Bitcoin Recovers Amid Economic Uncertainty: A Week in Review

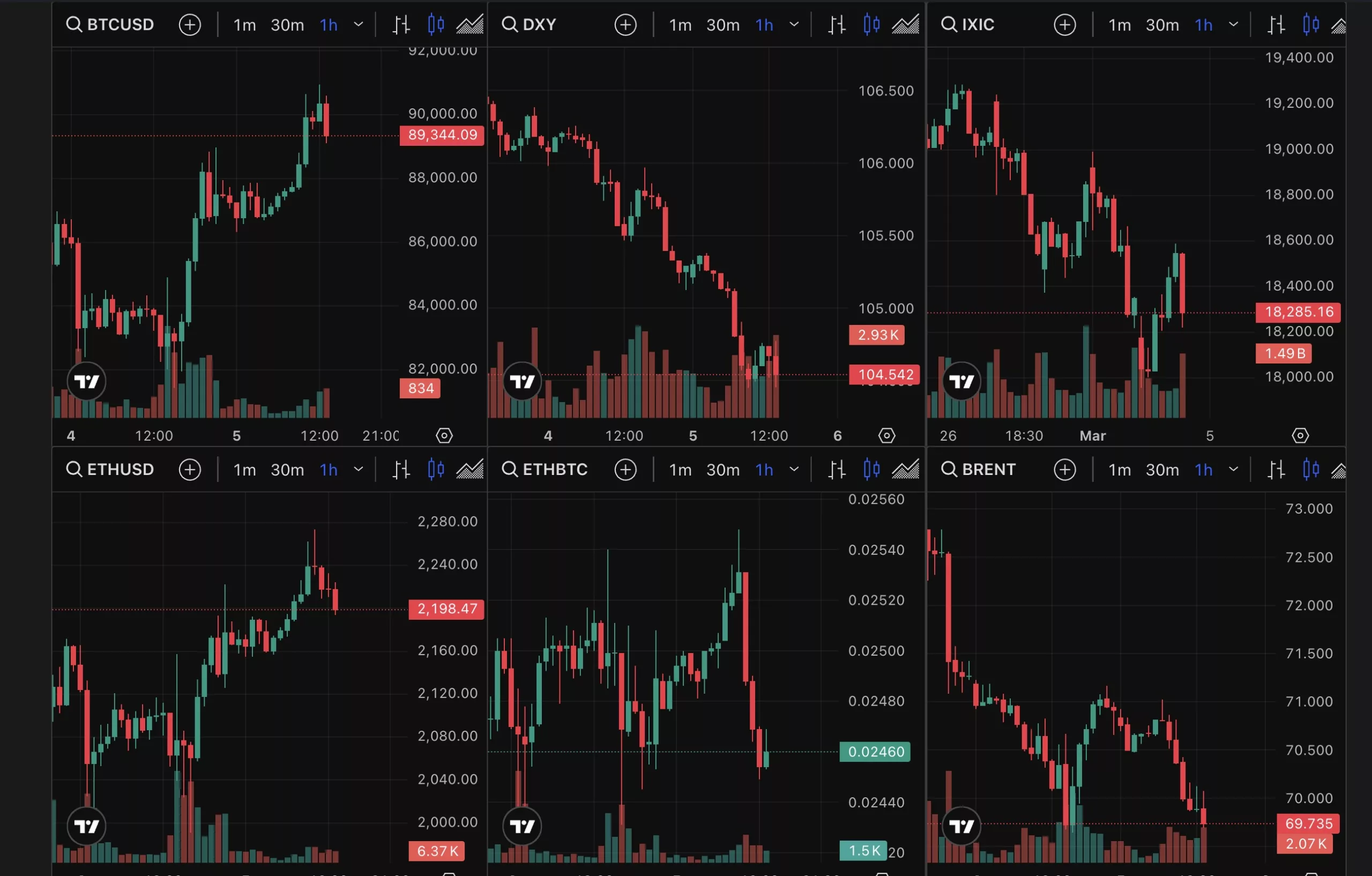

The cryptocurrency market experienced a rollercoaster ride this week, with Bitcoin (BTC) demonstrating remarkable resilience amidst a backdrop of both positive policy developments and economic uncertainty.

Positive Policy Developments

El Salvador, the smallest country in Central America, made history by becoming the first nation to adopt Bitcoin as legal tender. This groundbreaking decision, announced on June 5, 2021, was met with widespread enthusiasm within the crypto community. The Central American country aims to leverage this move to promote financial inclusion and stimulate economic growth. Following El Salvador’s lead, other countries such as Paraguay and Panama have reportedly shown interest in exploring similar initiatives.

Economic Uncertainty

Despite these positive developments, the wider economic landscape remained uncertain, with inflation fears and concerns over the Federal Reserve’s monetary policy continuing to weigh on investor sentiment. On June 10, 2021, the US Consumer Price Index (CPI) showed a year-over-year increase of 5%, the highest level since August 2008. This data fueled concerns that the Federal Reserve might accelerate its plans to taper its asset purchases, which could lead to higher interest rates and a stronger US dollar.

Impact on Individual Investors

For individual investors, the volatile nature of the cryptocurrency market can be both thrilling and intimidating. Those who have a long-term investment horizon and are willing to accept the inherent risks may find the recent price swings an opportunity to buy the dip. However, it is essential to remember that investing in cryptocurrencies carries significant risks, including market volatility, regulatory uncertainty, and security concerns. It is crucial to do thorough research, diversify your portfolio, and consider seeking advice from financial professionals.

Impact on the World

The adoption of Bitcoin as legal tender by El Salvador marks a significant milestone for cryptocurrencies as a whole. This move could encourage other countries to explore similar initiatives, potentially leading to increased mainstream acceptance and integration of digital assets into the global financial system. However, the potential implications of this shift are vast and complex, and the full extent of its impact remains to be seen. It is essential to keep a close eye on regulatory developments and market trends as the situation unfolds.

- El Salvador’s adoption of Bitcoin as legal tender could lead to increased mainstream acceptance and integration of digital assets into the global financial system.

- Volatility in the cryptocurrency market can create opportunities for long-term investors, but it also carries significant risks.

- Regulatory developments and economic uncertainty continue to play a significant role in shaping the cryptocurrency market.

Conclusion

The past week in the world of cryptocurrencies has been marked by a clash between positive policy developments and economic uncertainty. While the adoption of Bitcoin as legal tender by El Salvador represents a significant milestone, investor sentiment has been tempered by concerns over inflation, the Federal Reserve’s monetary policy, and other economic factors. As the situation continues to unfold, it is essential for investors to stay informed, diversify their portfolios, and consider seeking advice from financial professionals. The full impact of these developments on the world remains to be seen, but one thing is certain: the cryptocurrency landscape will continue to evolve at a rapid pace.