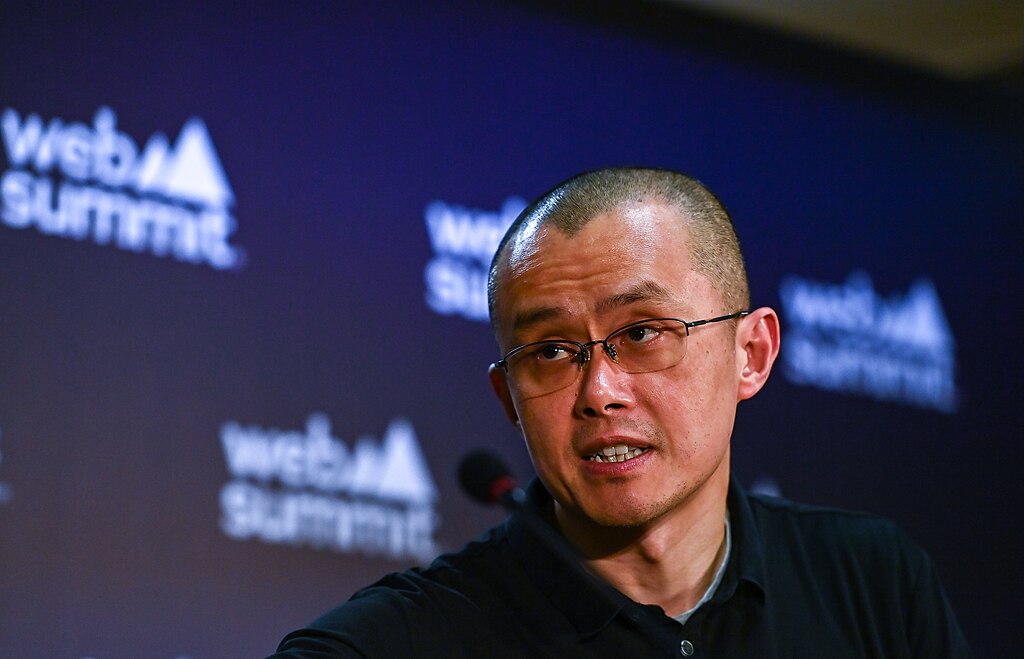

Binance’s CZ Praises BlackRock’s Bitcoin ETF: A Game-Changer in the Crypto World

Recently, Changpeng Zhao (CZ), the charismatic co-founder and former CEO of Binance, took to Twitter to express his admiration for BlackRock’s new Bitcoin Exchange-Traded Fund (ETF), IBIT. According to CZ, the ETF has been setting new records as the fastest-growing ETF in history.

BlackRock’s Massive Bitcoin Holdings

CZ’s praise came after data from Arkham Intelligence revealed that BlackRock, the world’s largest asset manager, currently holds over $54.25 billion worth of Bitcoin. This staggering figure underscores the growing institutional interest in the cryptocurrency market.

Impact on Retail Investors

For retail investors, the entry of such a giant player in the Bitcoin market can be both exciting and intimidating. On the one hand, the validation from an institution of BlackRock’s stature can lead to increased trust and confidence in the asset class. On the other hand, the sheer size of their holdings could potentially impact the market price, making it harder for smaller investors to compete.

- Increased Institutional Adoption: The entry of BlackRock into the Bitcoin market could lead to a wave of institutional adoption, as other asset managers follow suit.

- Price Volatility: The size of BlackRock’s holdings could lead to increased price volatility, making it harder for smaller investors to predict market movements.

- Regulatory Scrutiny: The entry of large institutional players into the market could also lead to increased regulatory scrutiny, which could impact the market in various ways.

Impact on the World

The impact of BlackRock’s foray into Bitcoin extends beyond the crypto market. Here are some potential implications:

- Mainstream Acceptance: The entry of a major player like BlackRock could lead to further mainstream acceptance of Bitcoin and other cryptocurrencies.

- Regulatory Framework: The move could also lead to the development of a clearer regulatory framework for digital assets, which could benefit the entire industry.

- Financial Inclusion: By investing in Bitcoin, BlackRock is acknowledging the potential of digital assets to provide financial inclusion to underbanked populations around the world.

Conclusion: A New Era for Crypto

In conclusion, the entry of BlackRock into the Bitcoin market, as praised by Binance’s CZ, is a significant development that could change the game for the crypto industry. With their massive holdings, BlackRock’s investment could lead to increased institutional adoption, price volatility, regulatory scrutiny, and mainstream acceptance. As a retail investor, it’s essential to stay informed and adapt to these changes to make the most of the opportunities in the crypto market.

So, buckle up, folks! It’s going to be an exciting ride!