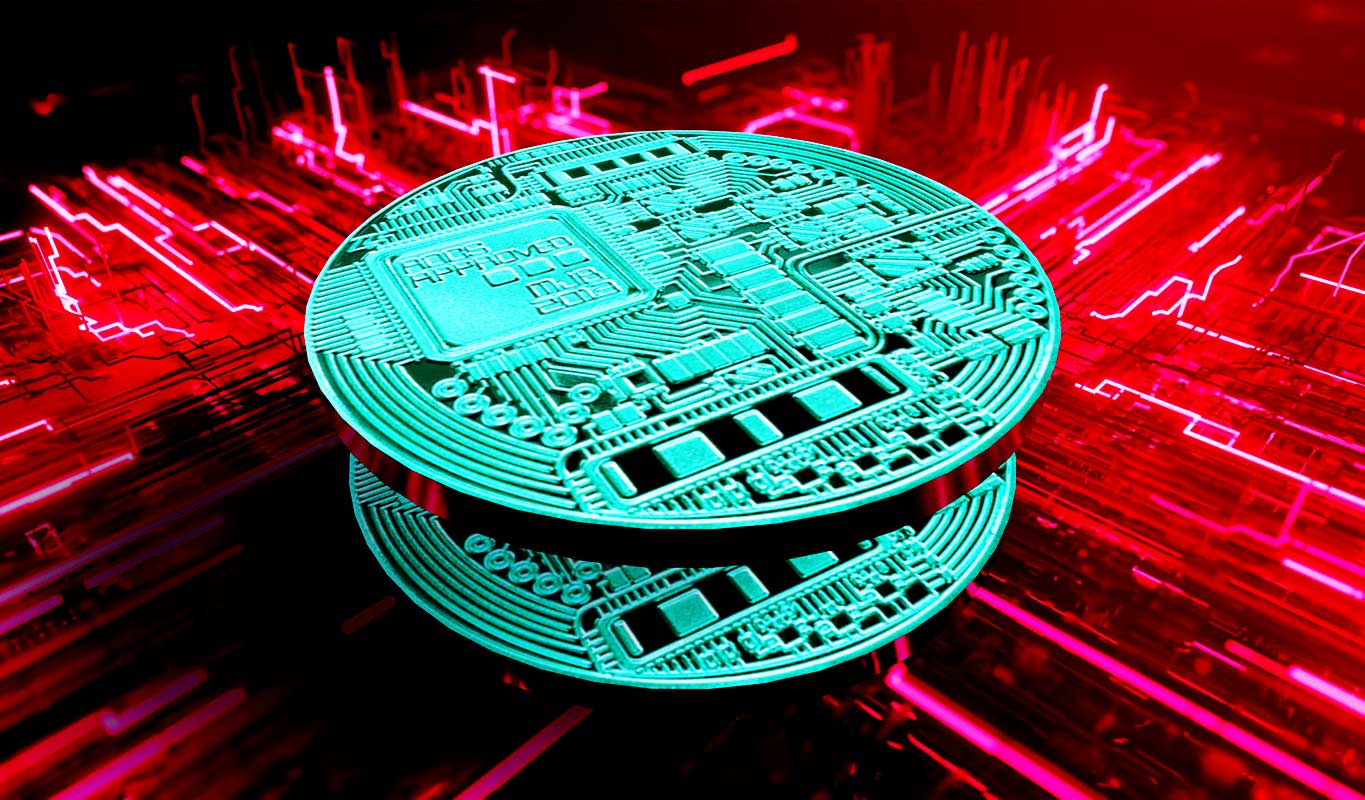

The Fall of Rowland Marcus Andrade: A Bitcoin Cryptocurrency Founder Convicted of Wire Fraud and Money Laundering

In a surprising turn of events, Rowland Marcus Andrade, the enigmatic founder of AML Bitcoin, has been convicted of wire fraud and money laundering in the District Court of Northern California. The verdict came after a five-week-long jury trial, leaving the cryptocurrency community in a state of shock.

The Rise of AML Bitcoin

AML Bitcoin, also known as “Anti-Money Laundering Bitcoin,” was marketed as a coin that could help prevent money laundering and other illegal activities in the cryptocurrency world. Andrade claimed that the coin used a unique algorithm that could identify and flag suspicious transactions. However, the SEC alleged that Andrade and his team had no such technology, and instead used the coin as a means to defraud investors.

The Allegations

According to the indictment, Andrade and his team raised over $25 million from investors through false and misleading statements about the coin’s capabilities. They also allegedly used the funds to pay for personal expenses and to purchase other cryptocurrencies, rather than developing the technology as promised.

The Impact on the Cryptocurrency Community

The conviction of Andrade has sent shockwaves through the cryptocurrency community. Some see it as a warning sign for other ICOs (Initial Coin Offerings) and crypto projects, urging investors to be more cautious and diligent when considering new investment opportunities.

- Increased scrutiny on ICOs and crypto projects: The AML Bitcoin case highlights the importance of due diligence when investing in new cryptocurrencies. Regulators and investors are likely to be more skeptical of new projects in the wake of this conviction.

- Damage to the reputation of the cryptocurrency industry: The conviction of a high-profile figure like Andrade could damage the reputation of the cryptocurrency industry as a whole, making it harder to attract new investors and users.

The Impact on the World

Beyond the cryptocurrency community, the conviction of Andrade could have wider implications. Some experts believe that it could lead to increased regulation of the cryptocurrency industry, as governments and regulators seek to protect consumers and prevent financial crimes.

- Increased regulation: The AML Bitcoin case could lead to increased regulation of the cryptocurrency industry, as governments and regulators seek to prevent similar fraudulent activities from occurring in the future.

- Impact on financial innovation: Some argue that increased regulation could stifle financial innovation in the cryptocurrency space, making it harder for new projects and ideas to emerge.

Conclusion

The conviction of Rowland Marcus Andrade on wire fraud and money laundering charges is a reminder that not all cryptocurrency projects are created equal. As the industry continues to evolve, it’s important for investors, regulators, and users to remain vigilant and cautious. While the AML Bitcoin case may have negative implications for the industry, it also presents an opportunity for greater transparency and accountability.

As the cryptocurrency landscape continues to change, it’s important for all of us to stay informed and make informed decisions. Whether you’re an investor, a user, or just curious about the world of cryptocurrencies, it’s crucial to do your own research and consult trusted sources before making any investment or financial decisions.