O2 Sponsor Finance Boosts 2024 Financing Activity with Branford Castle-Hoffman Engineering Deal

In the bustling financial scene of Chicago, Illinois, O2 Sponsor Finance, a division of Old Second National Bank (NASDAQ: OSBC), concluded an eventful 2024 with a significant financing transaction. O2 Sponsor Finance played a pivotal role in providing senior secured credit facilities to Branford Castle Partners (“Branford Castle”) to support their acquisition of Hoffman Engineering (“Hoffman”).

Background on Branford Castle Partners and Hoffman Engineering

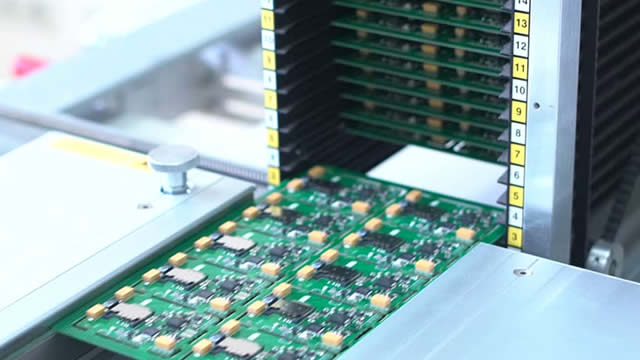

Branford Castle Partners is a prominent private equity firm with a focus on investing in manufacturing, industrial, and business services companies. Hoffman Engineering, based in Milwaukee, Wisconsin, is a leading provider of engineered solutions for the food and beverage, pharmaceutical, and biotech industries. The company’s expertise lies in designing, manufacturing, and installing customized systems that optimize production processes and enhance product quality.

Financing Details

The financing package from O2 Sponsor Finance will enable Branford Castle to successfully complete the acquisition of Hoffman Engineering. The exact terms of the deal were not disclosed, but it is known that the financing is senior secured, meaning it holds priority over other debts in the event of a bankruptcy. This type of financing is often preferred by private equity firms in acquisition situations, as it provides a degree of financial security.

Impact on Branford Castle and Hoffman Engineering

The acquisition of Hoffman Engineering by Branford Castle is expected to bring several benefits to both parties. For Branford Castle, this deal marks another successful investment in the industrial sector. Hoffman Engineering’s strong market position and expertise in engineered solutions will complement Branford Castle’s existing portfolio. The financing from O2 Sponsor Finance will provide the necessary capital to fund the acquisition and support the growth strategy of the combined entity.

For Hoffman Engineering, the acquisition by Branford Castle will bring new resources and expertise to the company. Branford Castle’s experience in the industrial sector and its financial backing will enable Hoffman Engineering to expand its offerings, enter new markets, and invest in research and development. This will ultimately lead to increased revenue, improved operational efficiency, and enhanced value for Hoffman Engineering’s customers.

Impact on the World

The Branford Castle-Hoffman Engineering deal is an illustration of the vibrant private equity market and the ongoing investment in the industrial sector. The transaction underscores the continued demand for engineered solutions, particularly in the food and beverage, pharmaceutical, and biotech industries. The successful completion of this financing also highlights the role of financial institutions like O2 Sponsor Finance in facilitating mergers and acquisitions, fostering economic growth, and creating value for investors.

Conclusion

The collaboration between O2 Sponsor Finance, Branford Castle Partners, and Hoffman Engineering is a testament to the dynamic financial landscape in Chicago and beyond. This acquisition financing deal signifies the ongoing investment in the industrial sector and the role of private equity firms and financial institutions in driving growth and creating value. As Branford Castle and Hoffman Engineering embark on this new chapter, they will bring enhanced capabilities, resources, and expertise to their respective industries and customers.

- O2 Sponsor Finance supported Branford Castle in its acquisition of Hoffman Engineering.

- Branford Castle is a private equity firm with a focus on manufacturing, industrial, and business services.

- Hoffman Engineering is a leading provider of engineered solutions for the food and beverage, pharmaceutical, and biotech industries.

- The financing package is senior secured, providing financial security for Branford Castle.

- The acquisition will bring benefits to both Branford Castle and Hoffman Engineering, including growth, resources, and expertise.

- The deal is an illustration of the vibrant private equity market and the ongoing investment in the industrial sector.