China rate cuts impact on Bitcoin price surge

China’s Central bank lowers key interest rates

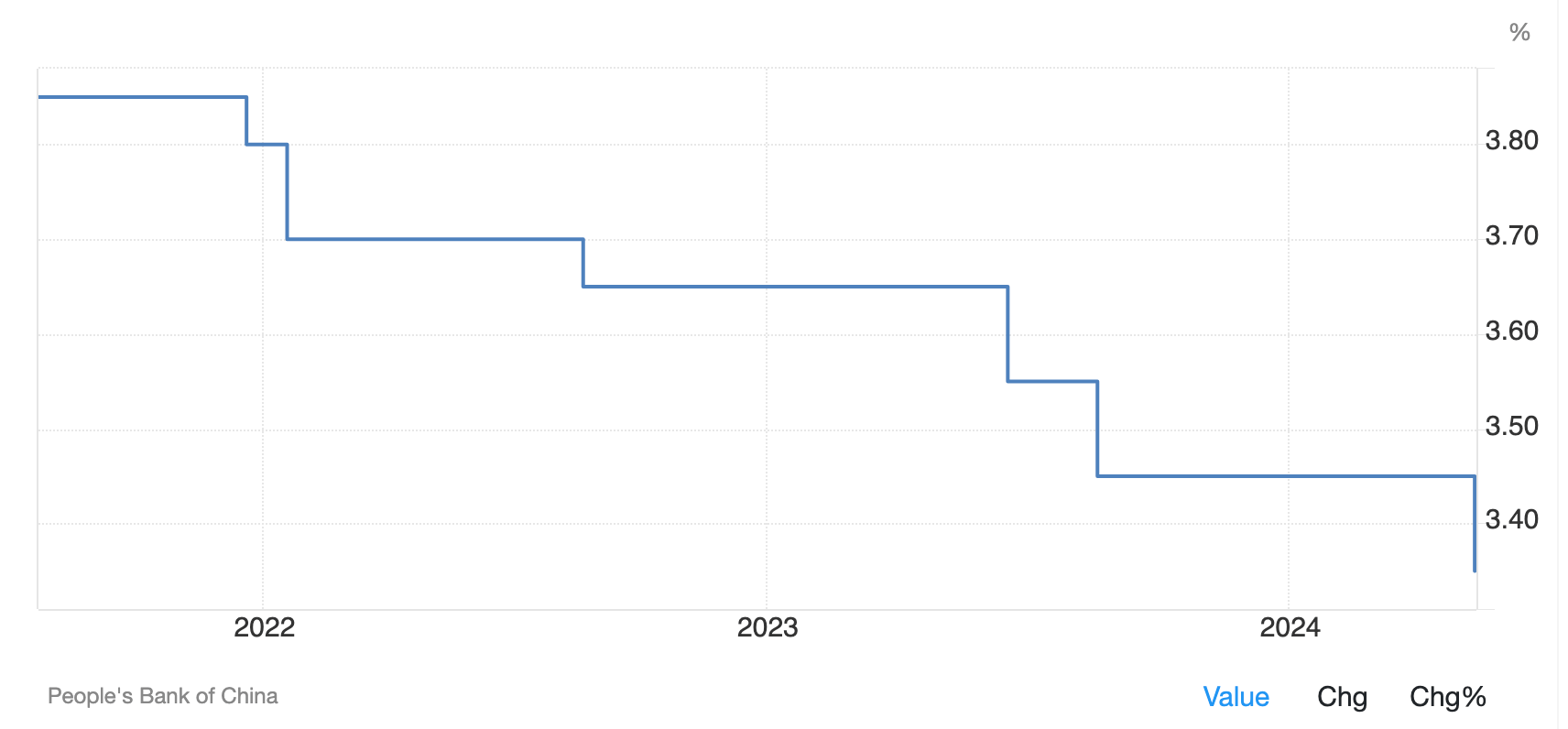

China’s central bank, the People’s Bank of China (PBOC), has cut key interest rates to stimulate economic growth amid ongoing challenges in the property sector and the broader economy. The seven-day reverse repo rate was reduced from 1.8% to 1.7%, the one-year loan prime rate (LPR) from 3.45% to 3.35%, and the five-year LPR from 4.6% to 4.5%. This move by the PBOC is aimed at boosting lending and driving economic activity in the country.

Bitcoin’s momentary lift

The announcement of these rate cuts had an immediate impact on the cryptocurrency markets, with Bitcoin experiencing a temporary surge in price. Investors and traders turned to digital assets like Bitcoin as a hedge against inflation and currency devaluation, leading to increased demand and a rise in prices.

Effect on individuals

For individual investors, the rate cuts in China could potentially lead to increased volatility in the cryptocurrency markets. As central banks around the world take measures to stimulate economies, digital assets like Bitcoin may continue to see fluctuations in price. It is important for investors to stay informed and research their investment decisions carefully.

Global impact

The rate cuts in China could have ripple effects on the global economy, as changes in one of the world’s largest economies often reverberate across international markets. Increased uncertainty and volatility in the cryptocurrency markets could impact traders and investors worldwide, prompting them to reassess their investment strategies and risk profiles.

Conclusion

In conclusion, China’s rate cuts have momentarily elevated the price of Bitcoin, highlighting the interconnected nature of financial markets and the impact of macroeconomic events on digital assets. It is essential for individuals and institutions to closely monitor these developments and adapt their investment strategies accordingly to navigate the evolving landscape of the cryptocurrency market.