Bitcoin’s Resilience Amidst Altcoins’ Market Correction

The cryptocurrency market has seen its fair share of volatility in recent times, with Bitcoin, the largest and most well-known digital asset, remaining a beacon of strength amidst the bearish trends plaguing many altcoins. While some investors may view this as a cause for concern, others see it as a testament to Bitcoin’s robustness and resilience.

Bitcoin’s Market Performance

Despite the overall market correction, Bitcoin has managed to maintain its value above the $30,000 mark. This is a significant improvement from its mid-June low of around $29,000, and a far cry from the sub-$30,000 levels that many analysts had predicted. Bitcoin’s ability to weather the storm is a positive sign for those who believe in the long-term potential of digital currencies.

Altcoins’ Market Struggles

In contrast, many altcoins have sunk back to bear market depths. Ethereum, the second-largest cryptocurrency by market capitalization, has seen its value drop below $2,000, a far cry from its all-time high of over $4,300 in May. Other major altcoins like Cardano, Binance Coin, and Polkadot have also experienced significant losses.

Factors Contributing to the Disparity

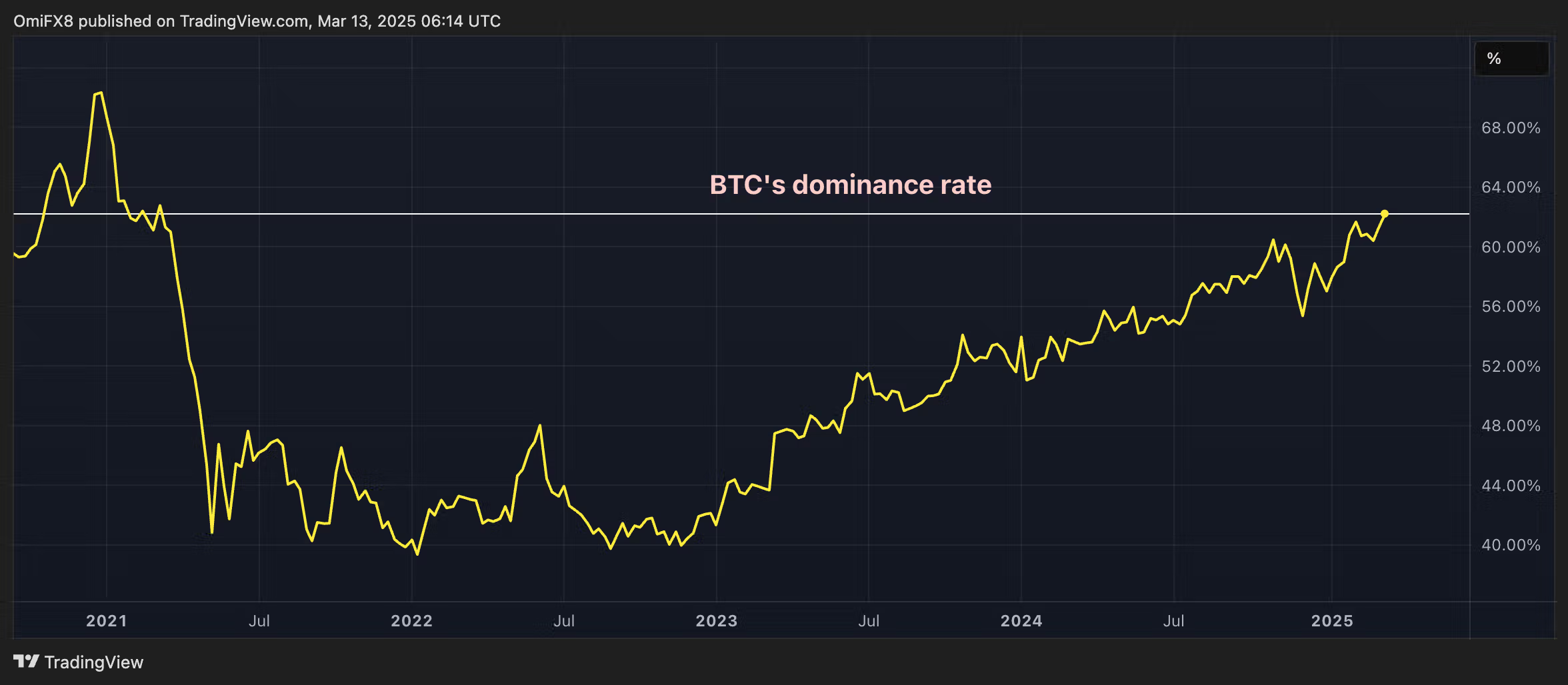

There are several factors contributing to the disparity in performance between Bitcoin and altcoins. One of the main reasons is Bitcoin’s status as a “digital gold” or “digital store of value.” Many investors view Bitcoin as a safe haven asset, much like gold, and are more likely to hold onto their Bitcoin during market corrections.

Another factor is the increasing institutional adoption of Bitcoin. Major companies like Tesla and Square have announced significant investments in Bitcoin, which has helped to bolster its value and stability. In contrast, altcoins are often viewed as riskier investments, and their market performance is more susceptible to market sentiment and hype.

Impact on Individual Investors

For individual investors, the disparity in performance between Bitcoin and altcoins can present both opportunities and challenges. Those who have invested in Bitcoin and held onto their investments may be feeling more confident about the long-term potential of the digital asset. However, those who have invested heavily in altcoins may be feeling the pinch of the recent market correction.

It’s important for investors to remember that the cryptocurrency market is highly volatile and subject to rapid price swings. Those who are new to the space should consider diversifying their portfolios and doing their own research before making any investment decisions.

Impact on the Wider World

The continued strength of Bitcoin and the struggles of altcoins have wider implications for the cryptocurrency industry as a whole. Some analysts argue that the disparity in performance is a sign of maturation in the market, with investors increasingly recognizing the value of Bitcoin as a stable store of value.

Others see it as a potential threat to the decentralized nature of the cryptocurrency market. As institutional investors continue to pour money into Bitcoin, the digital asset may become more centralized and less accessible to individual investors. This could lead to a shift in focus towards decentralized finance (DeFi) projects and other altcoins that offer more opportunities for individual investors.

Conclusion

In conclusion, despite the recent market correction, Bitcoin’s resilience is a testament to its strength and robustness as a digital asset. However, the struggles of altcoins highlight the importance of diversification and the need for investors to do their own research before making any investment decisions. As the cryptocurrency market continues to evolve, it will be interesting to see how Bitcoin and altcoins perform in the coming months and years.

- Bitcoin’s status as a digital store of value is contributing to its resilience.

- Institutional adoption of Bitcoin is helping to bolster its value and stability.

- Altcoins are more susceptible to market sentiment and hype.

- Individual investors should consider diversifying their portfolios.

- The disparity in performance between Bitcoin and altcoins has wider implications for the cryptocurrency industry.