Bitcoin’s dual nature: shifting between risk-on and risk-off amid market turbulence

Introduction

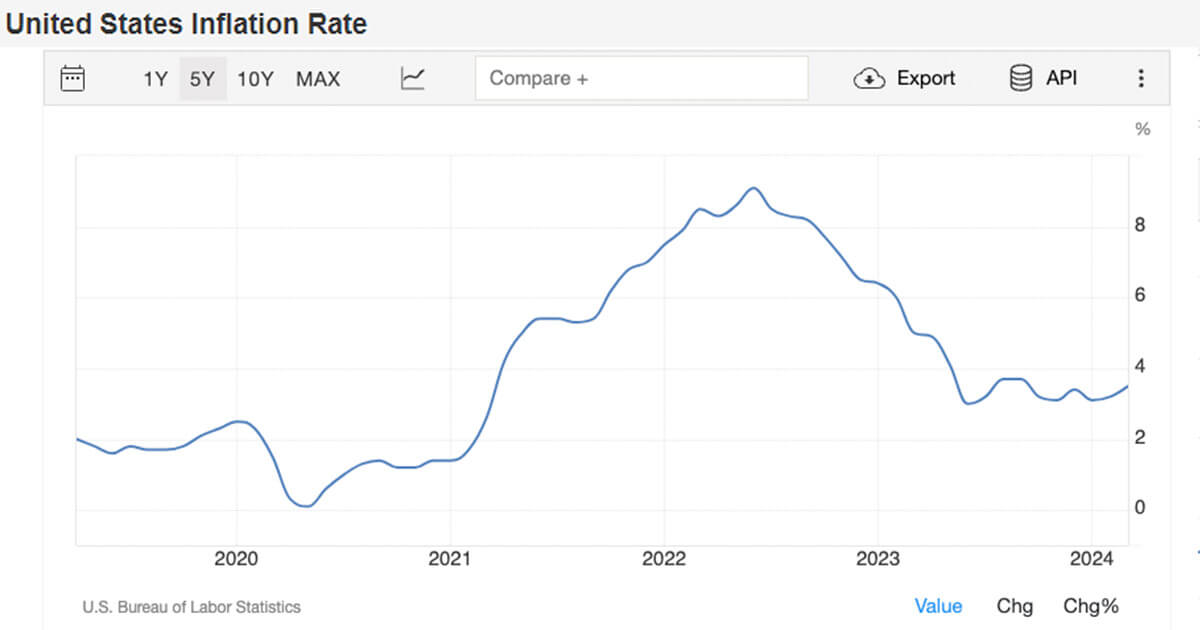

The latest US inflation data has surprised analysts, with headline inflation year-over-year (YoY) coming in at 3.5% — 0.1% above forecasts. The development is significant considering the Federal Reserve’s most aggressive hiking cycle in decades, according to Statista, which aimed to tame the rampant inflation that the central bank initially claimed was transitory.

Main Content

Bitcoin’s dual nature as an asset has been evident in recent years, particularly amid market turbulence. The cryptocurrency has often been referred to as “digital gold,” with some investors viewing it as a safe haven asset during times of economic uncertainty. However, Bitcoin’s price volatility has also led to it being categorized as a risky asset, shifting between risk-on and risk-off sentiments in the market.

With the recent US inflation data surprising analysts and exceeding forecasts, investors are keeping a close eye on how Bitcoin will perform in the coming months. The cryptocurrency has historically been seen as a hedge against inflation, with some believing that its fixed supply of 21 million coins makes it a store of value in times of monetary expansion.

However, Bitcoin’s price fluctuations have also been a cause for concern for some investors, as the cryptocurrency’s value can swing dramatically in a short period of time. This dual nature of Bitcoin, as both a safe haven and a risky asset, poses a unique challenge for investors looking to navigate market turbulence.

How This Will Affect Me

As an individual investor, the shifting nature of Bitcoin between risk-on and risk-off sentiments could have a direct impact on my investment portfolio. Depending on my risk tolerance and investment goals, I may need to reassess my exposure to Bitcoin and adjust my investment strategy accordingly.

How This Will Affect the World

On a global scale, the performance of Bitcoin amid market turbulence could have broader implications for financial markets and the economy. As the cryptocurrency continues to gain mainstream acceptance, its role as a safe haven asset and a risky investment will be closely watched by policymakers, regulators, and investors around the world.

Conclusion

In conclusion, Bitcoin’s dual nature as a shifting asset between risk-on and risk-off sentiments reflects the complexity of the modern financial landscape. As investors navigate market turbulence and economic uncertainty, understanding the unique characteristics of Bitcoin and its impact on the world will be crucial in shaping investment decisions and financial outcomes.