Tron Founder Justin Sun Raises Concerns Over Ethereum’s High-Leverage Trading Issues

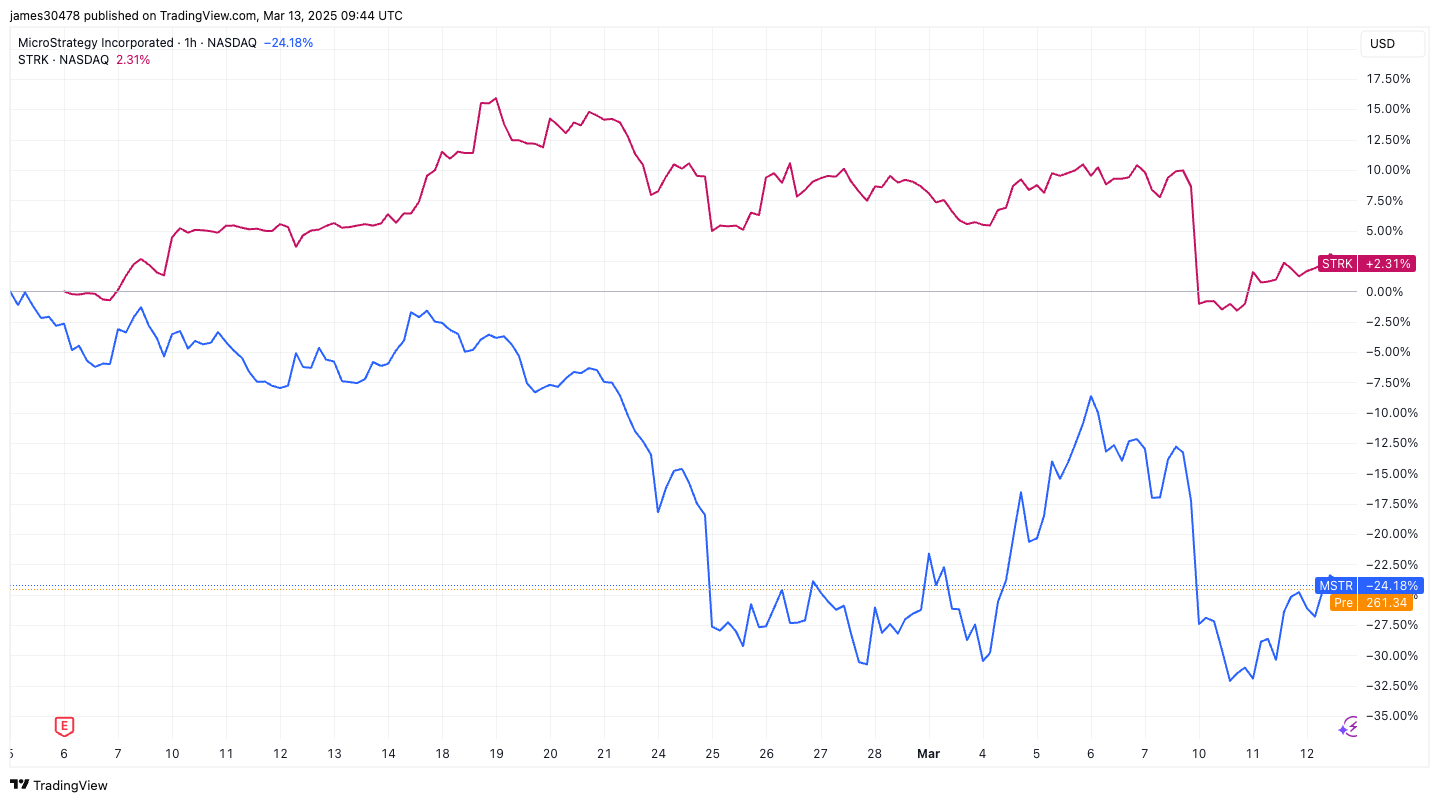

Justin Sun, the founder of the Tron blockchain, recently took to Twitter to express his concerns over the current state of Ethereum’s decentralized finance (DeFi) ecosystem. With liquidations reaching an astounding $2.1 billion in the last two weeks, Sun believes that high-leverage trading could lead to significant losses for DeFi protocols built on the Ethereum blockchain.

What is High-Leverage Trading?

High-leverage trading refers to the practice of using borrowed funds to amplify potential profits and losses in financial markets. In the context of DeFi, this involves borrowing cryptocurrencies to increase the value of positions taken in various decentralized lending and borrowing platforms.

Impact on Individual Investors

For individual investors, high-leverage trading can be both an opportunity and a risk. On one hand, it can lead to substantial gains when market conditions are favorable. However, when market conditions turn sour, the potential for significant losses increases. Sun’s concerns stem from the fact that Ethereum’s DeFi ecosystem has seen a surge in high-leverage trading activity, which could lead to a cascade of losses if the market turns bearish.

Impact on the Wider Crypto Community

The potential impact of high-leverage trading on the wider crypto community goes beyond individual investors. If a significant number of DeFi protocols built on Ethereum experience losses due to high-leverage trading, it could lead to a loss of confidence in the Ethereum blockchain and the DeFi ecosystem as a whole. This could result in a sell-off of Ethereum and other cryptocurrencies, further exacerbating the situation.

Possible Solutions

To mitigate the risks associated with high-leverage trading, some in the crypto community have suggested measures such as implementing circuit breakers or limiting the amount of leverage that can be used in DeFi protocols. Others have advocated for education and transparency, as some investors may not fully understand the risks involved in high-leverage trading.

Conclusion

Justin Sun’s concerns over Ethereum’s high-leverage trading issues highlight the risks and rewards of the DeFi ecosystem. While high-leverage trading can lead to substantial gains, it also carries the potential for significant losses. As the crypto market continues to evolve, it is essential for investors to be aware of the risks involved and to take appropriate measures to mitigate them. Whether through education, transparency, or regulatory measures, addressing these risks will be crucial for the continued growth and success of the crypto industry.

- High-leverage trading is a double-edged sword in the crypto market.

- The potential for significant gains is matched by the potential for significant losses.

- Justin Sun’s concerns over Ethereum’s high-leverage trading issues highlight the need for caution and transparency in the DeFi ecosystem.

- Measures such as circuit breakers, limiting leverage, and education can help mitigate the risks associated with high-leverage trading.