The Stock Market Trends: A Comparative Analysis of STRK and MSTR

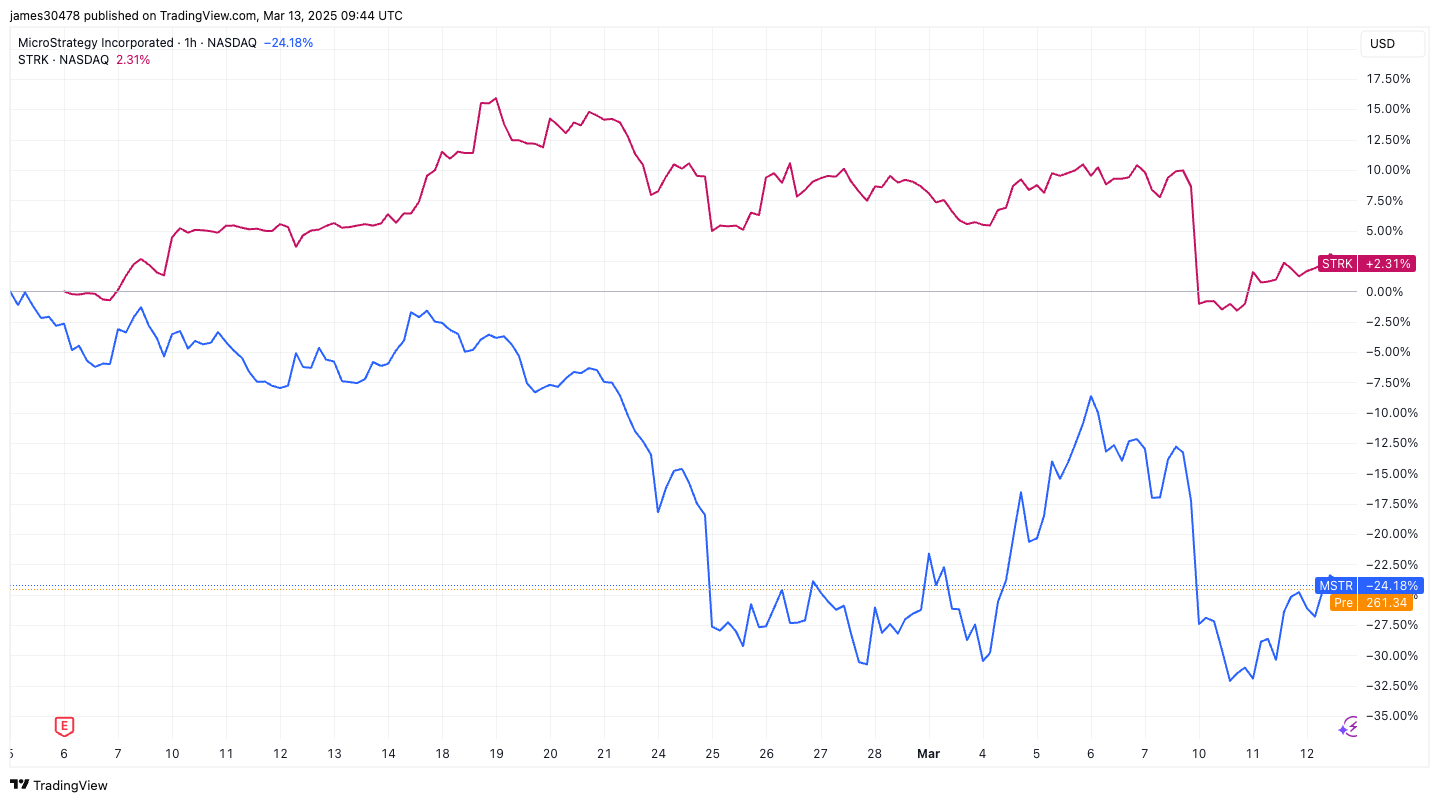

The stock market is a dynamic and ever-changing entity that requires constant attention and analysis. Two of the recent additions to the market, STRK and MSTR, have been making waves since their February launch. While STRK has seen a steady rise of 3%, MSTR, on the other hand, has experienced a significant drop of over 20%.

STRK: A Closer Look

STRK, or Supertech Renewable Energy Limited, is an Indian renewable energy company that specializes in solar energy. The company’s stock has been performing well due to the increasing demand for renewable energy sources and the Indian government’s commitment to reducing carbon emissions. The company’s financial reports have been impressive, with consistent revenue growth and a strong balance sheet. Moreover, the Indian government’s recent policies encouraging renewable energy have given STRK a significant boost.

MSTR: A Troubled History

MSTR, or MicroStrategy Incorporated, is a leading business intelligence company based in the United States. The company’s stock has been underperforming due to several factors, including a decline in revenue growth and a shift in investor sentiment towards technology stocks. Moreover, the company’s heavy reliance on its Bitcoin holdings has been a cause of concern for investors. The recent volatility in the Bitcoin market has led to a significant drop in MSTR’s stock price.

Impact on Individual Investors

For individual investors, the performance of STRK and MSTR has significant implications. Those who have invested in STRK are likely feeling optimistic about their investment, as the company’s financials and market trends indicate a promising future. On the other hand, those who have invested in MSTR may be feeling anxious about the future of their investment. The decline in revenue growth and the volatility in Bitcoin prices have raised concerns about the company’s long-term prospects.

Impact on the World

The performance of STRK and MSTR also has wider implications for the world. The rise of STRK and other renewable energy companies indicates a shift towards a more sustainable future, as investors recognize the potential of renewable energy sources. On the other hand, the decline of MSTR and other technology stocks could indicate a broader trend towards risk aversion in the market. This could lead to a slowdown in innovation and economic growth.

Conclusion

In conclusion, the performance of STRK and MSTR is a reminder of the dynamic nature of the stock market. While some companies thrive, others struggle. For individual investors, it is important to stay informed about the financials and market trends of the companies in which they invest. For the world, the rise of renewable energy companies like STRK and the decline of technology companies like MSTR indicate broader trends that have significant implications for the future.

- STRK has seen a steady rise of 3% since its February launch

- MSTR has experienced a significant drop of over 20% since its February launch

- STRK is an Indian renewable energy company specializing in solar energy

- MSTR is a leading business intelligence company based in the United States

- The rise of STRK indicates a shift towards a more sustainable future

- The decline of MSTR could indicate a broader trend towards risk aversion in the market