcome, it is crucial for investors to stay informed and adapt to market conditions. Keeping a close eye on news and developments related to Cardano and the broader crypto market will be essential for making informed investment decisions.

Conclusion: Riding the Wave of Crypto Volatility

In conclusion, the sudden 6% surge in Cardano’s price is a reminder of the inherent volatility in the crypto market. While this volatility can create opportunities for investors, it also carries risks. As such, it is essential to stay informed, diversify your portfolio, and carefully consider your investment strategies. With the upcoming Federal Reserve interest rate decision and the expected Shelley hard fork for Cardano, the coming weeks are sure to be an exciting time for crypto investors.

- Cardano’s price has surged by 6% in the past 24 hours.

- Bulls took control of the price action during the Asian session.

- Several factors contributed to the price surge, including market sentiment and upcoming developments.

- Retail investors should be aware of both opportunities and risks.

- The global implications of the crypto market’s volatility are complex and far-reaching.

- The Federal Reserve’s interest rate decision could significantly impact the crypto market.