Daily Pivots and Forex Trading: What You Need to Know

Understanding Daily Pivots

Have you ever heard of daily pivots in the world of forex trading? If not, don’t worry – you’re not alone. Daily pivots are a key technical indicator that many traders use to make decisions about their trades. They provide important levels of support and resistance that can help traders determine the best entry and exit points for their trades.

What Do Daily Pivots Mean for USD/CHF?

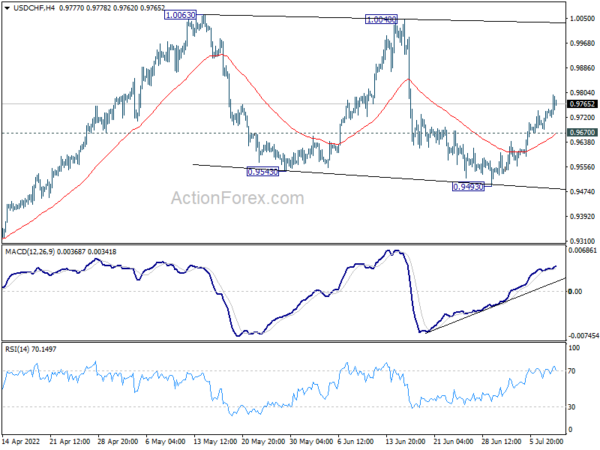

Let’s break down the daily pivots for USD/CHF: (S1) 0.9699; (P) 0.9724; (R1) 0.9766. What does this mean for traders? The break of 0.9731 resistance suggests that consolidation pattern from 1.0063 has shifted. This could signal a potential trend reversal or continuation, depending on other factors in the market.

How This Affects Traders Personally

For traders in the forex market, understanding daily pivots is essential for making informed decisions about their trades. By paying attention to these key levels of support and resistance, traders can better predict price movements and increase their chances of success.

How This Affects the World

While daily pivots may seem like a small technical detail, they have the potential to impact the forex market on a larger scale. Shifts in these key levels can trigger larger trends and affect currency values around the world. It’s important for traders and investors to stay informed and adapt to these changes.

Conclusion

In conclusion, daily pivots play a vital role in forex trading and can have a significant impact on both individual traders and the global market. By understanding and using these key technical indicators, traders can make more informed decisions and improve their overall trading results.