Two Tech Giants in the Technology Services Sector: JBT Marel (JBTM) and Thomson Reuters (TRI)

Investors on the hunt for promising stocks in the Technology Services sector are often faced with a daunting array of options. Two names that frequently crop up in conversations are JBT Marel (JBTM) and Thomson Reuters (TRI). But which of these two companies is the hidden gem for those seeking undervalued stocks? Let’s delve deeper into the unique offerings of each.

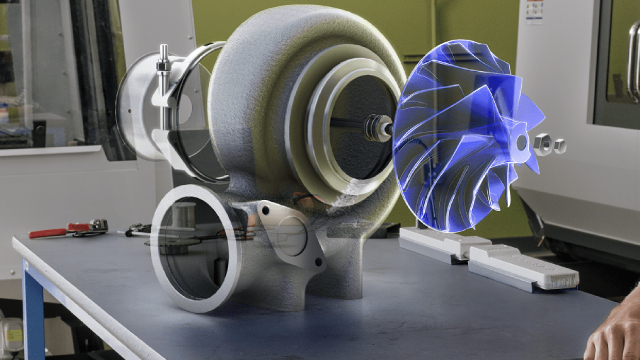

JBT Marel (JBTM): The Unassuming Innovator

Background: JBT Marel is a leading global technology provider of food processing and automation solutions for the food industry. They offer a wide range of products and services, from equipment and systems to consulting and engineering.

Financials: In the past year, JBTM has seen a steady increase in revenue, up by 3.4% year-over-year, while their net income has nearly doubled. Their current price-to-earnings ratio (P/E) sits at a modest 14.4, making them an attractive option for value investors.

Market Position: JBTM’s strong market position is backed by their extensive customer base and diverse product portfolio. Their innovative solutions cater to the growing demand for automation and efficiency in the food industry, ensuring a steady stream of revenue.

Thomson Reuters (TRI): The Global Information Powerhouse

Background: Thomson Reuters is a leading provider of business intelligence, data, and analytics. They offer a wide array of products and services, including financial market data, news, and research, among others.

Financials: TRI’s revenue has remained relatively stable in the past year, with a slight decrease of 0.3% year-over-year. However, their net income has improved, up by 11.3%. Their current P/E ratio is 19.3, which is slightly higher than JBTM but still considered reasonable for a stable, dividend-paying stock.

Market Position: Thomson Reuters’ global reach and extensive offerings make them an indispensable resource for businesses and investors around the world. Their financial data and analytics are widely used in the financial industry, ensuring a steady revenue stream.

A Comparative Analysis: JBT Marel vs. Thomson Reuters

Both JBTM and TRI have their unique strengths and appeal to different investor profiles. JBTM, with its focus on the food industry and attractive valuation, is an excellent choice for value investors seeking growth opportunities. TRI, on the other hand, offers a stable dividend and a global presence, making it an attractive option for income investors.

The Impact on You: A Tailored Investment Strategy

When considering an investment in either JBTM or TRI, it’s essential to assess your investment objectives, risk tolerance, and time horizon. Value investors may find JBTM more appealing due to its attractive valuation and growth potential, while income investors might prefer TRI for its stable dividend and global reach.

The Impact on the World: A Technologically Driven Future

The investment decisions made by individuals and institutions alike can shape the future of industries and even the world. In the case of JBTM and TRI, their continued success and growth can lead to further innovations and advancements in the food industry and the global information landscape, respectively. This, in turn, can lead to improved efficiency, productivity, and connectivity, benefiting businesses and consumers alike.

Conclusion: A Diversified Portfolio

In conclusion, JBT Marel (JBTM) and Thomson Reuters (TRI) are two compelling options for investors in the Technology Services sector. While both companies possess unique strengths and cater to different investor profiles, a well-diversified portfolio may include investments in both. By carefully considering your investment objectives and risk tolerance, you can unlock the full potential of these tech giants and contribute to a technologically driven future.

- JBT Marel (JBTM) offers value for growth-oriented investors with its focus on the food industry and attractive valuation.

- Thomson Reuters (TRI) is an attractive option for income investors due to its stable dividend and global reach.

- Both companies’ continued success can lead to further innovations and advancements in their respective industries, benefiting businesses and consumers alike.