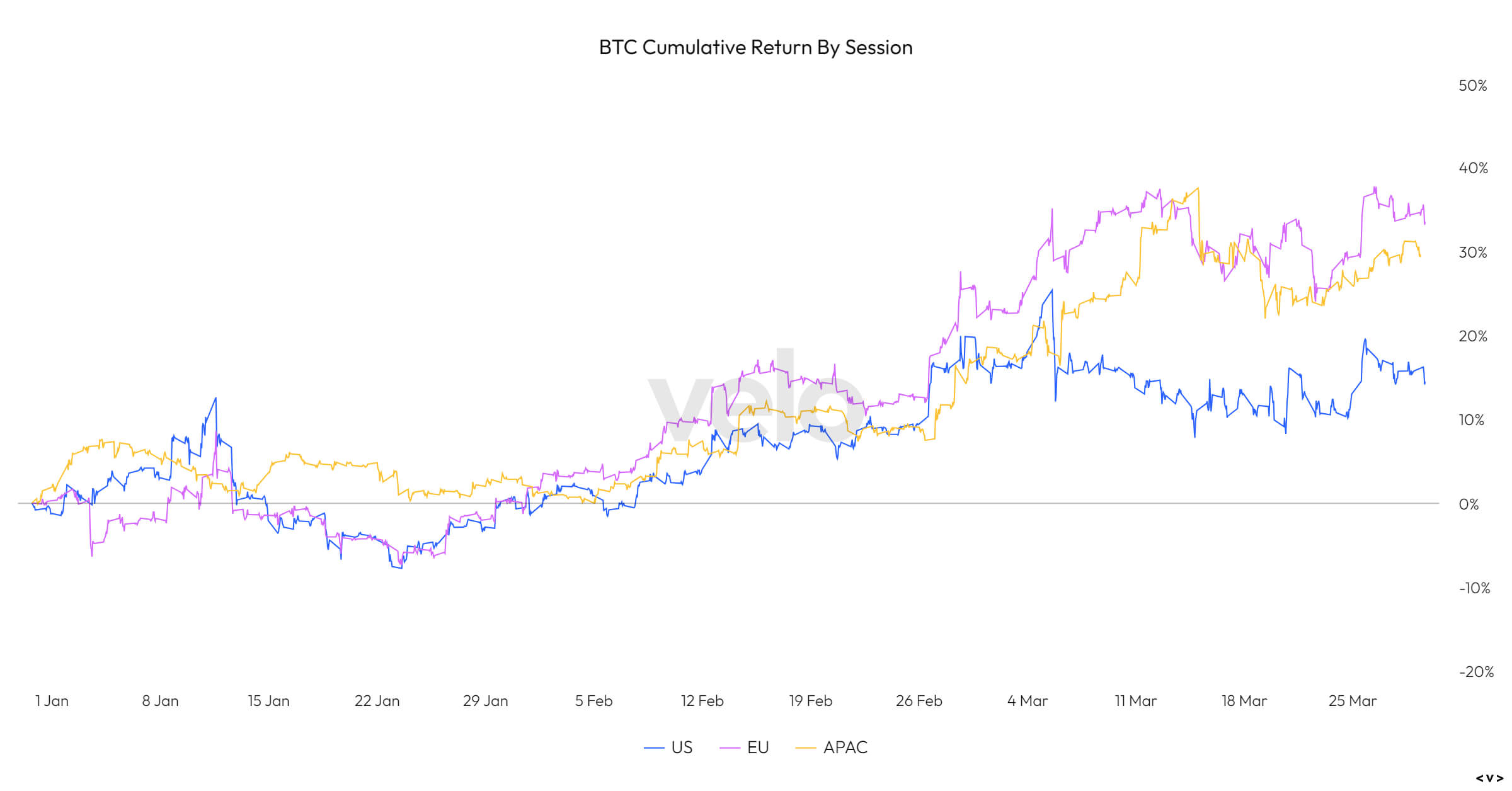

European trading hours lead global Bitcoin surge in 2024’s first quarter

Bitcoin’s Remarkable Performance in the First Quarter of 2024

Bitcoin has experienced a remarkable first quarter in 2024, as reported by Coinglass, with the digital asset surging by an impressive 64% over the quarter and by 13% in March alone. This surge marks the seventh consecutive month of gains for Bitcoin. The introduction of spot Bitcoin ETFs in the United States has played a significant role in driving this upward momentum.

European Trading Hours Fuel Bitcoin Surge

One of the key factors contributing to Bitcoin’s surge in the first quarter of 2024 has been the increased trading activity during European trading hours. European investors have shown a growing interest in Bitcoin, leading to higher trading volumes and price appreciation during these hours. This trend has had a ripple effect on global Bitcoin markets, contributing to the overall bullish sentiment surrounding the cryptocurrency.

Impact on Individuals

For individual investors, Bitcoin’s strong performance in the first quarter of 2024 presents both opportunities and risks. The significant price appreciation can potentially lead to substantial profits for those who have invested in Bitcoin. However, it is essential for investors to exercise caution and conduct thorough research before entering the market, as the volatility of the cryptocurrency can also result in significant losses.

Impact on the World

Bitcoin’s surge in the first quarter of 2024 is not only significant for individual investors but also has broader implications for the global economy. The increasing adoption of Bitcoin as a digital asset and a hedge against inflation has the potential to reshape the financial landscape. Central banks and regulatory bodies around the world are closely monitoring the cryptocurrency market and considering the implications of Bitcoin’s growing influence.

Conclusion

In conclusion, Bitcoin’s surge in the first quarter of 2024, driven by European trading hours and the introduction of spot Bitcoin ETFs, highlights the growing importance of the cryptocurrency in the global financial system. While this presents opportunities for investors, it also underscores the need for careful consideration and risk management in navigating the volatile cryptocurrency market.