Stock Market: JPMorgan Chase, Citigroup, and Morgan Stanley Experience Significant Dips

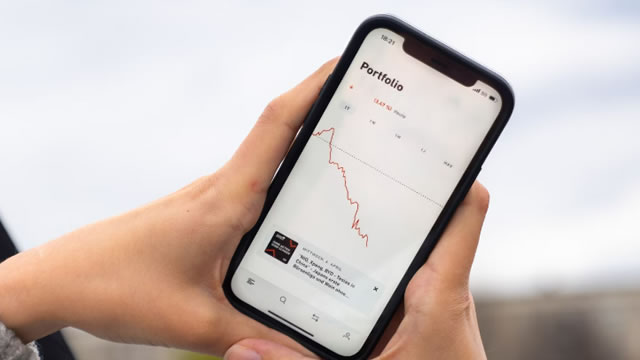

In an unfolding turn of events, shares of three major financial institutions, JPMorgan Chase & Co (NYSE:JPM), Citigroup Inc (NYSE:C), and Morgan Stanley (NYSE:MS), are taking a hit in the stock market. The economic uncertainty and continued market weakness are the primary reasons behind this sharp decline.

JPMorgan Chase & Co (NYSE:JPM)

JPMorgan Chase & Co, the largest bank in the United States by total assets, has seen its stock price drop by more than 3% as of the market close. This decline comes after a disappointing earnings report last week, which showed a decrease in profits from the previous year. The bank’s trading revenue also took a hit, which added to investor concerns.

Citigroup Inc (NYSE:C)

Citigroup Inc, the fourth-largest bank in the U.S., is experiencing a similar trend, with its stock price falling by over 4% on Monday. The bank’s woes can be attributed to a weak third-quarter earnings report, which saw a decline in profits compared to the same period last year. Additionally, concerns over the bank’s exposure to potential loan losses and economic uncertainty have weighed heavily on investor sentiment.

Morgan Stanley (NYSE:MS)

Morgan Stanley, the second-largest investment bank in the U.S., has not been left untouched by the market downturn, with its stock price dropping by around 3%. The bank’s earnings report for the third quarter showed a decline in profits, and investors are concerned about the potential impact of a slowing global economy on the bank’s business.

Impact on Individual Investors

For individual investors, this market volatility can be a cause for concern. If you own shares in any of these financial institutions, it’s essential to keep a close eye on the situation. It may be wise to consider diversifying your portfolio to minimize risk. However, it’s important to remember that short-term market fluctuations are a normal part of investing, and long-term investors should remain focused on their financial goals.

Impact on the World

The declines in the shares of JPMorgan Chase, Citigroup, and Morgan Stanley are a reflection of the broader economic uncertainty that is affecting the global economy. The ongoing trade tensions between the U.S. and China, geopolitical tensions, and concerns over a potential recession have all contributed to the market weakness. These factors could lead to further declines in the stock market and have broader implications for the global economy.

Conclusion

In conclusion, the sharp declines in the shares of JPMorgan Chase, Citigroup, and Morgan Stanley are a reflection of the economic uncertainty and continued market weakness. Individual investors should keep a close eye on the situation and consider diversifying their portfolios to minimize risk. The broader implications of this market volatility extend beyond the financial sector and could have significant consequences for the global economy.

- JPMorgan Chase & Co, Citigroup Inc, and Morgan Stanley are experiencing significant dips in their stock prices.

- Economic uncertainty and market weakness are the primary reasons behind the decline.

- Individual investors should keep a close eye on the situation and consider diversifying their portfolios.

- The broader implications of this market volatility could have significant consequences for the global economy.