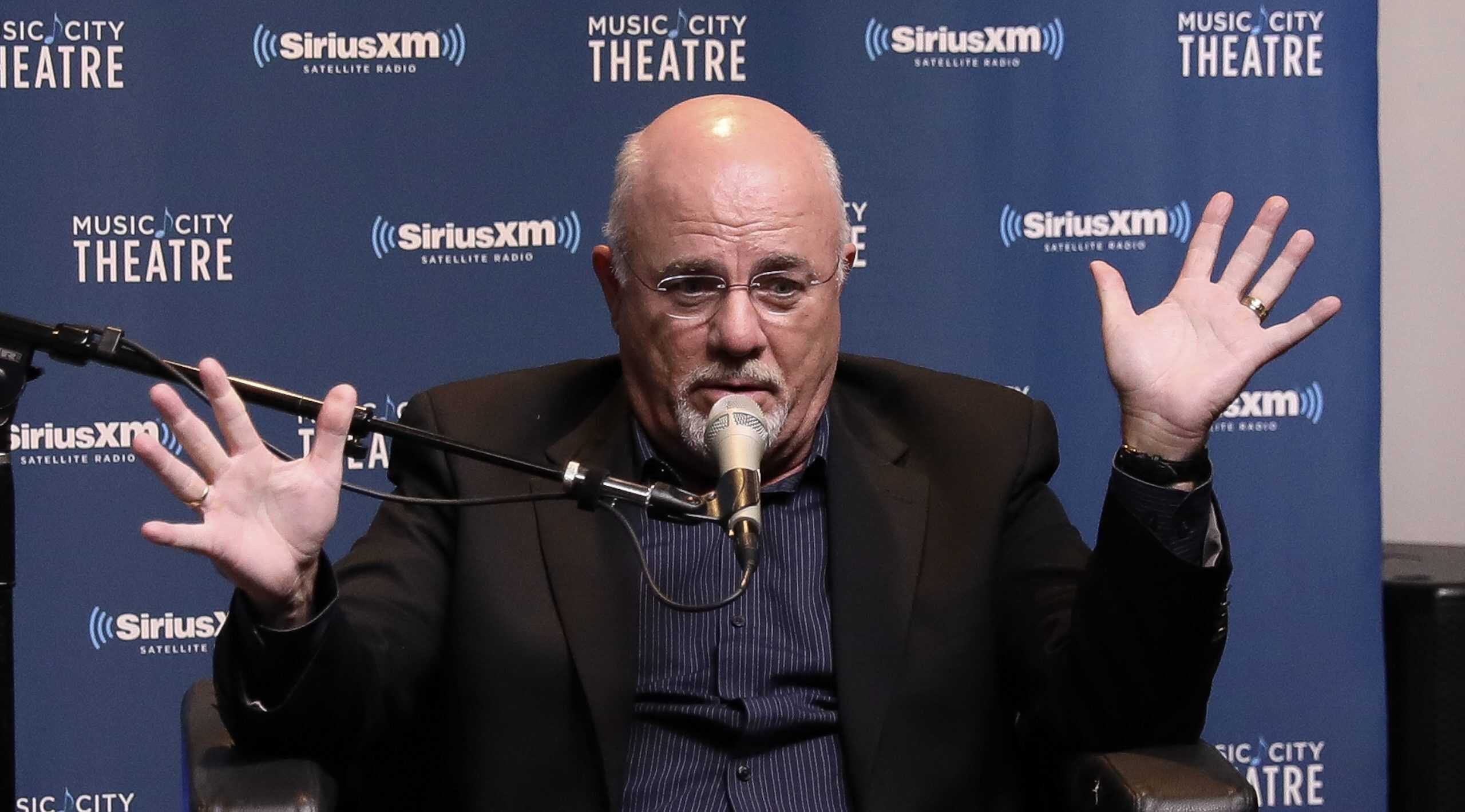

Dave Ramsey’s Controversial Advice: Taking Social Security at 62

While not all of Dave Ramsey’s financial advice resonates with everyone, there’s one viewpoint that I wholeheartedly agree with: taking Social Security at 62. Yes, you read that right. Despite the common wisdom that suggests delaying Social Security payments for a larger payout later, there are compelling reasons to consider taking the money sooner.

The Case for Taking Social Security at 62

First and foremost, taking Social Security at 62 offers financial flexibility. If you’re in good health and have the desire to travel or engage in various activities during your early 60s, taking the money sooner can provide a significant boost to your quality of life. Moreover, the time value of money (TVM) may be higher than you think by the time you reach 62.

Investing Your Social Security Benefits

Another advantage of taking Social Security at 62 is the opportunity to invest the funds. Ramsey suggests that retirees should consider investing a portion of their Social Security income in a “good mutual fund.” By doing so, they may potentially earn better returns over the long term compared to someone who waits until 70 to start collecting.

Personal Circumstances Matter

It’s important to note that the decision to take Social Security at 62 is highly personal, and your specific circumstances will play a significant role in whether this is the right move for you. For example, if you’re in poor health, it may be wiser to delay your Social Security payments to secure a larger payout later. Additionally, if you’re confident that you’ll live well into your 90s, delaying Social Security payments could make more sense.

Effect on Individuals

Taking Social Security at 62 can have a profound impact on an individual’s financial situation. By investing the funds, you may be able to grow your nest egg more quickly, providing a greater financial cushion for the later years of retirement. Furthermore, having the cash on hand offers a degree of flexibility to adapt to unexpected expenses or changes in circumstances.

Effect on the World

On a larger scale, the decision to take Social Security at 62 can have implications for the economy. A larger number of people taking Social Security earlier could potentially lead to increased consumer spending, boosting economic growth. However, it could also result in a larger strain on Social Security funds, potentially requiring adjustments to the program in the future.

Conclusion

In conclusion, while Dave Ramsey’s advice to take Social Security at 62 may be controversial, it’s an option worth considering for those who prioritize financial flexibility and investment opportunities. Ultimately, the decision to take Social Security earlier or later depends on your individual circumstances, health, and financial goals. It’s always a good idea to consult with a qualified financial advisor to help you optimize your Social Security and retirement income plan.

- Taking Social Security at 62 offers financial flexibility

- Investing the funds can potentially lead to greater returns

- Effect on individuals: improved quality of life and financial cushion

- Effect on the world: potential for increased consumer spending and strain on Social Security funds

Remember, personal finance is a complex and ever-evolving field, and it’s crucial to do your research and consult with experts before making any major financial decisions. Happy investing!