BlackRock’s CEO Warns Trump’s Trade Policies May Fuels Inflation, Dampens Rate Cuts

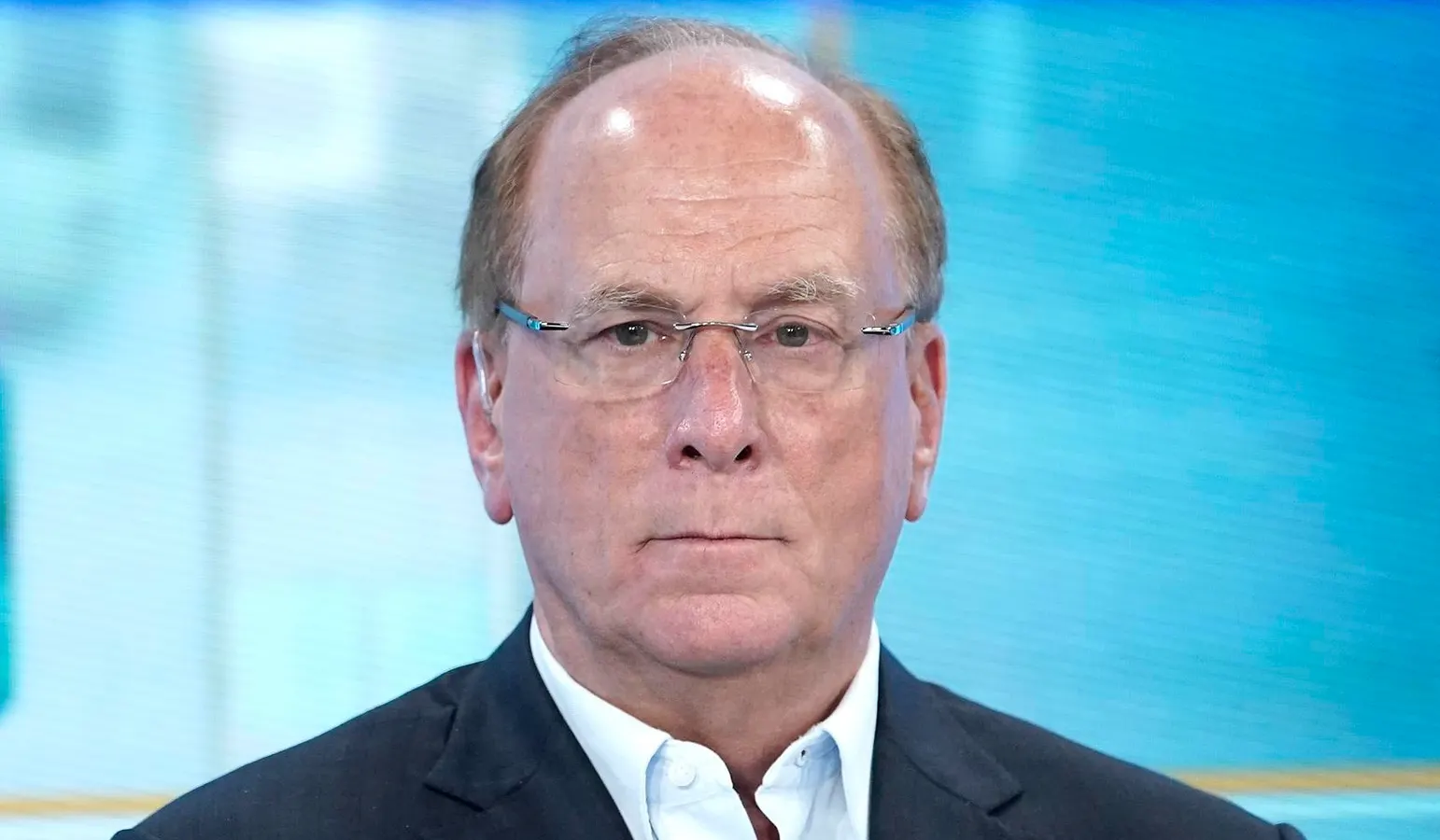

In a recent interview with CNBC, BlackRock’s CEO Larry Fink voiced his concerns over the potential inflationary impact of President Trump’s trade policies. Fink’s warning casts a shadow over the prospects of further interest rate cuts by the Federal Reserve (Fed) through 2025.

Impact on the U.S. Economy

According to Fink, the ongoing trade tensions between the United States and its major trading partners could result in higher prices for consumers and businesses. He explained that tariffs and other protectionist measures increase the cost of imported goods, which ultimately gets passed on to the end consumer.

- Higher prices for consumers: Increased costs for consumer goods could lead to a decrease in purchasing power and, in turn, a potential slowdown in consumer spending.

- Higher costs for businesses: The increased cost of raw materials and components for manufacturers could lead to higher production costs, potentially reducing profit margins and leading to fewer jobs.

Furthermore, Fink believes that these trade tensions could hinder economic growth. Trade is a critical driver of economic growth, and the uncertainty created by ongoing trade disputes could discourage businesses from investing and expanding.

Impact on the Global Economy

The trade war between the United States and its trading partners is not confined to U.S. borders. The global economy is interconnected, and the consequences of protectionist policies extend far beyond the borders of the United States.

- Slowing global economic growth: The World Bank and the International Monetary Fund have both lowered their growth forecasts for the global economy due to trade tensions.

- Currency instability: Currency devaluations could result from trade disputes, leading to further economic instability and uncertainty.

- Increased risk of recession: The ongoing trade tensions could lead to a global economic slowdown and, potentially, a recession.

In conclusion, BlackRock’s CEO Larry Fink’s warning of the potential inflationary impact of President Trump’s trade policies is a cause for concern. The ongoing trade tensions could lead to higher prices for consumers and businesses, potential economic slowdowns, and currency instability. These issues could dampen the prospects of further interest rate cuts by the Federal Reserve, making it essential for investors to stay informed and adapt to the changing economic landscape.

As individuals, we can take steps to mitigate the potential impact of trade tensions on our personal finances. This might include diversifying our investment portfolios, reducing our reliance on imported goods, and staying informed about economic developments. On a larger scale, governments and businesses must work together to find solutions that promote free and fair trade while addressing the underlying issues that have led to trade tensions in the first place.

The global economy is complex and interconnected, and it’s crucial that we remain informed and adapt to the changing economic landscape. By staying informed and taking proactive steps, we can better navigate the challenges posed by trade tensions and continue to grow and thrive in an ever-changing world.