Robinhood Markets: Navigating the Dips and Discovering Hidden Opportunities

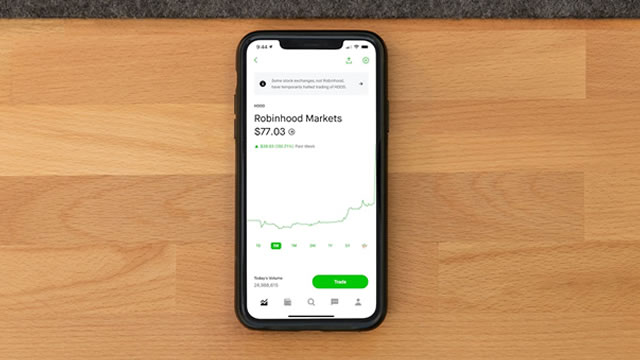

In the ever-volatile world of stock markets, fluctuations are a common occurrence. One such example is Robinhood Markets, which has experienced a significant dip of approximately 40% from its peak. Despite this setback, a closer look at the company’s fundamentals and strategic initiatives reveals promising growth potential and undervaluation.

Strong Fundamentals

Robinhood’s financial health remains robust, as evidenced by its net new assets growing by an impressive 28% YoY in February 2025, reaching a total of $4.8 billion. This figure surpasses consensus estimates, indicating a strong demand for the company’s services.

Record Trading Volumes

This growth is further underscored by record trading volumes in both options and equities. In February 2025, Robinhood recorded a significant increase in trading activity, suggesting that investors are actively engaging with the platform despite market volatility.

Strategic Initiatives

Robinhood’s strategic initiatives are another testament to its potential for growth. The company’s recent foray into desktop trading platforms aims to cater to a wider demographic of investors who prefer desktop interfaces for more complex trading activities. Additionally, the offering of futures trading broadens Robinhood’s product line and attracts a more diverse customer base.

Gold Membership Program

Furthermore, the introduction of the Gold membership program enhances Robinhood’s competitive edge by offering features such as level 2 market data, extended hours trading, and more. This subscription-based model not only generates recurring revenue for the company but also adds value to the user experience.

Impact on Individual Investors

For individual investors, the dip in Robinhood’s stock price may present an opportunity to purchase shares at a lower price. As the company continues to innovate and grow, the long-term potential for investors remains strong.

- Lower entry price for potential investors

- Robust financials and growth potential

- Diversified revenue streams

Impact on the World

On a larger scale, Robinhood’s success in attracting a younger demographic to the stock market and democratizing access to financial services can have significant implications. As more individuals engage in investing, the overall financial literacy and economic growth potential of society may increase.

- Encouraging financial literacy

- Expanding access to financial services

- Potential for increased economic growth

Conclusion

The dip in Robinhood’s stock price may be disheartening for some, but a closer look at the company’s fundamentals and strategic initiatives reveals a strong foundation for growth. For individual investors, this presents an opportunity to purchase shares at a lower price. Additionally, Robinhood’s impact on the world, in terms of financial literacy and expanding access to financial services, can have far-reaching implications.

As the company continues to innovate and grow, investors and the world stand to benefit from its success. Despite the current market conditions, Robinhood remains a compelling investment opportunity with significant potential for long-term gains.