The Dollar’s Favor: A Market Sentiment Shift

By: FinancialFoxy

March 2021

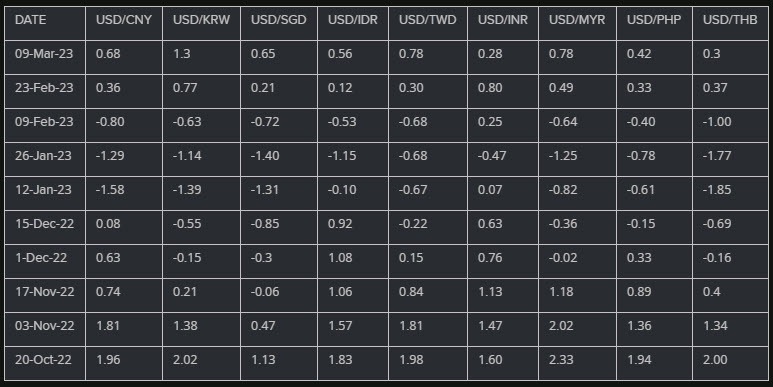

I would take this as a view on current market sentiment, as the tides are turning in the dollar’s favour this week. It is pretty much a double whammy in this instance, after having seen China disappoint with just a 5% growth target over the weekend and then Fed chair Powell putting out some more hawkish comments on Tuesday.

According to the Reuters poll, bearish bets intensified on nearly all Asian currencies with speculation that further tightening could be on the horizon. As this news reverberates across the market, investors are starting to realign their portfolios and reassess their risk exposure.

The uncertainty and potential volatility in the market has led many to seek refuge in the stability of the US dollar. This shift in sentiment has caused ripples in the forex market, with traders adjusting their positions accordingly.

As we navigate through these uncertain times, it is important to stay informed and adapt to the changing dynamics of the market. Keeping a close eye on key developments and understanding the implications for your investments is crucial in positioning yourself for success.

How This Will Affect Me

The strengthening of the US dollar may have implications for your investment portfolio, especially if you hold positions in foreign currencies. It is important to reassess your risk exposure and consider diversifying your assets to mitigate potential losses.

How This Will Affect the World

The shift in market sentiment towards the US dollar could impact global trade and economic relations. Countries heavily reliant on exports may face challenges as their goods become more expensive in international markets. It is essential for policymakers to monitor these developments closely and implement measures to support their economies.

Conclusion

In conclusion, the current market sentiment favors the US dollar as investors seek stability in uncertain times. As we navigate through these changes, it is important to stay informed, adapt to the evolving dynamics of the market, and make strategic decisions to protect and grow our investments.